With the developments this week, the price of Bitcoin, which gave back its October gains, remained confined to a narrow range. At the time of writing, Bitcoin was trading at $26,798, fluctuating between the $28,000 resistance level and the $26,750 support level. The almost stagnant price movement of Bitcoin increases bias among investors, leading to low volume and volatility weakness.

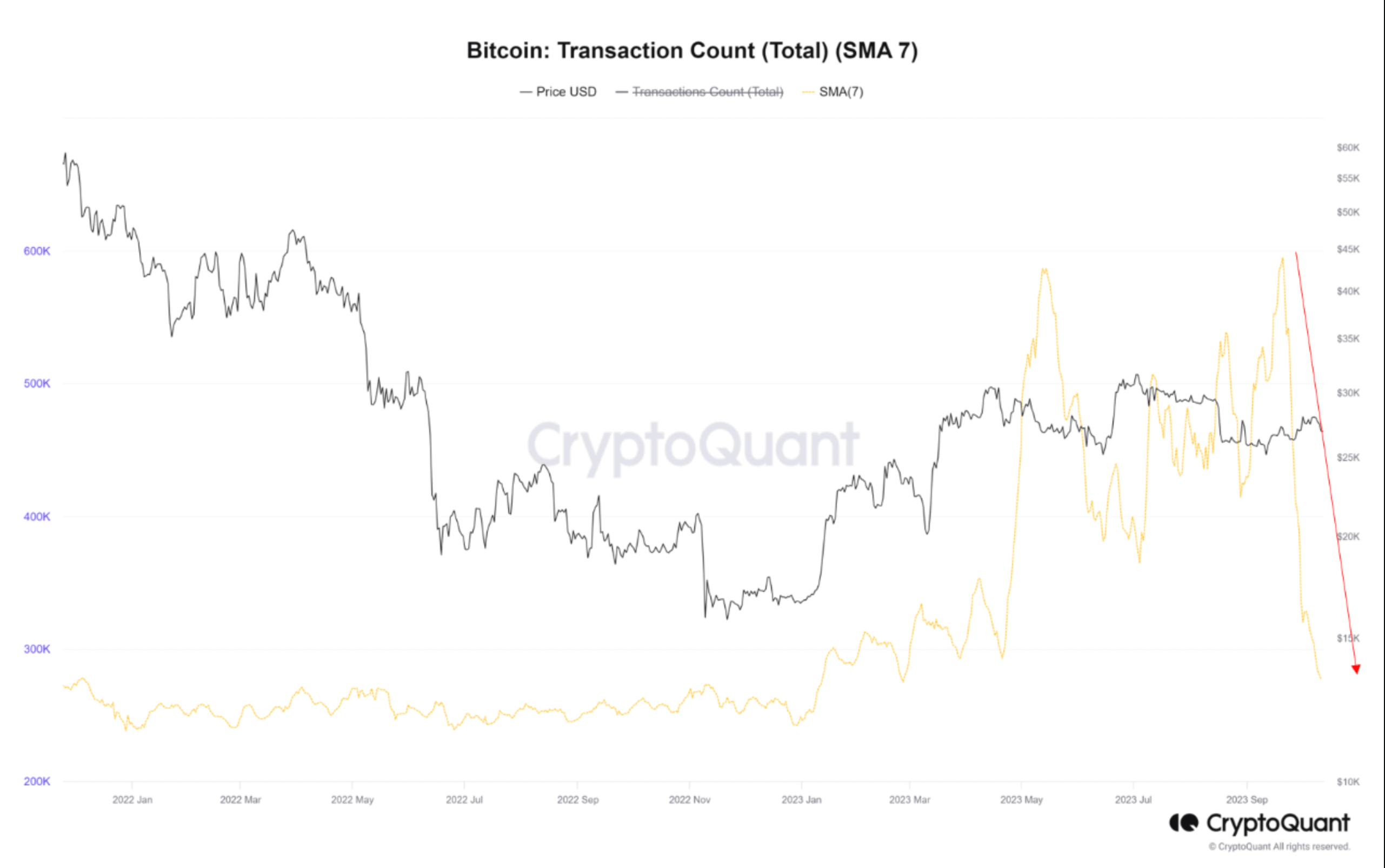

BTC Network Activity Continues to Decline

The consolidation period in Bitcoin price comes with a significant decrease in deposits, withdrawals, and overall transaction volume. Especially, all these metrics had increased significantly during the Bitcoin frenzy in May. However, they have started to decline significantly since September.

