Crypto markets made a good start to October, with the BTC price rising above $28,500 on Monday. The selling pressure from this resistance zone caused the price to lose about $1,000. We have already witnessed similar movements in the past few months. The weakness of investors’ belief in the rise triggers profit-taking in resistance areas.

QCP Analysts’ Bitcoin Commentary

In their last evaluation in September, QCP analysts mentioned that the price of Bitcoin could drop to the $22,000 region. This downward scenario was based on Elliot wave counting and would not be invalidated without closings above $30,000.

Yesterday, analysts shared their latest market evaluation while the price continued to stay strong above $28,000.

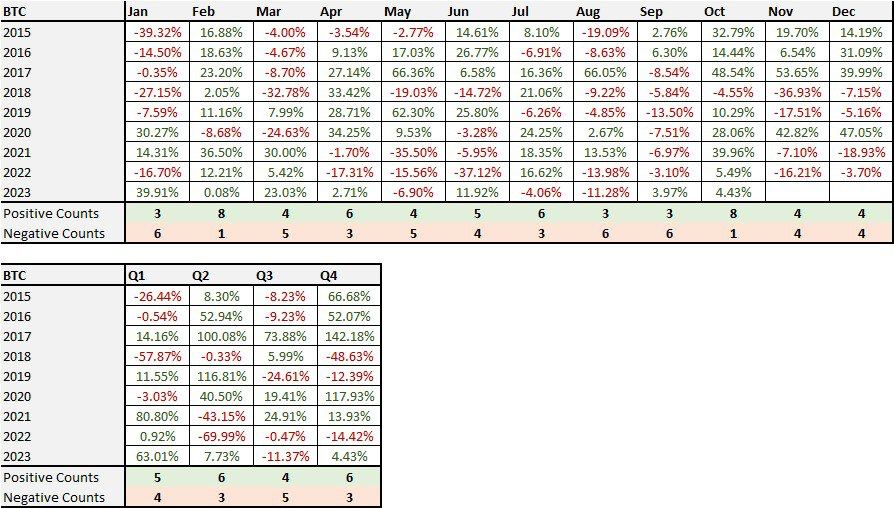

“We have entered the last quarter of the year, and the cryptocurrency markets have taken off like a rocket. In the past 2 weeks, BTC has shown a surprising increase of 15%, and in the last 3 days, it has increased by 9%. This came after a lackluster 3rd quarter (-12% in BTC) that coincided with this year’s Super Moon cycle. Does this strong bounce indicate the start of the long-awaited 4th quarter rally? Seasonality can say YES, as October is historically the strongest month for BTC, even though the 4th quarter generally has mixed results.”

Will Bitcoin Price Rise?

Although analysts say that historical data and the recent recovery are signs of strength, they are not convinced of a real turnaround. As mentioned in the first part, Elliot charts suggest that a deeper local bottom needs to be reached.

“However, this move did not fully convince us, and we believe that BTC will test the key support level of $25,000 in the last quarter of 2023. There are four reasons for this:

- This aggressive bounce has been mostly driven by external factors so far and may not have continued momentum. First, the upcoming SEC approvals for ETH futures ETFs, followed by lower-than-expected core PCE inflation and finally the solution that keeps the US government open for another 45 days until November 17th.

- ETH futures ETF. The BTC ETF from two years ago caused a great excitement. As noted by leading on-chain analysts, a futures ETF may only result in the addition of synthetic coins without creating a real impact on spot supply. So, it is not a sustainable catalyst for growth. Moreover, it can be argued that a futures ETF can be unquestionably harmful to spot prices since it can redirect demand from the spot market to a synthetic market. (Will Woo previously referred to this as “paper BTC” and we have covered this topic in detail in COINTURK articles).

- Although the agreement to keep the government open is positive in the short term, it will support the decline in the medium term.

We are taking advantage of this rally to buy downside hedges. We expect the resistance at $29-30k to hold, and with front-end vols still trading low in the 30s, it provides cheap optionality for any sharp downside reversal.”

In conclusion, QCP analysts do not seem convinced that the expected major turnaround has begun yet.