Bitcoin‘s (BTC) drop to $26,794 would normally spread fear of another decline. This is because the leading cryptocurrency managed to hold at $27,000 for a few days. However, investors were not affected by the drop and doubled their long BTC positions.

Analyst’s Bitcoin Comment!

Analyst Ali Charts, also known as a pseudonym, mentioned this unprecedented situation on October 11th. Using the Bitcoin long/short ratio indicator, Ali Charts revealed that 65.33% of the positions in the market were long. This inequality caused the long/short ratio to rise to 1.88. Generally, a value below 1 indicates more short positions.

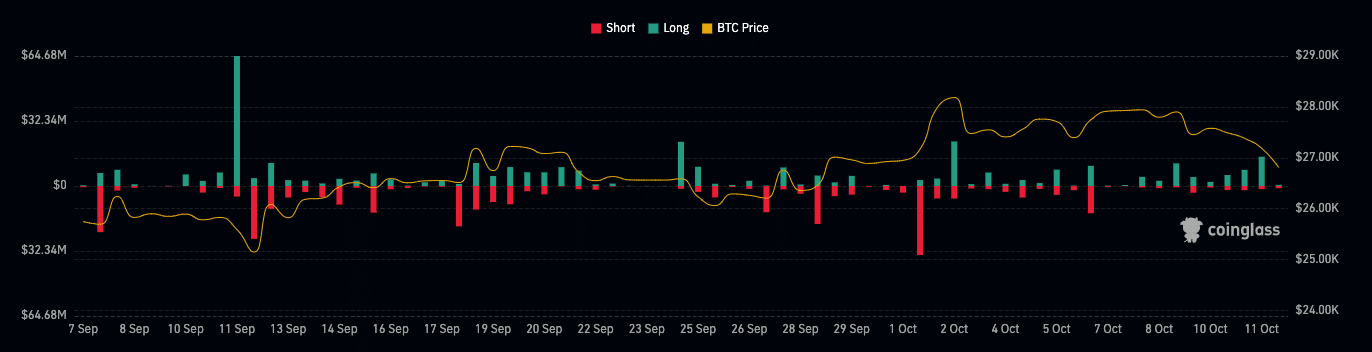

Therefore, the value of 1.88 may indicate that traders’ sensitivity largely signals a significant recovery for BTC in the short term. However, on the same day, BTC’s long liquidations were higher than short positions. According to Coinglass, $14.57 million worth of long positions were liquidated on October 11th.

Therefore, investors were not expecting a quick recovery and it could possibly take a few days. Meanwhile, the four-hour BTC/USD chart showed a clear competition between bulls and bears for control of the market. However, the accumulation/distribution (A/D) line rose to 3.275 million.

Critical Metric for BTC!

A/D measures the supply and demand of a token. Generally, a rising A/D confirms price increases, while a decreasing A/D indicates a downward trend. The increase in the indicator may indicate buying pressure for BTC. If A/D continues to rise, there is a possibility that Bitcoin will surpass $27,000 in the coming days. This is also reinforced by the Bollinger Bands (BB).

At the time of writing, the BB was expanded. Therefore, there is a possibility of significant volatility in prices. However, if accumulation continues to surpass distribution, this situation can only be upward. From an on-chain perspective, there is also evidence of intense accumulation. A metric used to evaluate this probability is the balance of Bitcoin in addresses.

This metric is defined as the amount of Bitcoin held in the portfolios of Bitcoin holders. However, the balance of addresses holding between 1 and 100,000 tokens has been increasing recently. If this increase continues, investors with long positions may eventually profit.

Türkçe

Türkçe Español

Español