MAC_D, an on-chain data analyst at CryptoQuant, highlighted the decrease in Bitcoin network activity and commented:

“This is due to less new investments entering the crypto market, resulting in less liquidity and lower volatility.”

The Realities of Bitcoin in the US

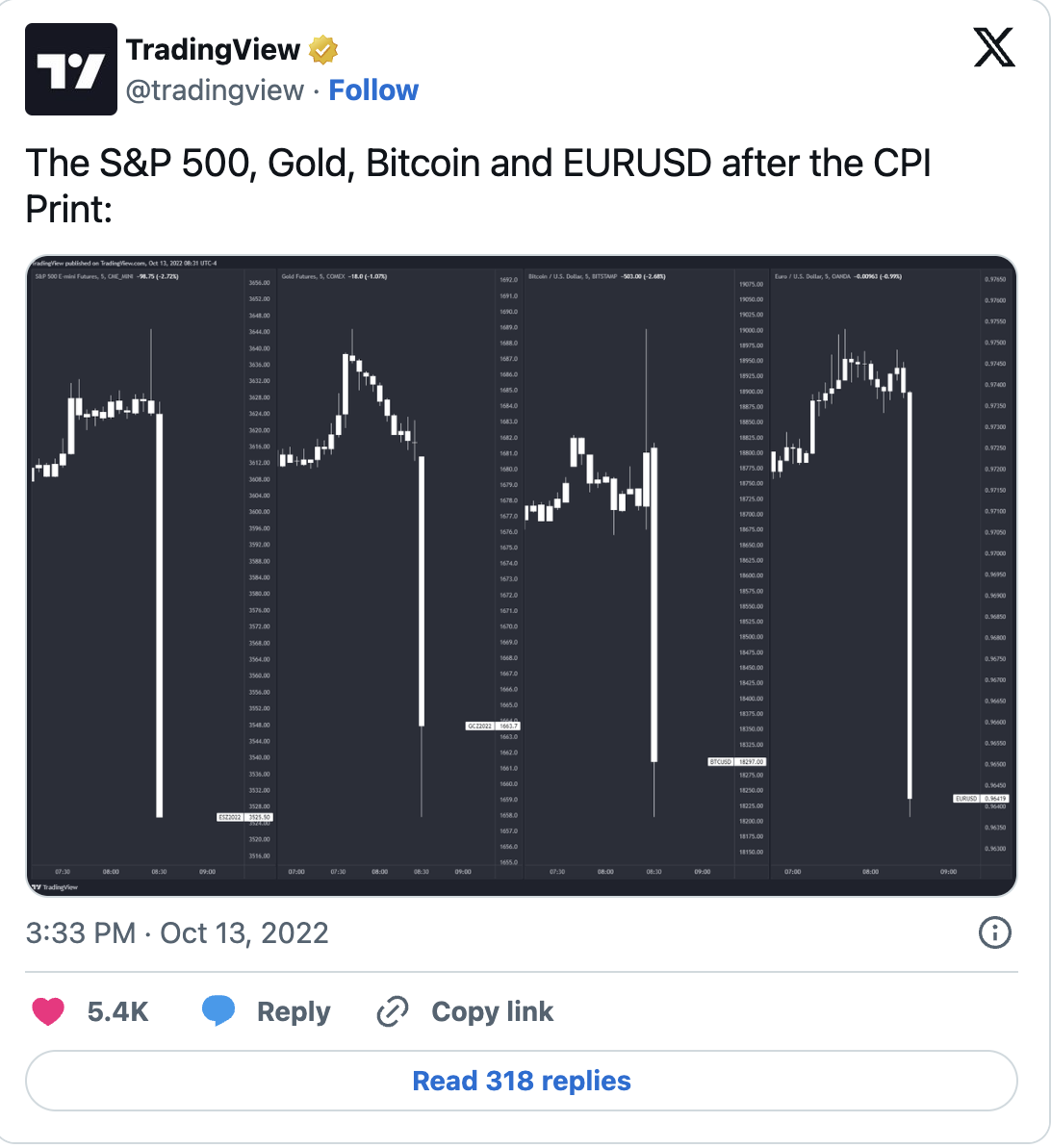

The consolidation period in Bitcoin price emerged right after two conflicting market catalysts: the possible approval of a Bitcoin ETF in the US and concerns about the Federal Reserve’s “longer and higher” interest rate strategy.

