Analyst Lyn Alden shared a long-term positive view on both the leading currency and gold, highlighting the potential financial challenges ahead and the optimism fueled by the price increase of Bitcoin (BTC) in the cryptocurrency world. She particularly discussed the two-year growth perspective for Bitcoin.

Increases in Bitcoin Holders!

She claimed that Bitcoin only needs a few small, decentralized bases in various jurisdictions to withstand such challenges and that it offers profit potential to those supporting these decentralized bases. This view is promising for Bitcoin holders because it suggests that the cryptocurrency can withstand regulatory pressures and ultimately benefit long-term investors by becoming stronger. At the time of writing, Bitcoin is trading at $29,524.

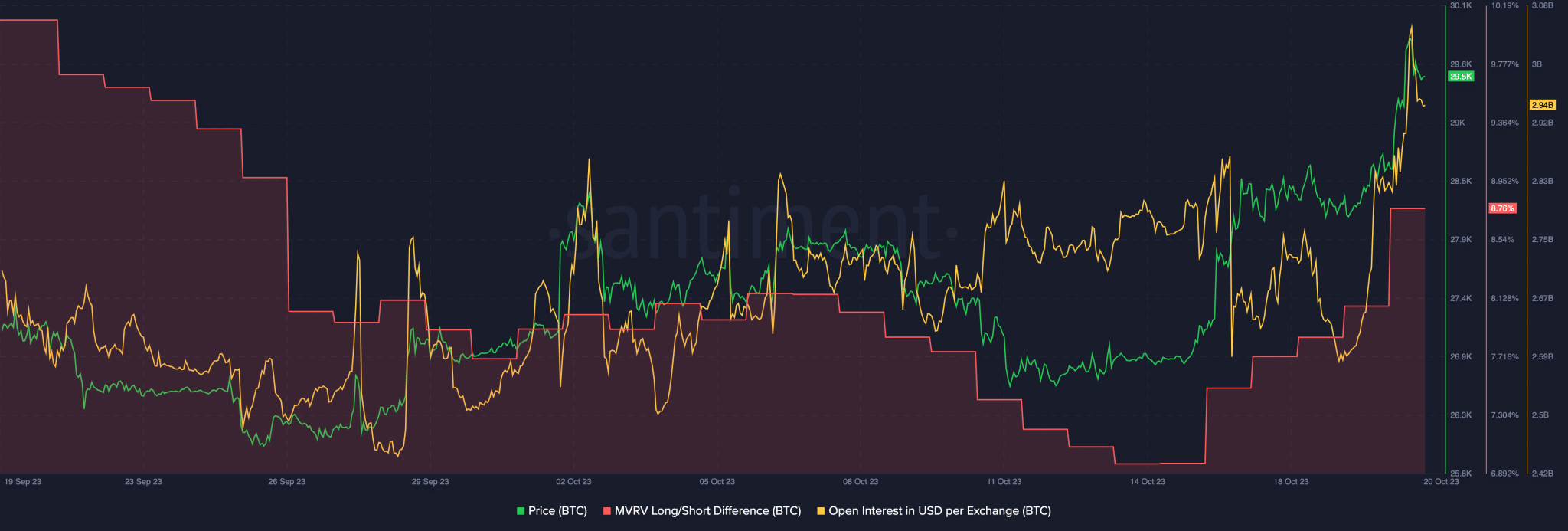

The increase in the long/short ratio for Bitcoin indicated that long-term holders were accumulating BTC. This behavior brings confidence in the future potential of cryptocurrencies to mind. The open position for Bitcoin also grew in parallel with the price increase. This reflects an increase in the number of outstanding contracts in the market.

Critical Metric for BTC!

Overall, the increasing open position can indicate increased investor participation and interest in Bitcoin futures. Among its consequences is a more active and liquid market. Implied volatility for Bitcoin has also increased. Implied volatility is a measure of market expectations for future price volatility.

The increase in implied volatility may indicate that investors anticipate more significant price movements in the near future. This can lead to higher trading activity and potentially greater price volatility. On the other hand, the BTC 25 delta curve, which measures the perceived risk of significant market movements, has decreased significantly. A decreasing slope may indicate a more balanced sentiment in the market. Investors may perceive lower risks associated with higher price volatility, which can influence their trading strategies and market behavior.

Türkçe

Türkçe Español

Español