Solana (SOL) has recently published the latest edition of its validator health report, emphasizing the status of its network activity. According to the report, Solana’s validator network has continued to grow in recent months.

Current Data on Solana

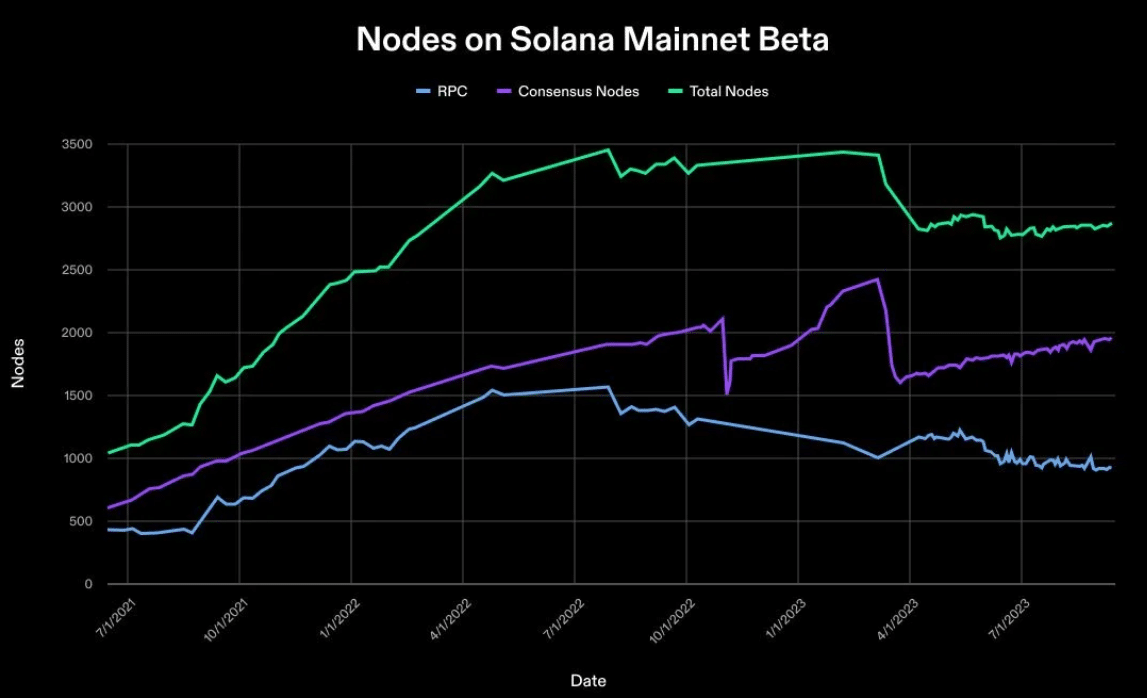

Popular altcoin Solana remains one of the largest proof-of-stake networks in terms of node count. It consists of approximately 2,800 consensus and RPC nodes distributed globally. The report highlights significant progress in Solana’s development as a multi-client network. Over 31% of the stakes are executed through the Jito Labs client. Moreover, Solana’s blockchain is geographically well-distributed, with no single country holding more than 33.3% of active stakes.

The report also notes a decrease in the total consensus nodes from 2,200 to 1,700 in March. This was due to a significant amount of stakes being redelegated from the nodes. Additionally, the report emphasizes how the network has evolved in the recent past. Solana had gained fame for its downtime periods in the past years. However, in the recent period, since February 2023, it has had a 100% uptime according to the blockchain records. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Future of SOL Token Price

As the state of the blockchain improves, the local token has also demonstrated a noteworthy performance. According to CoinMarketCap, SOL has seen an increase of over 20% in the past 24 hours. At the time of writing, it was trading at $23.30 with a market capitalization of over $9.6 billion.

Furthermore, SOL’s social engagement has increased by over 65% in the past week. The sentiment graph has also followed a similar trend, growing by 80%. Additionally, the AltRank has significantly increased. Although these measurements appear optimistic, a different picture emerges when looking at SOL’s daily chart. The relative strength index (RSI) is hovering near the overbought zone, indicating the possibility of increased selling pressure in the coming days. Solana’s Chaikin money flow (CMF) has recorded a decline and is staying near the neutral level, suggesting a higher chance of price correction.

Türkçe

Türkçe Español

Español