Analysts who anticipate that the approval of a Bitcoin ETF would bring $600 billion worth of demand to the crypto market argue that it could trigger a rally led by Bitcoin. Additionally, the reality of inflation, which will stay with us for a long time, increases the potential for the Fed to keep future interest rates higher, creating concerns for risky assets, including Bitcoin.

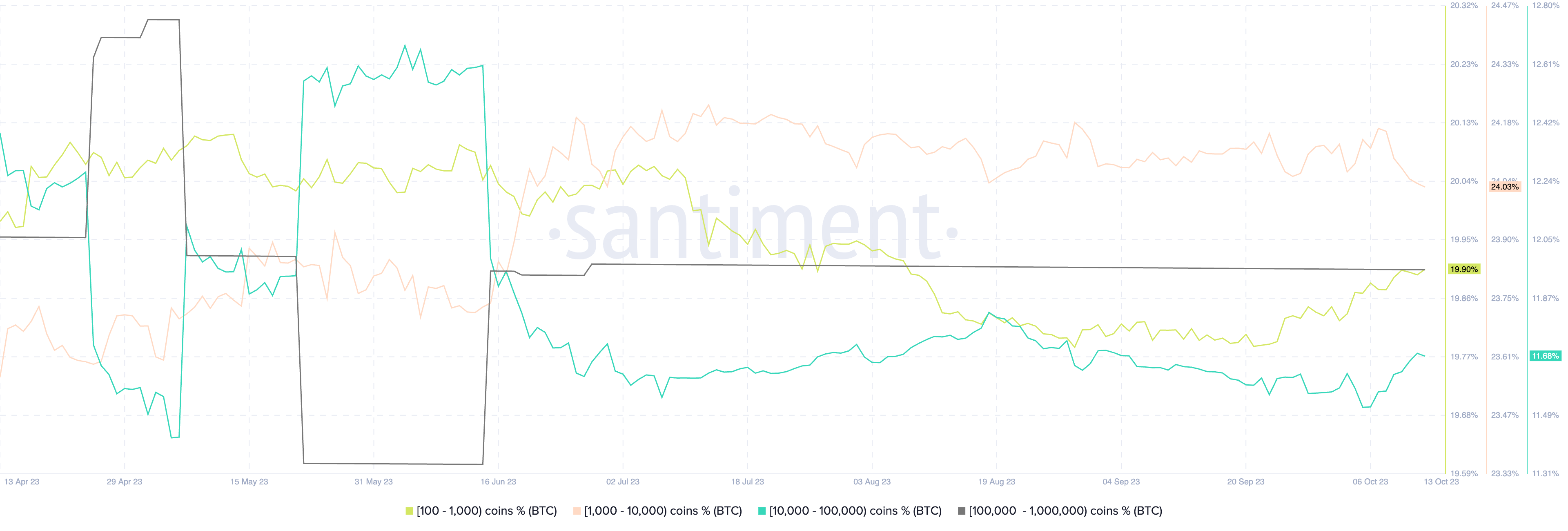

Whales Accumulating BTC

There has been an increase in the number of Bitcoin held by whale and institutional addresses entering October. This indicates that the wealthiest investors trading in the cryptocurrency market are accumulating Bitcoin without using centralized exchanges. For example, the supply held by Bitcoin addresses with a balance between 10,000 and 100,000 Bitcoins (blue line in the graph) increased by over 1% from its lowest level on October 5th.

The notable point in this increase is the decrease in the supply held by Bitcoin addresses with a balance between 1,000 and 10,000 Bitcoins (orange wave). Additionally, the amount of Bitcoin held by wallets with a balance between 100 and 1,000 Bitcoins (green wave) has increased.

Türkçe

Türkçe Español

Español