Ethereum price maintained its bullish momentum this week despite concerns arising from a large transfer of the leading cryptocurrency. ETH, which gained 3% last week, was trading at $1,634 as of Wednesday.

Bitcoin and Ethereum Current Situation

The crypto market, showing a positive outlook with a 5% increase in Bitcoin, trading at $27,156, may be focused on the Federal Open Market Committee (FOMC) meeting and the September monetary policy decision.

Since the announcement of the United States Consumer Price Index (CPI) a week ago, which revealed that inflation is still a problem, Ethereum and Bitcoin have experienced significant upward movements. The Federal Reserve is seen as considering interest rate hikes to curb rapidly rising inflation caused mainly by the continuous increase in global crude oil prices.

On the other hand, the crypto market has shown a strong stance against interest rate hikes in recent months. Therefore, investors may show a positive outlook regardless of the outcome of the FOMC meeting.

Will Ethereum Price Rise?

Ethereum bulls seem to be facing a significant resistance level between $1,650 and $1,700. A breakthrough and holding above this range could support a rise towards $1,800 and trigger buying momentum for gains that could surpass $2,000.

On the weekly chart, ETH currently indicates one of the bullish market indicators. The 200-week Exponential Moving Average (EMA) (purple) is located at $1,626. Whenever the Ethereum price attempts to rise above this level, profit-taking activities trigger a rally before diminishing the bullish trend.

However, investors should be aware that the 200-week EMA may not be sufficient to trigger the expected rally in Ethereum price. Therefore, bulls should make a general effort to defend the $1,600 support and reclaim the 21-week EMA (red) and the 100-week EMA (blue). With all three moving averages serving as support, bulls may have a chance for a larger breakout and upward attempt above the rising triangle formation.

A breakout in this formation could occur after the ETH price surpasses the $2,100 resistance. An increase in volume accompanying the orders placed above the resistance could be expected. The breakout target of 58% is $3,325, which is equivalent to the height of the triangle calculated above the breakout point.

Some traders may want to act on the rally with a buy signal from the Moving Average Convergence Divergence (MACD) indicator. Such a situation occurs when the blue MACD line crosses above the red signal line, and the momentum indicator is generally upward.

Ethereum Current Situation

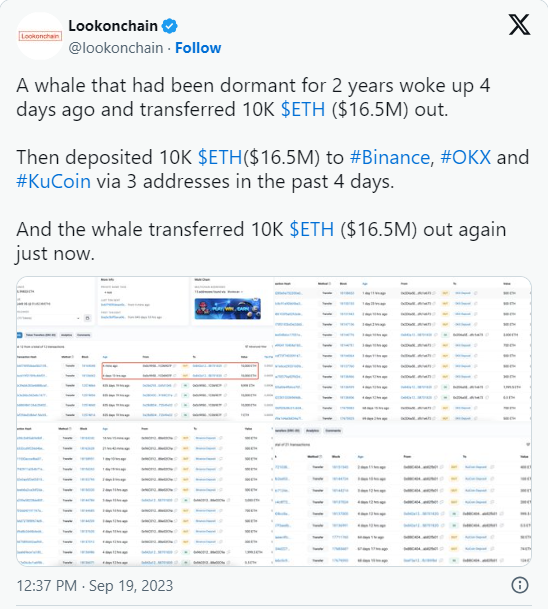

On-chain transaction trackers revealed that whales have sent large amounts of ETH to exchanges. Approximately $60 million worth of Ethereum has been moved from dormant wallets to exchange platforms amid the uncertainty based on the potential impact of the transfers on the price.

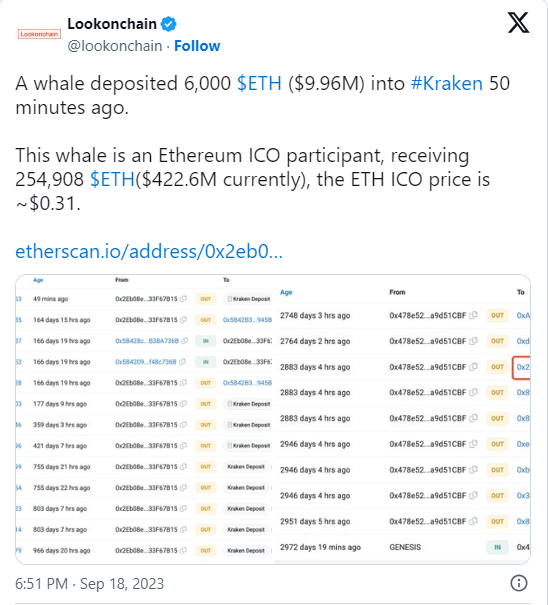

Ethereum co-founder Vitalik Buterin announced on Tuesday that he transferred approximately 300 ETH worth about $492,000 to the Kraken exchange. While this single transaction may not affect the ETH price, it has sparked debates among enthusiasts considering Buterin’s position in the community.

According to the blockchain tracking platform Lookonchain, another wave of large transfers worth approximately $50 million to various exchanges, including OKX, Binance, and KuCoin, took place in the last five days.

It doesn’t end there. Another transaction worth $10 million was made on Kraken by a crypto wallet that participated in the protocol’s ICO nine years ago. Transfers to exchanges often indicate that investors may be preparing to sell, which triggers discussions about the recent whale transfers.

Türkçe

Türkçe Español

Español