At the time this article was written, the king of cryptocurrencies was at $27,400. This is $1,100 below yesterday’s peak. The downward pull in BTC price also caused significant losses in altcoins. In fact, some of them went below where they were when the recent surge began. Isn’t this what has been happening for months?

Why Did Bitcoin Price Fall?

After reaching $28,590 yesterday, the price of Bitcoin, which climbed to the highest level in two months, began to fall. BTC is currently at $27,390, with a drop of over 4% compared to the previous day. This situation is quite frustrating for altcoins and is exactly what has been happening for months. As BTC price increases slightly and altcoins recover slightly, new lows are seen in the downturn.

Rising US bond yields have reached historic levels and are affecting the price of Bitcoin negatively. On October 3rd, the yield on the benchmark 10-year US Treasury bond reached 4.75%, reaching the highest level in the past sixteen years. This is not a surprise because Fed members are saying that they will not lower interest rates at the expected pace.

We said that the discount target for next year was 50bp. The statements made by the members in the last two days suggested that a new rate hike could be made on November 1st. Emphasis on data-dependent decisions was one of the main focal points of the last meeting, and the data did not come as desired. It was clear that it would not, so Powell indirectly gave a message of tightening by seeing this.

On the other hand, futures ETH ETFs were a complete disappointment. The ETFs, which were one of the price catalysts at the beginning of the week, had a daily volume of around $2 million. When the BTC ETF was launched, it had a volume of over $100 million two years ago. If there is no demand, it seems that the ETF approval does not have a supportive role for the price.

Crypto Market Analysis

From a technical perspective, the pullback of Bitcoin could be predicted due to the inflated RSI. However, the price increase that continues with the inflated RSI during strong uptrends is something that investors are accustomed to. So investors once again paid the price for their optimism. On October 2nd, BTC’s four-hour RSI value exceeded 70, reaching the highest overbought zone in the past month.

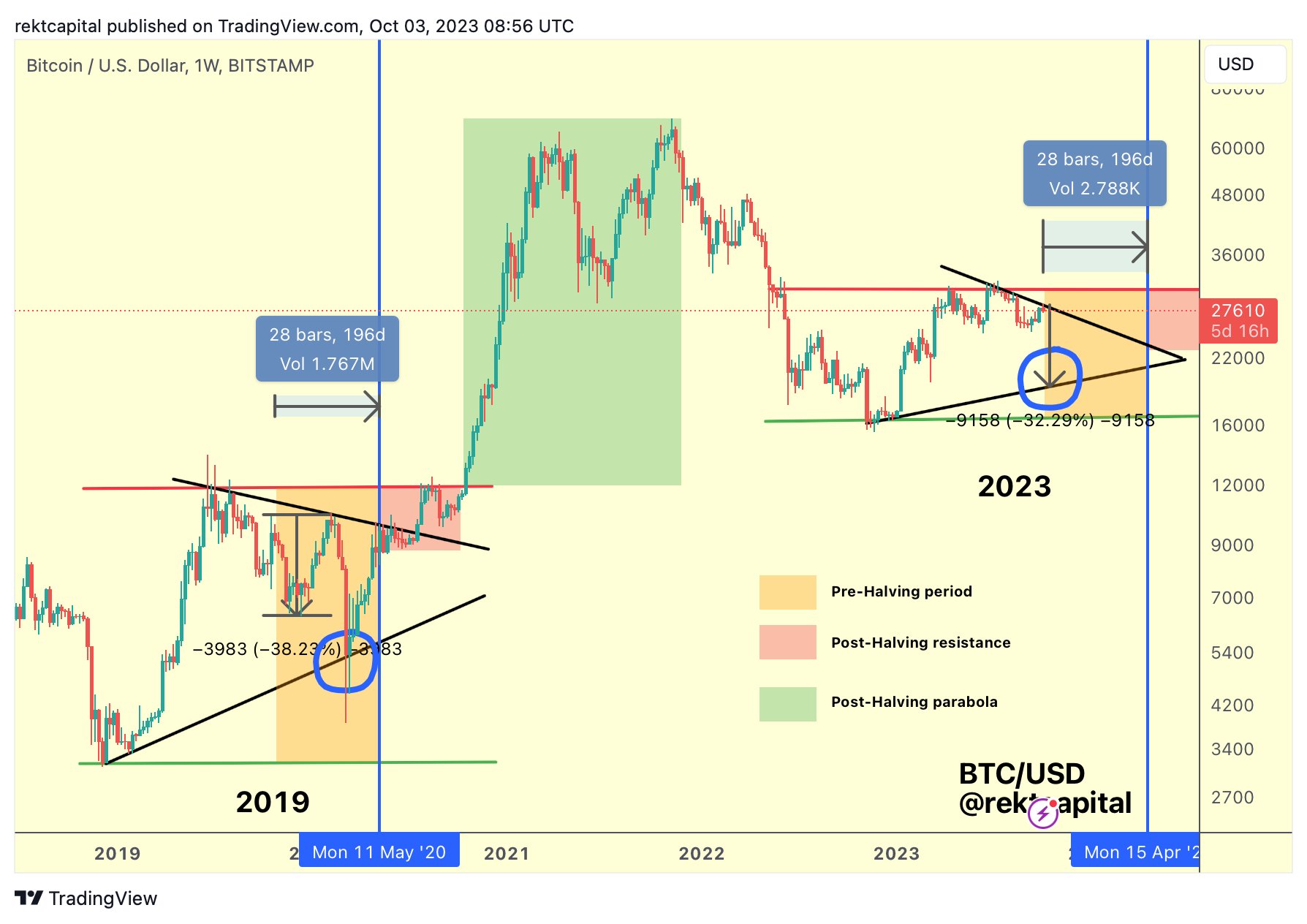

In addition, analyst Rekt Capital argues that the drop in BTC prices is accompanied by a pre-halving fractal from 2019, as shown below. The fractal shows that Bitcoin may be prone to a decline within 28 weeks before recovering to a new record level.

Of course, no one can predict the future, and predictions do not always succeed.

Türkçe

Türkçe Español

Español