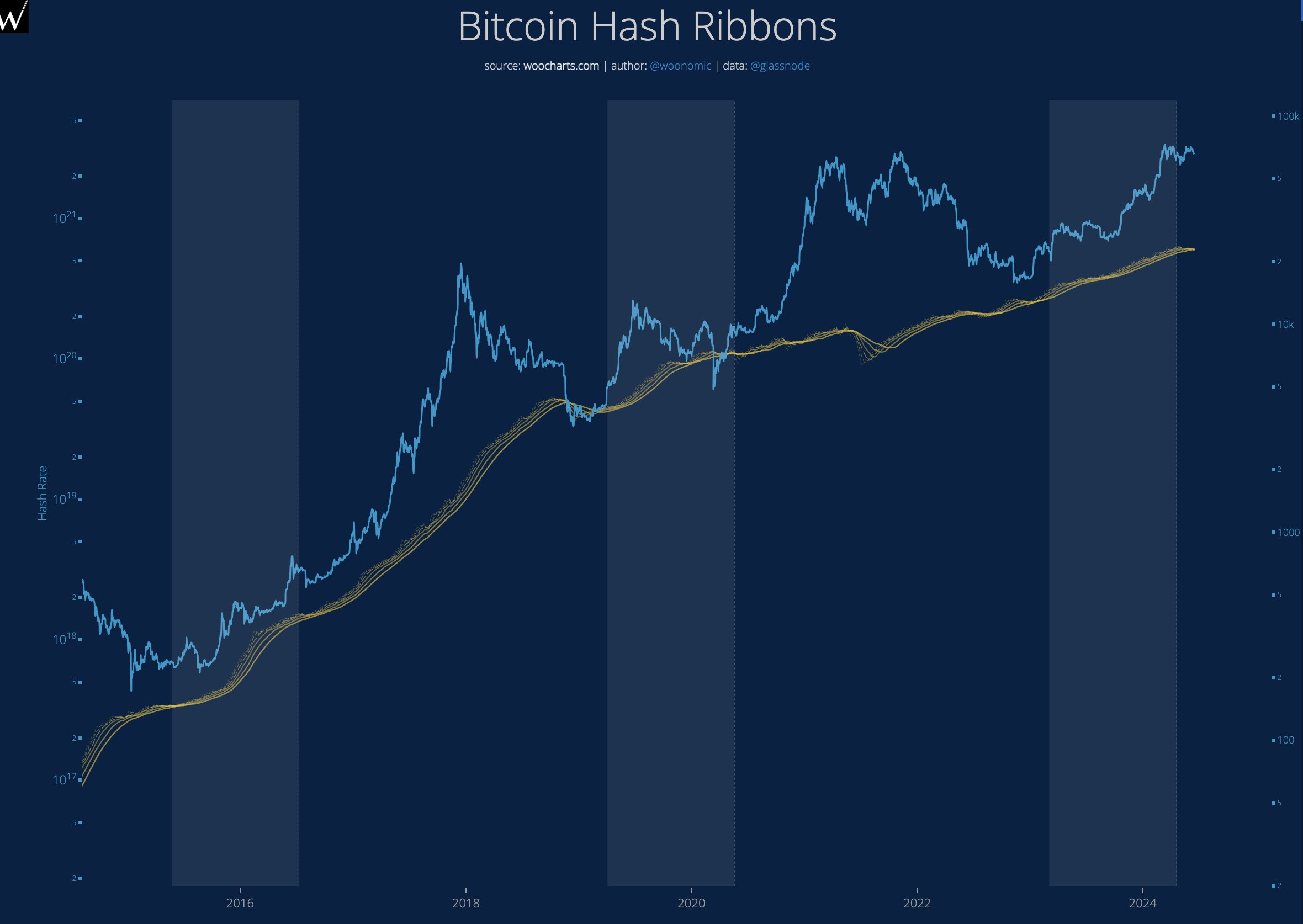

Famous on-chain analyst Willy Woo suggested in his latest analysis that despite the gloomy outlook of the cryptocurrency market, the miner surrender process is nearing its end, which could herald a significant rally for Bitcoin (BTC). The analyst pointed to hash ribbons and the dynamics of miner behavior for this.

Bitcoin Miners Must Surrender

Woo shared his views on what he believes is necessary for Bitcoin to start a new rally from his personal X account. According to the analyst, for BTC to see a significant upward movement, Bitcoin miners need to surrender. This surrender process, which involves miners giving up their activities due to unprofitable conditions, is seen as a potential harbinger of a rally.

Bitcoin hash ribbons are a tool used to identify periods when Bitcoin miners are in distress and potentially surrendering. These ribbons analyze hash rate data to determine miner behavior. Woo advised investors to watch for compressions in these hash ribbons as a signal for when to buy and hold BTC. Despite the frustrating outlook of the cryptocurrency market, the end of miner surrender typically leads to significant rallies in Bitcoin’s price.

Woo added that Bitcoin’s price will continue to struggle until there is a significant increase in hash market volume. The current low level of BTC’s price can partly be attributed to the distressed situation of miners. This miner surrender period results in reduced selling pressure as weak miners exit the market, potentially setting the stage for a price recovery.

Liquidations and Bullish Signals

Another point Woo highlighted is the current level of bets or leveraged positions in Bitcoin. The analyst indicated that a significant number of liquidations are still needed for the market to pave the way for a bullish trend. This suggests that the market needs to rid itself of excessive leverage, leading to more stable and sustainable price increases.

At the time of writing, Bitcoin is trading around $65,000. Despite being the top-ranked cryptocurrency by market value, BTC has experienced a 7% drop in the last 7 days. This decline reflects the overall market conditions and ongoing struggles in the mining sector.

Türkçe

Türkçe Español

Español