ARK Invest continues to actively accumulate shares of the crypto-friendly financial application Robinhood. According to a notable transaction disclosure, ARK Invest made a significant purchase of Robinhood shares on November 8th, acquiring a total of 1.1 million shares worth $9.5 million in just one day. These transactions by ARK occurred after Robinhood announced its plans for Europe.

ARK Invest Continues to Make Moves with HOOD

This purchase by Ark Invest was made through three exchange-traded funds (ETFs) managed by ARK, including ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF).

ARK Invest purchased 888,500 shares of Robinhood, accounting for 78% of the total daily purchase during the 24-hour period, making it the largest share purchase. ARKW and ARKF allocated 152,849 shares and 99,697 shares to their respective funds. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

This significant purchase followed ARK’s regular buying of Robinhood shares, but the recent transactions included a series of smaller purchases. On October 23rd, ARK purchased 197,285 Robinhood shares for ARKW funds, and on October 22nd, they acquired 259,628 Robinhood shares.

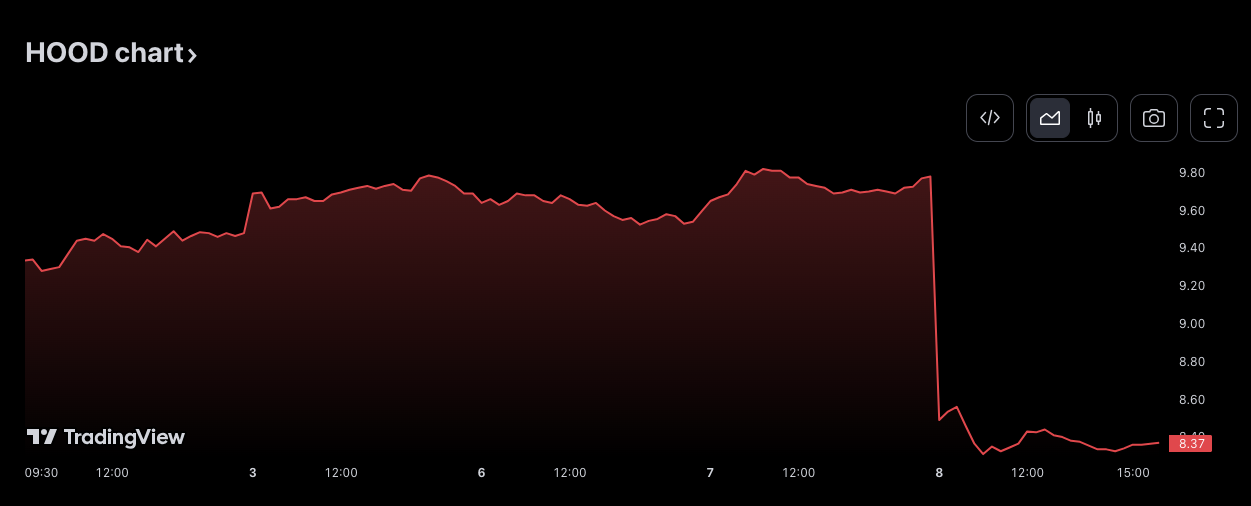

Why Did Robinhood Stock Lose Value?

The recent purchase came after Robinhood’s announcement on November 8th that they are exploring plans to expand into Europe, particularly by establishing a brokerage platform in the United Kingdom.

Simultaneously, the decline in Robinhood shares by over 14% occurred due to the announcement and the company reporting worse-than-expected results, attributed to a decrease in trading activity and user base. According to data from the price analysis platform TradingView, Robinhood shares closed at $8.37 per share on November 8th.

ARK, which regularly purchases Robinhood shares, continues to sell shares of Grayscale Bitcoin Trust (GBTC). On November 8th, ARKW sold 48,477 GBTC shares for $1.4 million. On November 6th, ARKW also garnered attention by selling a significant portion of approximately 139,506 GBTC shares worth around $4 million.

Türkçe

Türkçe Español

Español