The biggest stablecoin in the cryptocurrency market, Tether, has managed to stay in the spotlight for years with FUD. To be successful in this field, you need to strictly adhere to regulators’ rules. In fact, this is an unwritten rule, and we have seen this with leading crypto companies. The only problem is getting into trouble with regulators.

Tether and the Singapore Decision

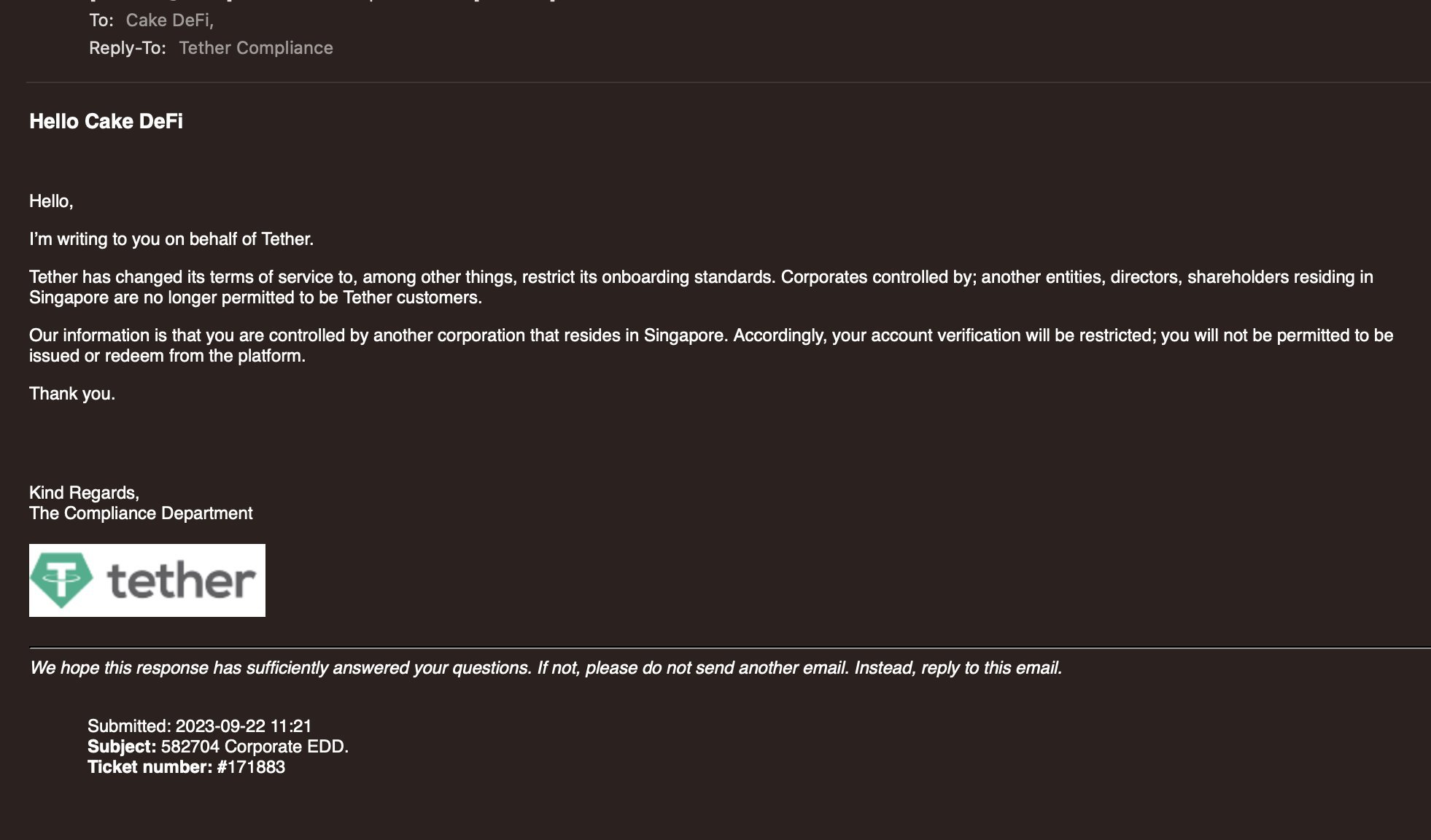

Cake DeFi CEO shared an email sent by Tether, stating that the company has updated its terms of service. According to this update, companies, executives, and shareholders residing in Singapore who are controlled by another organization are no longer allowed to be Tether customers.

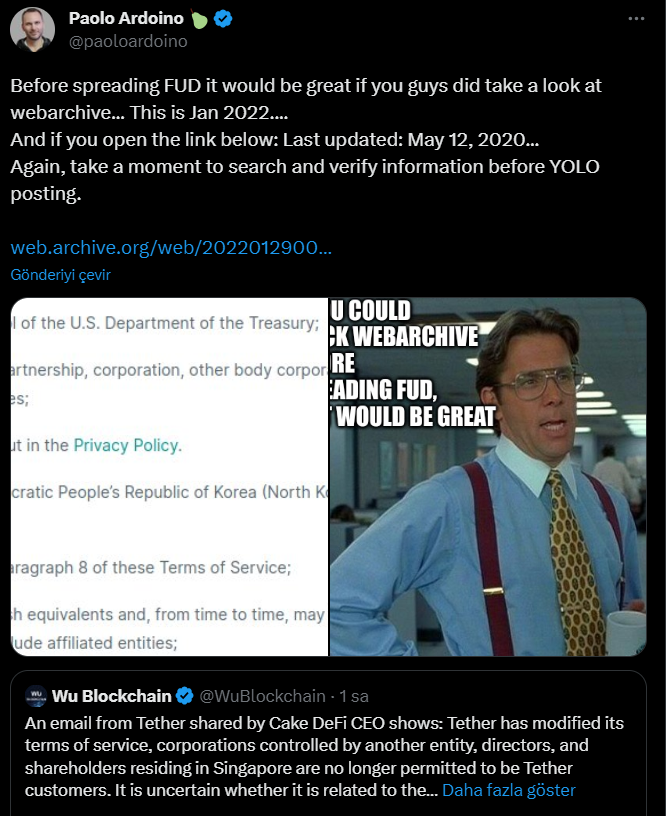

It is unclear whether this move is related to the money laundering case in Singapore. On the other hand, Tether’s CTO made an important statement today regarding this matter;

“Before spreading FUD, it would be great if you take a look at the web archive. This is January 2022…

And if you open the link below: Last update: May 12, 2020.”

The source of the allegation, WuBlockchain, wrote the following;

“Tether has said that Singapore has been a prohibited jurisdiction since 2020. In addition, Cuba, Iran, Pakistan, and 4 other countries are on the banned list.”

The recent email seems to be an update regarding the previously announced restriction specific to the company.

Cryptocurrency Lawsuits

It is well known that leading crypto companies have grown without caring much about the rules. The consequence of this has been ongoing lawsuits for years, which have intensified this year. In addition to the issues Tether faces with regulators, it also faces constant criticism due to a lack of transparency. The crypto community has targeted it in many major crashes.

Although the recent news has been debunked, Tether pays the price for being susceptible to FUD every time. Its past encounters with many regulators have left this mark on it.

In the $735 million money laundering case in August, it was revealed that cryptocurrencies were actively used. The incident, in which 10 people with Chinese passports were arrested, occurred just last month. While Singapore froze $110 million in 35 bank accounts, it also seized properties worth hundreds of millions of dollars.

Türkçe

Türkçe Español

Español