Investments in the crypto sector during the 3rd quarter of 2023 continued to be characterized by a negative trend, with decreasing investment volume and limited significant deals. Uncertainty and growing concerns among investors led to a stagnant year for investments in the crypto sector. CryptoRank’s latest report examines the key trends, narratives, and statistics in the crypto investment sector for the 3rd quarter of 2023.

Overview of Crypto Sector Investments in the 3rd Quarter in Numbers

The total amount of investments in the crypto sector in the 3rd quarter of 2023 reached $1.61 billion, indicating a significant decrease of 31.5% compared to the 2nd quarter and 75.8% compared to the 3rd quarter of 2022, highlighting the continuing decline in investments in the crypto sector.

Blockchain services emerged as the most attractive category for investors in the 3rd quarter of 2023, with ventures in this sector receiving $515 million in investment across 73 deals. Centralized Finance (CeFi) projects, including BitGo’s $100 million funding round, unexpectedly became the second most preferred category with $300 million in investments.

GameFi and DeFi sectors diversified investor interest, receiving $215 million and $178 million in investments, respectively.

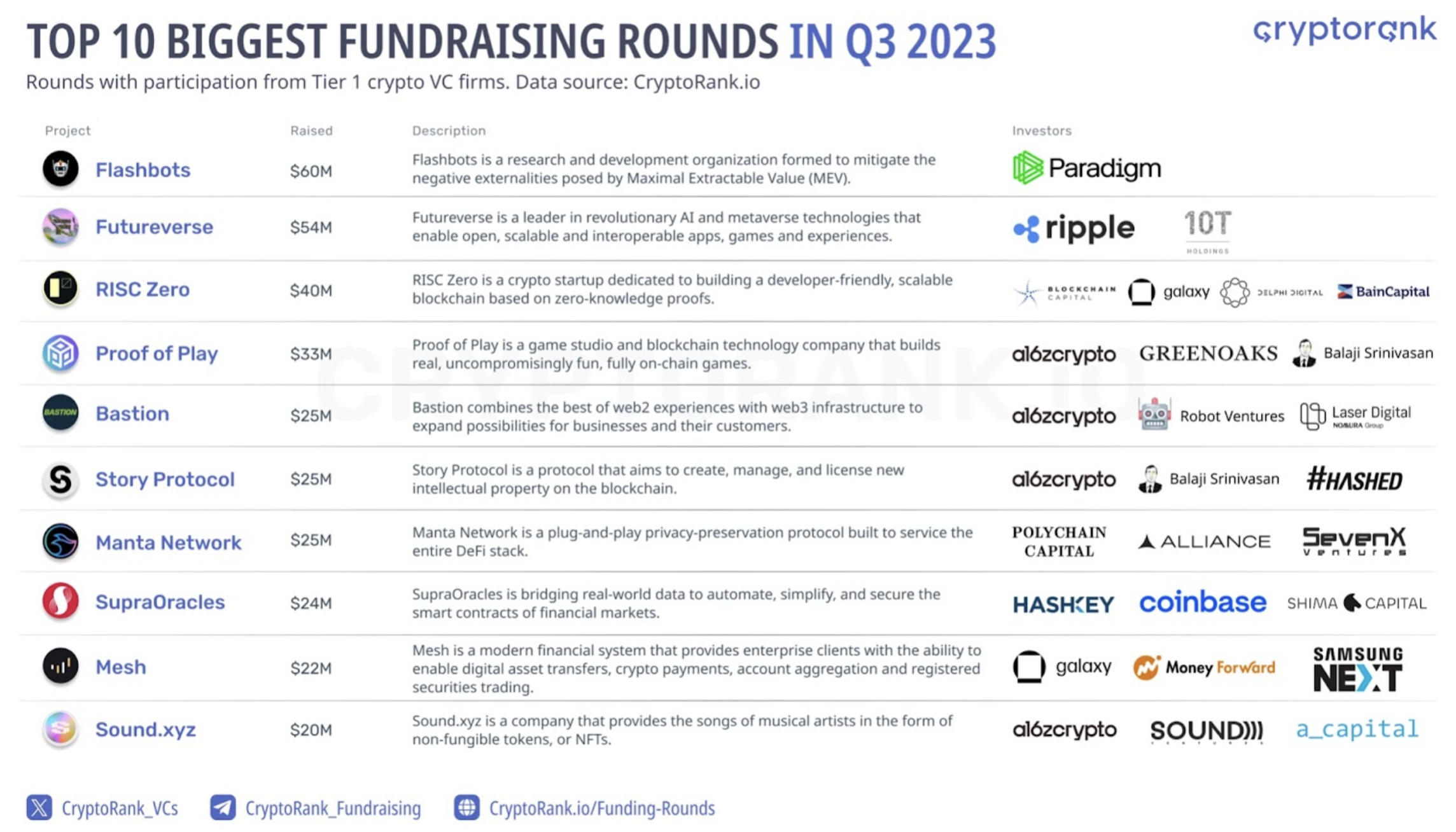

Significant Investment Rounds in the Three-Month Period

Flashbots, dedicated to reducing Maximal Extractable Value (MEV), demonstrated transparency and sustainability in the MEV ecosystem by securing $60 million in the B Series investment round led by Paradigm. Futureverse, a leader in artificial intelligence and metaverse technologies, received $54 million in the A Series investment round, which also involved Ripple showcasing the FuturePass Smart Wallet SDK.

RISC Zero, focusing on a scalable blockchain with zero-knowledge proof, secured $40 million in the A Series investment round led by Blockchain Capital, highlighting zkVM. BitGo stood out as the custodian of Wrapped Bitcoin (WBTC), receiving $100 million in investments in the 3rd quarter of 2023, signaling compliance and strategic acquisitions.

Investor Trends

Binance Labs, the investment arm of Binance, and Coinbase Ventures, the investment arm of Coinbase, emerged as the most active first-stage investors in the 3rd quarter, focusing strongly on DeFi projects. Balaji Srinivasan, Coinbase’s former CTO, stood out as one of the most active investors, particularly interested in social projects.

Early-stage projects continued to be preferred by investors, accounting for 33% of total deals by attracting $405.6 million in investments across 75 funding rounds.

Top Countries in Generating Funds

Despite regulatory challenges, the United States (US) remained the most active crypto venture hub, accounting for 46% of the total funding rounds in the 3rd quarter of 2023, with $743.1 million invested. Surprisingly, India became the second most popular country, raising $76.1 million, followed by Hong Kong, which raised $35 million due to its crypto-friendly policies.

France stood out among EU countries as a nation where investments of over $30 million were made in crypto projects.

In summary, investments in the crypto sector faced significant challenges in 2023, and these challenges continued in the 3rd quarter. An anticipated market improvement and the possibility of a potential “bull run” could rapidly change this landscape.

Türkçe

Türkçe Español

Español