The king of cryptocurrencies, Bitcoin, surged to $35,280 about 5 hours ago. The footsteps of the rally were heard yesterday. Investors, who have lost huge amounts of money in fake rallies for months, were reluctant to believe in the latest rally. However, the BTC price reached higher peaks as they refused to believe. Now, it is trying to solidify above $33,000 as support.

Bitcoin (BTC) at $35,000

As the Asian markets opened, BTC surpassed $35,000, signaling the end of bear markets. Those who remember the exciting days of the bull should have kept the volatility at the opening hours of the Asian markets in mind. With a positive daily close, the ongoing demand turned into a massive explosion.

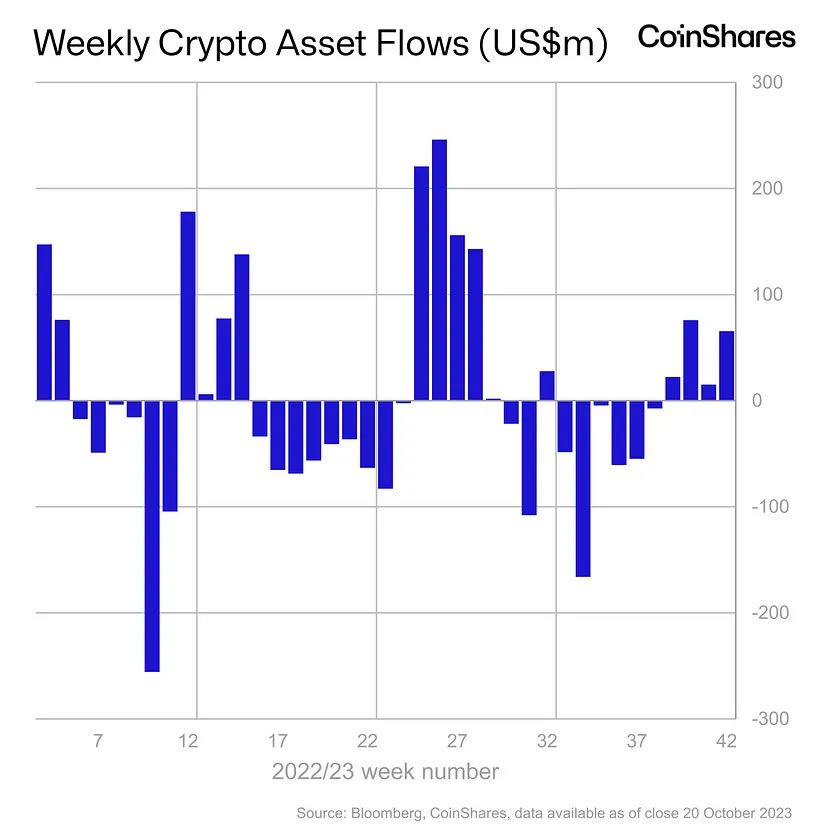

Bitcoin (BTC), reaching its highest level since May 2022, had been signaling this for a few weeks. Institutional investor demand started to rise rapidly after remaining in the negative zone for 2 months. Moreover, the volume of crypto ETP products was also recovering. This demand came from professional investors, and they had valid reasons to expect an increase.

Rise of Spot Bitcoin ETF

This is the most important reason for the rise of Bitcoin. Even though the macro front was volatile this week and the smell of the third world war spread everywhere, BTC bulls believe in the approval of ETFs. Analysts have received some signals that asset manager BlackRock will soon release its ETF. The sharing of experts yesterday saying that the approval is coming soon also moved the markets.

Bloomberg ETF analyst Eric Balchunas said yesterday evening that BlackRock has obtained a new license and that the company may start the seeding process at the beginning of this month.

“Seeding an ETF refers to the use of a few creation units (underlying assets) (in this case Bitcoin) to purchase the first creation units that can be traded on the open market on the first day (typically) by a bank or broker-dealer in exchange for ETF shares.”

No massive investments are made during the seeding period. So, it should not be interpreted as BlackRock preparing to buy billions of dollars worth of BTC.

Summary of Cryptocurrencies (Bullet Points)

- It is advisable not to lose caution as personal consumption expenditure data will be announced this week.

- The court decision for GBTC has been finalized, and the application will be reviewed again by the SEC. The SEC is struggling to find a new reason to reject the application. The possibility of approval is higher, and this last-minute development may further increase the demand in the market.

- The final decision dates for BlackRock and other ETF applications are in March. However, if the SEC wishes, it can end the process by saying “I approve” in October.

- The letter from US Representatives saying “approve the ETF now and avoid making mistakes that you cannot disclose in the future” is one of the things that form the basis of today’s optimism.

- The statement made by BlackRock CEO Fink last Monday triggered the ongoing rise. We will remember this statement as a turning point for years to come. Fink stated that demand for crypto will increase in the coming period. He also mentioned pent-up interest.

- Many Bitcoin metrics were at their lowest levels. Volumes, traffic, and accumulation reached their highest levels since 2015 at the end of the challenging bear market. So, the king of cryptocurrencies can really achieve it this time. Closures above $35,000 for Bitcoin are extremely important and will accelerate the recovery in altcoins.

Türkçe

Türkçe Español

Español

Hi fine thanks