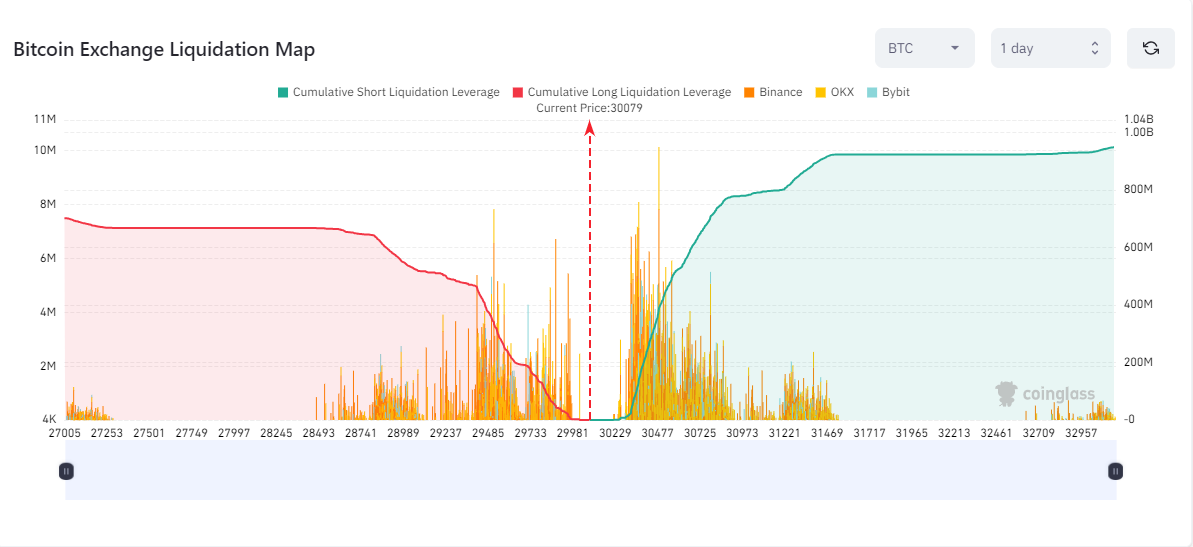

Bitcoin (BTC) struggled to stay above $30,000 while the price of the largest cryptocurrency dropped from $30,300 to $29,600 in the last 24 hours, hitting long investors who were expecting an upward movement. On-chain data from CoinGlass shows that $85.68 million worth of long positions were liquidated in the past 24 hours, with a total of $116.38 million worth of long and short positions liquidated as the cryptocurrency market became more volatile.

Majority of Open Positions Between $30,200 and $30,500

As Bitcoin fights to stay above $30,000, on-chain data indicates that a significant number of investors who were expecting an upward movement in the largest cryptocurrency have been liquidated. Crypto data platform CoinGlass states that $85.68 million worth of long positions were liquidated in the last 24 hours, signaling a weakening cryptocurrency market, with a total of $116.38 million worth of long and short positions liquidated.

CoinGlass data also reveals that a significant portion of the liquidated investors held high leveraged positions, with many opening positions between $30,200 and $30,500.

Futures trading, which involves leverage, allows investors to open high long or short positions by depositing a relatively small amount of money called margin. Margin calls occur when the market moves against leveraged positions, forcing investors to close their long or short positions.

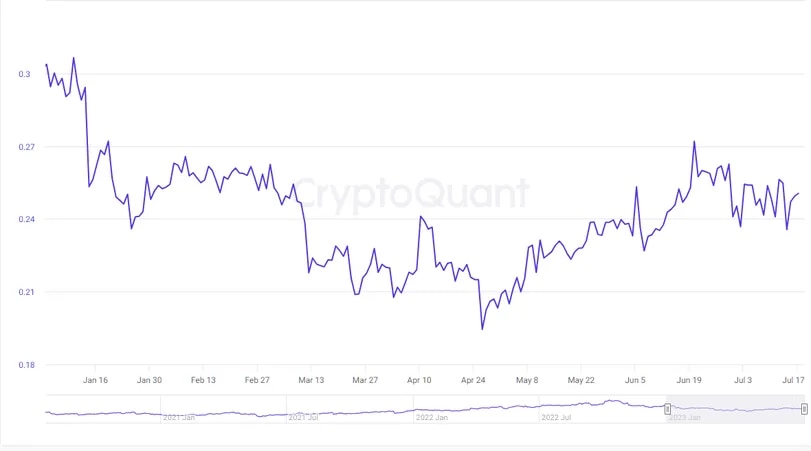

Estimated Leverage Ratio Increasing Rapidly

The use of leverage in the cryptocurrency market, which dropped to historical lows in late April, has been on an upward trend ever since. The higher the leverage ratio in the market, the greater the probability of sharp price movements.

CryptoQuant reported that the estimated leverage ratio for Bitcoin has increased from 0.19 in late April to 0.25 currently. This increase is attributed to recent applications for spot Bitcoin ETFs by BlackRock and other financial giants.

The interest shown by major financial companies in the cryptocurrency market through their applications for spot Bitcoin ETFs has led to an increase in the expectation of a market rally. Experts believe that if this expectation continues, the estimated leverage ratio will further increase.