ApeCoin’s (APE) price continues its volatile movement. As of the time of writing, its price of $1.12 continues to unsettle investors. According to price expectations based on recent analysis of APE coin’s charts, it wouldn’t be wrong to say that bulls focusing on short-term gains have set their sights on a price target of $1.7. This price movement seemed to be untested yet. Additionally, at the time of writing, liquidity was above the critical level.

ApeCoin’s Future and Price Chart

ApeCoin’s recent highest and lowest price levels were reflected in the charts as $1.305 and $0.993, respectively. According to these price points, the 38.2% Fib level coincided with the $1.10 to $1.13 red breakout level within the same range.

However, based on the current structure of the price chart indicators, a potential price movement towards $1.15 or $1.18 could occur. Especially in the APE market, as indicated by the upward price movement of CMF, there has been a significant increase in capital entering the market.

Although the RSI indicates an upward trend, there have been fluctuations above 50 in the past few days. This indicates an increase in buying pressure for ApeCoin, followed by an uncertain period. A pullback at the $1.12 resistance level could lead buyers to target $1.067 as their new price goal.

ApeCoin’s Future

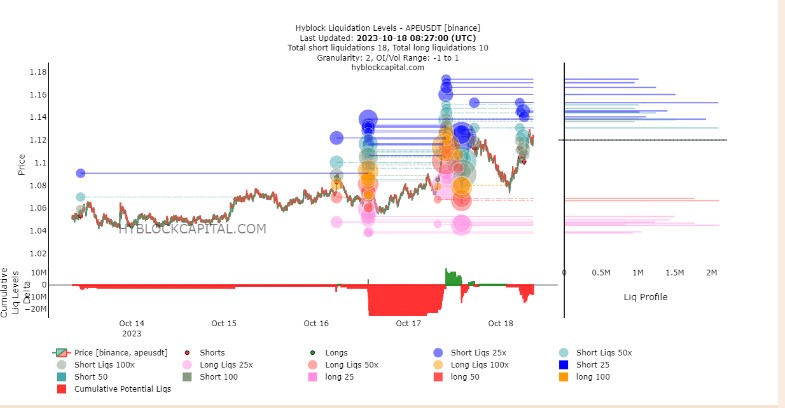

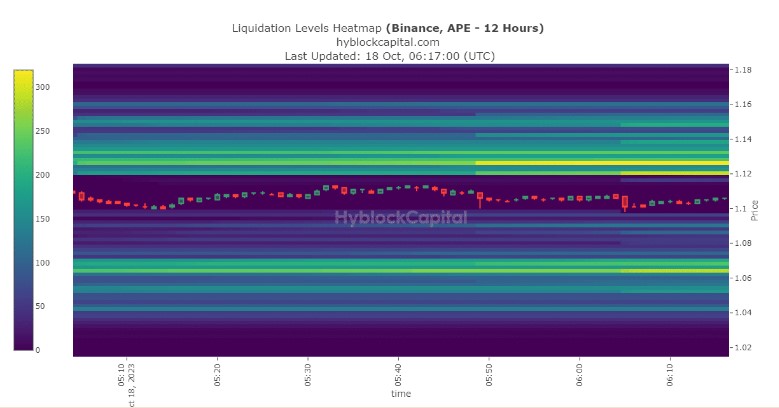

According to data from Hyblock Capital, significant high liquidation levels are present at $1.12 and $1.06, as indicated by the orange areas. This suggests that ApeCoin may react strongly at these price levels and make a price movement. According to the Fib level shown on the price chart, it reflects the $1.12 resistance level and the $1.06 support level.

If we examine the liquidation levels in more detail, we can see that liquidity is concentrated above the mentioned levels at $1.14 and $1.15. Considering the positive appearance of the Cumulative Liquidation Level Delta (CLLD), APE can experience a price surge up to $1.15 (50% Fib level). Therefore, the critical two levels, 38.2% and 50% Fib regions, can play an important role in APE’s price reversal.

Türkçe

Türkçe Español

Español