The price of popular altcoin Solana (SOL) surged on October 1st, surpassing the $22 resistance level and indicating a continuation of the price recovery. This upward movement overshadowed a significant peak from the previous correction phase, suggesting a potential change in market dynamics. But does SOL have enough upward momentum for a sustainable upward trend?

Solana (SOL) Price Analysis

Bitcoin, the largest cryptocurrency, is struggling to surpass the $28,500 mark, causing many altcoins to stumble in their recovery efforts. As a result, Solana’s price dropped by 9% this week, falling to around $22.58 from its recent peak of $24.75.

This recent drop acted as a catalyst, increasing buying interest at the $22 support level and pushing SOL’s price up by 3.9% to its current level of $23.59. If this buying enthusiasm continues, it could potentially lead to another 8% rise, targeting the significant resistance zone around $25.3.

Taking a broader perspective, the ongoing recovery of this popular altcoin can be seen within the boundaries of an ascending channel formation. This formation strongly responds to both the upper and lower limits of SOL’s price, highlighting its significant impact on market participants.

Sticking to this chart formation suggests that the altcoin could reach up to $36 before reaching the upper trendline of the channel during its recovery.

Comparison of SOL and BTC Performance

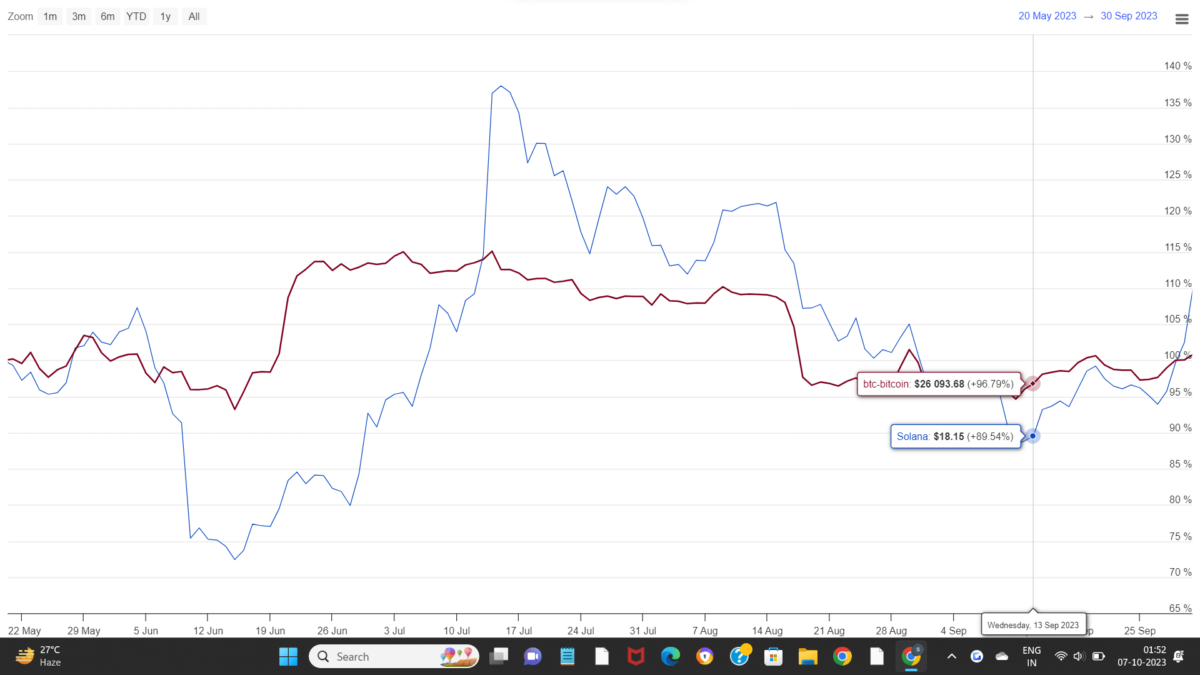

When evaluating the price movements over the past 6 months, it becomes evident that Solana exhibits significant volatility, especially when compared to Bitcoin. While Bitcoin’s price has been relatively stable, SOL reflects high volatility. Particularly in a period of increased bullish expectations across the market, Solana has clearly outperformed Bitcoin in recent weeks, achieving significant gains.

Currently, the upward movement of Solana near the upper band of the Bollinger Band indicates that buying momentum is still strong. Furthermore, the Average Directional Index (ADX) has increased by approximately 26%, indicating that buyers have enough strength to sustain the ongoing recovery rally.