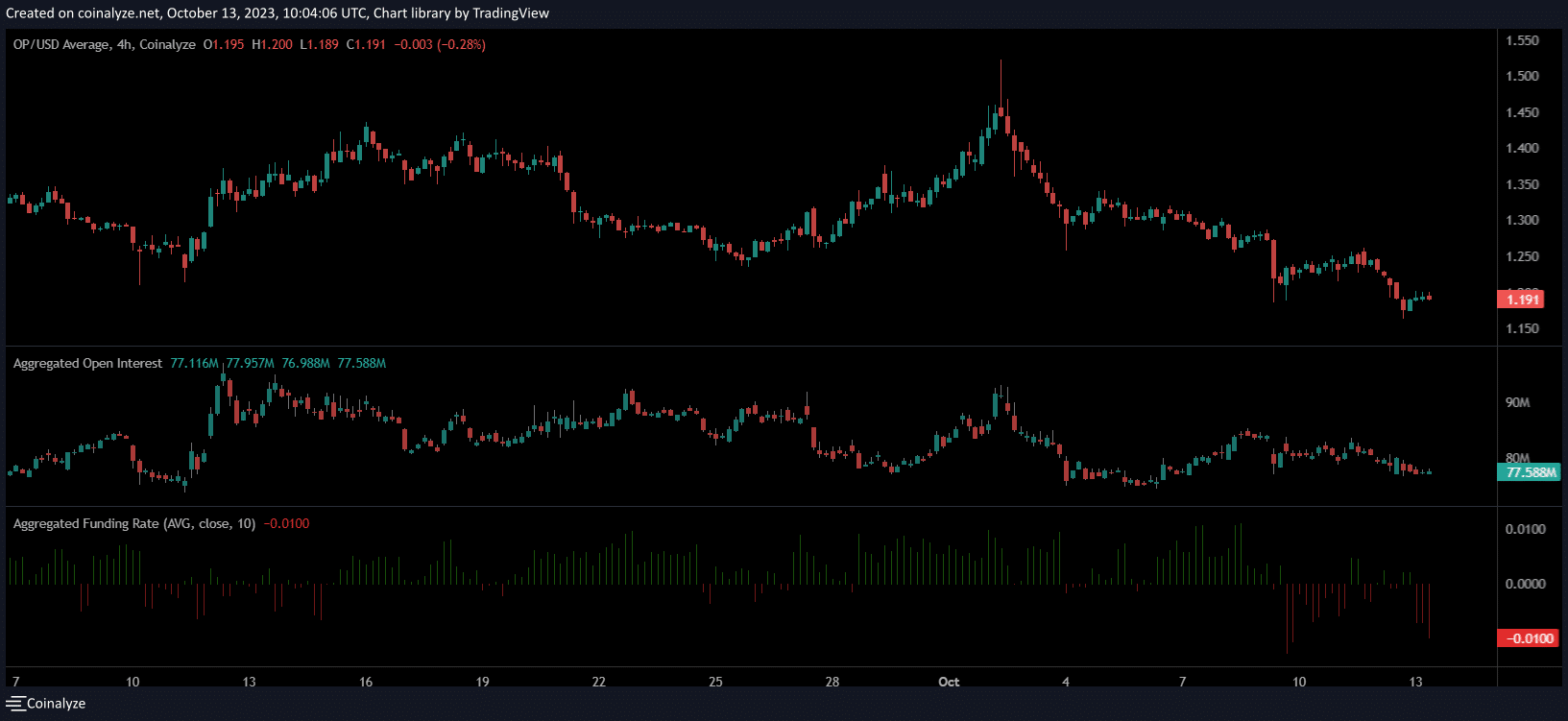

Selling pressure on Optimism (OP) may turn the short-term support level of $1,165 into resistance. The rejection of the bullish rally at the resistance level of $1,419 on October 2nd opened the way for a continuous downward momentum volatility, leading to an 18.9% drop in Optimism between October 2nd and October 13th.

Effects of BTC on OP

Bitcoin (BTC) trading below $27,000 may take advantage of breaking the bullish defense at the key support level. Considering the upward price movement, the support level of $1,165 can be seen as crucial for the bulls. Significant rally movements occurred from the support level in June and July 2023.

Despite the recent downward structure, Optimism has remained strong to halt the bearish trend. However, the latest price movement on the OP chart indicated a weakening of the bullish defense. The 12-hour timeframe showed that OP has posted three consecutive bearish candles in the last 48 hours. This is reflected in the relative strength index (RSI) falling below the neutral 50 and hovering just above the oversold zone as of the time of writing.

Price Future of OP

Despite a slight decline, the on-balance volume (OBV) still indicates a good upward trend. The breaking of the support level may provide new short-selling opportunities for sellers targeting $1,042. However, a successful defense of the level and Bitcoin returning to $27,000 could lead OP bulls to resume their uptrend.

Negative funding rates indicate that the majority of the futures market is short and willing to pay funding to bearish positions. Additionally, data from Coinalyze showed that open positions decreased along with the price on the four-hour timeframe. Therefore, investors may wait for the support level to break before adding more short positions in the short term.

Türkçe

Türkçe Español

Español