Toncoin (TON) showed a stable price performance during October 17th and witnessed a 7% price increase. However, with possible news from the market, a reversal in price may occur, forcing buyers to return to the short-term support at $1.98. At the time of writing, Toncoin attempted to surpass the overall resistance at the $2.1 level, which is the 50% Fib level, with a minor rally, but the obtained liquidation data indicated a potential reversal in price.

As recently shared, it was believed that the selling pressure on the altcoin could deepen TON’s decline to the $1.78 level. However, the movements in Bitcoin (BTC) price allowed TON to regain its lost strength by reversing the recent price losses.

TON Coin Chart and Analysis

An important intersection area for TON Coin was located at the $1.98 level. This notable level indicated the previous breakout level of the mini rally in September. Additionally, the daily bullish order block (OB) between the 38.2% Fib level and $1.93 to $2.04 range was also found in the same price area.

Altcoin‘s recent pullback appeared to have eased in the identified intersection area. If TON encounters resistance at the 50% Fib level ($2.1), bulls may regroup in the consolidation zone. The upside target will be the 50% and 61.8% Fib levels.

Chart analysis reveals an improvement in capital inflows. However, there has been a slight decrease at the time of writing, as indicated by the movement towards zero in the Chaikin Money Flow (CMF) indicator. The overbought condition seen in the RSI may still not be interpreted as a clear indication of a potential reversal. Nevertheless, the available liquidation data suggested possible TON losses to investors.

Ton Coin Future Outlook

Examining the liquidation data from Coinglass, it can be observed that risk-taking investors faced difficulties in the last one and four hours before the time of writing. According to the charts, it was revealed that investors who took long positions lost their positions. This indicates the possibility of an additional short-term rally. Consequently, a potential reversal in price may occur at the 50% Fib level.

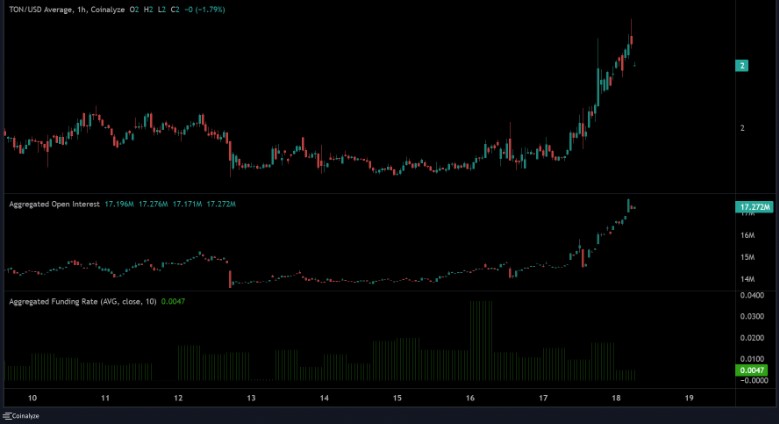

In conclusion, despite an impressive recovery in Futures market demand, challenges may arise in the long-term recovery movement of TON price, as indicated by the increase in Open Interest (OI) rates and funding rates.

Türkçe

Türkçe Español

Español