As the price of Bitcoin continues to reach new highs, altcoins are also gaining momentum. BTC is currently hovering around $31,000. However, the overall rise in cryptocurrency prices will only be possible if BTC can maintain higher levels of support. For now, the expectation is that the king of cryptocurrencies will support altcoins with daily closings above $30,000.

Cardano (ADA)

ADA Coin price has reached its highest point in 14 days as capital inflows to altcoins increase. Although the popular cryptocurrency briefly reached $0.27, it is still far from its yearly low. Furthermore, the current price level was seen during the November-December crash when BTC was at $15,500.

ADA Coin, which has been affected by overselling, is now showing signs of recovery. Whales have made a $30 million entry in the past 2 weeks. This is a positive sign considering the low volumes. If the trend continues, we may see the target of the $0.3 resistance level.

The chart below shows the total holdings of whales holding 1 million to 1 billion ADA. These holdings, which remained relatively stable between July 14 and October, caused the price to fluctuate between $0.24 and $0.28. However, since the beginning of October, whales have purchased 110 million ADA, increasing their total holdings to $20.35 billion.

ADA Coin Price Predictions

The consolidation period for ADA Coin seems to be over, as mentioned above. However, for investors to regain confidence, BTC needs to show more strength. False rallies in recent months have led to significant losses for investors.

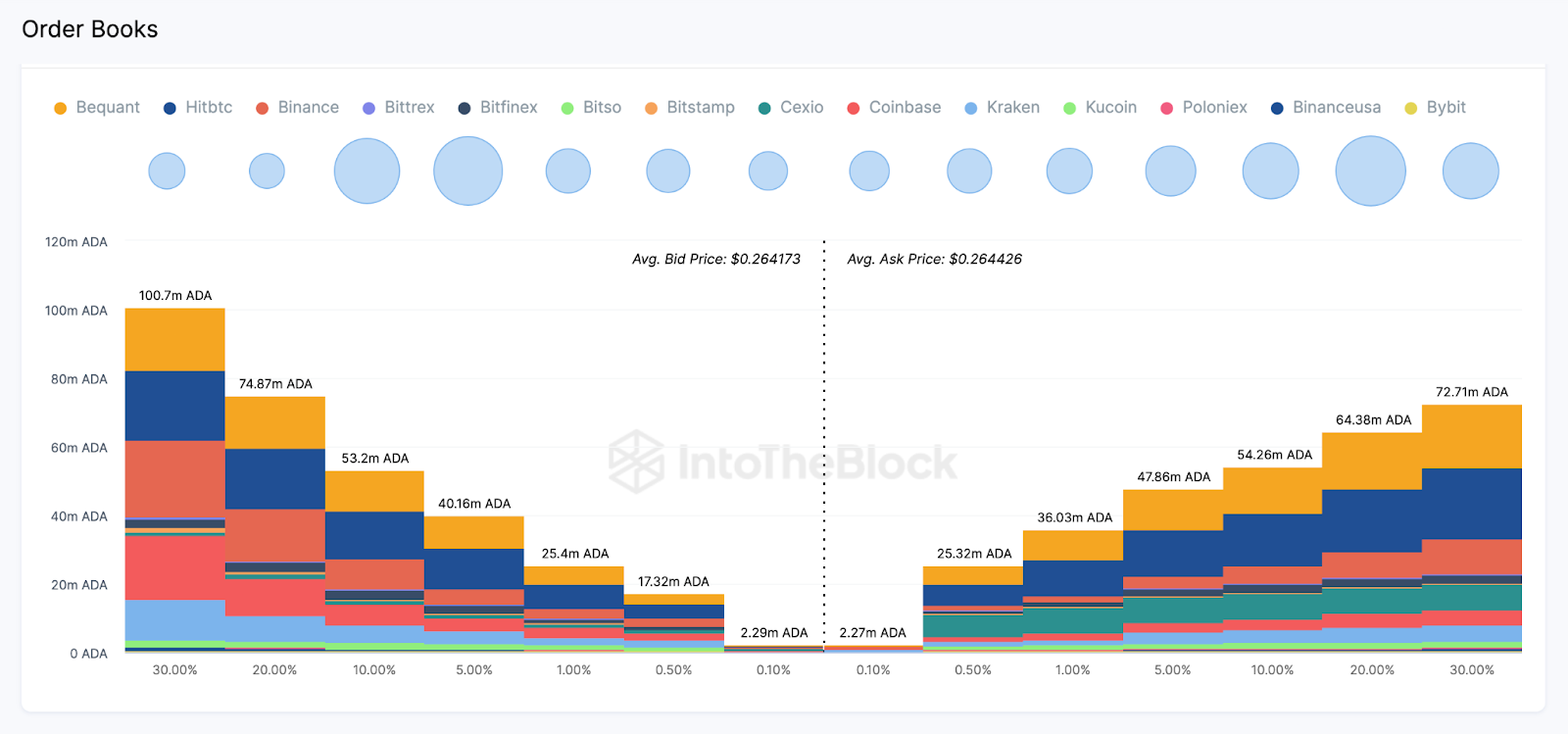

So, is this rally also false? This time, the situation may be different as BTC has been closing at higher levels for days. Furthermore, the liquidity in ADA Coin’s order books indicates that bulls are dominant.

In the past 3 months, the $0.30 region has historically become a significant resistance level. Although there is a strong sell wall of 5.9 billion ADA Coin at this price, bulls can surpass this critical threshold once investors are convinced of the upward movement. Closings above this level will target $0.37.

However, if events such as Powell’s speech or personal consumption expenditure data create pressure on the macro front and interrupt BTC’s rally, a drop to $0.25 would not be surprising.