CryptoQuant CEO Ki Young shared a familiar flood today that will be familiar to most investors. What’s going on with Binance? The 2023 fluctuations in the cryptocurrency markets have occurred very quickly. Could the decreasing demand, accompanied by a decrease in volumes, be artificially supported? What do the claims of the famous crypto CEO mean?

Is the Rise/Fall of Bitcoin Artificial?

Ki Young Ju, the CEO of on-chain analysis company CrypytoQuant, had previously written a similar article about TUSD. The Binance exchange saw movement in TUSD pairs after massive TUSD transfers. These suspicions, which coincided with the price increase, caught the attention of many experts. Then Binance turned to a different stablecoin.

As BUSD is set to disappear in the first quarter of next year, the popular cryptocurrency exchange Binance added pairs for alternative stablecoins. TUSD was among them. As the discussions continued, interest in TUSD pairs decreased. Now, there is an increasing demand for FUSD pairs.

Claims About Binance Exchange

Ki Young Ju shared things similar to what he had previously written about TUSD this evening. Binance’s CEO will probably say that these claims are nothing more than excessive suspicion in a few hours.

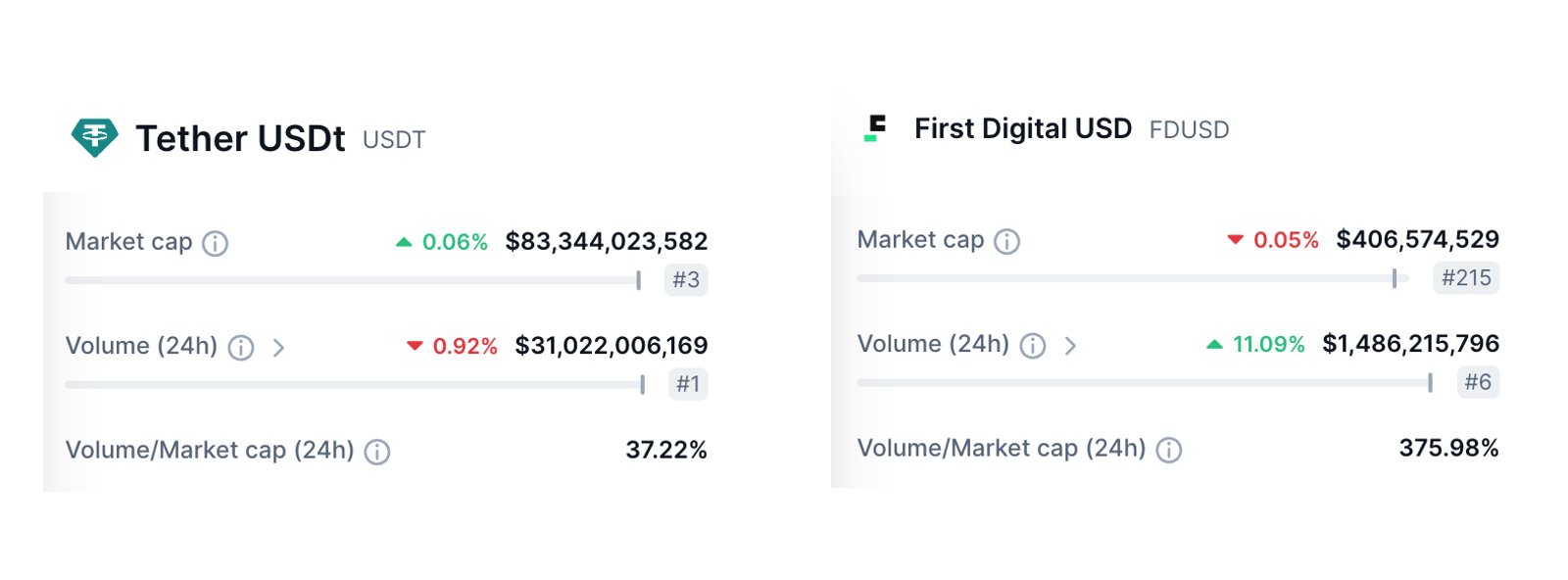

“The BTC/FDUSD pair on Binance has been the most traded pair in the Bitcoin market in the last 24 hours. The trading volume of FDUSD is significantly higher compared to the amount deposited into Binance.”

