Altcoins have been on a downward trend for the past two days, with BTC finding buyers at the $27,500 level for now. The cumulative value of cryptocurrencies has dropped below the $1.1 trillion threshold, while the volume has fallen to $35 billion. The decrease in volume along with the price decline supports the possibility that the recent recovery is a bull trap.

Why Did Cryptocurrencies Fall?

Although the price of Bitcoin tested $28,500 with an increase of over 5%, it could not sustain at that level. The price dropped after a failed resistance test. While the approval of the Ethereum ETF futures generated excitement, it did not lead to significant demand and resulted in disappointment. Furthermore, the latest data from the US was not positive.

The number of open positions, which was 8.9 million, rose to 9.6 million yesterday. This data created expectations that the US labor market could trigger further tightening actions. Indeed, recent comments from Fed members suggested that interest rates, which are already near their peak, could be raised further. JOLTS report added fuel to the fire.

In his speech at the Jackson Hole symposium in August, Powell specifically addressed the labor market. The Fed Chairman implied that if there is no improvement in this area, policy could be further tightened. The data that has emerged in the past two months supports the worst-case scenario.

Bitcoin and Altcoin Analysis

Expectations for an interest rate hike in the November meeting were at 16% last week, but it has climbed to 30% in the past 24 hours. Considering the latest data and statements, the expectation of an interest rate hike could have a negative impact on the markets as the November meeting approaches.

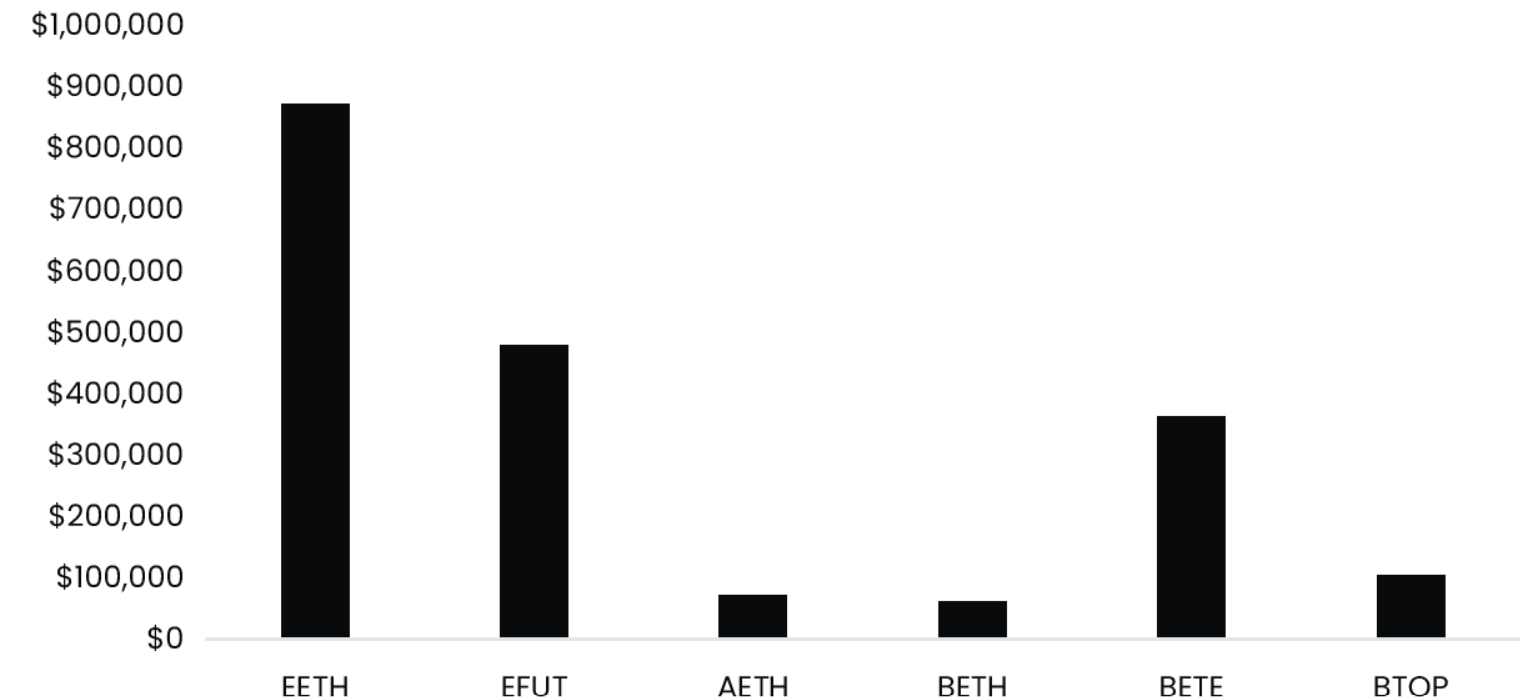

On the other hand, the lack of demand for the futures ETFs has exacerbated the negativity in the sensitivity in the medium term. The 6 ETFs had a total daily volume of nearly $2 million. This is almost zero compared to the trading volume on the listing day of the BTC ETF in November 2021, which exceeded $150 million.

Even if a spot BTC ETF is approved, there could be a major disappointment due to the lack of demand. In fact, the current situation has indirectly undermined the optimism regarding the results of the spot BTC ETF. With the increased risk aversion in the markets, a different outcome would have been a surprise.

Finally, the lawsuit filed against CZ two days ago alleges that FTX was intentionally bankrupted. The problem is that the US Department of Justice may soon turn the ongoing investigation into a lawsuit. The Fed is aiming for further tightening. As inflation continues to remain strong on a global scale, US stock markets have started a downward journey. With the increase in oil prices and DXY, demand for risk assets is decreasing. Considering all these factors, cryptocurrencies may be facing more challenging days ahead.

Türkçe

Türkçe Español

Español