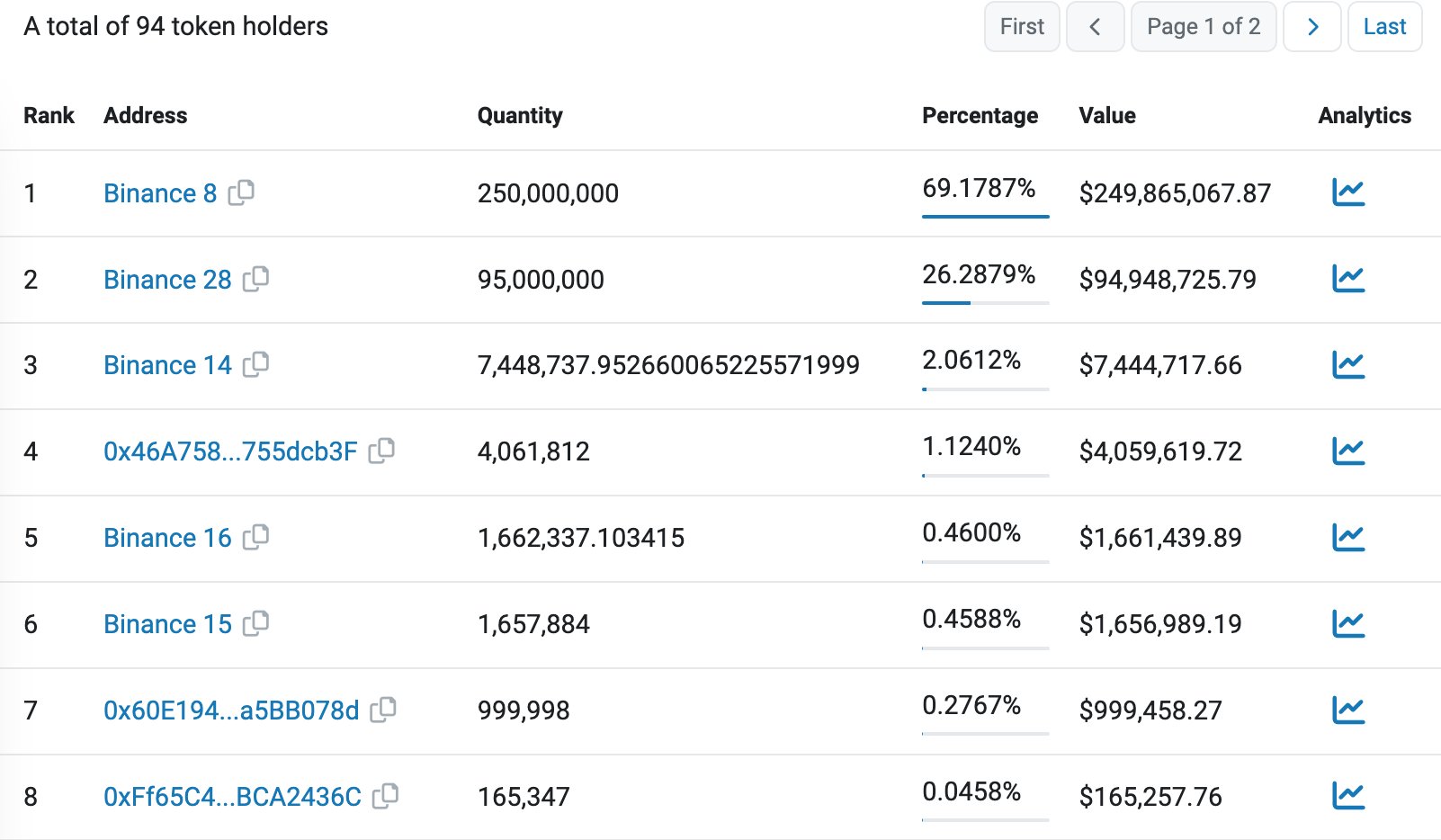

“The volume-to-cap ratio for FDUSD is 10 times higher than that of USDT. 98.5% of the FDUSD supply is held in Binance wallets. Can someone provide a reasonable explanation for this?”

“The numbers look surprisingly astonishing, which conspiracy theorists cannot ignore. I’m not even talking about market manipulation, wash trading, or money laundering allegations. I’m trying not to oversimplify the situation, but I still can’t find a glimmer of hope.”

The significant comments made by Ki Young were things that Capo had been saying for a while. The expert who expected the price of Bitcoin to drop to $12,000 claimed that the Binance exchange was dancing the market with new stablecoins.

Türkçe

Türkçe Español

Español