The arbitrage strategy, which is among the most popular trading approaches during previous bull runs in the cryptocurrency market, has come back into the spotlight thanks to the widening gap between the price in the perpetual futures market associated with Bitcoin (BTC) and the spot market price. So what does this mean for investors, let’s take a closer look.

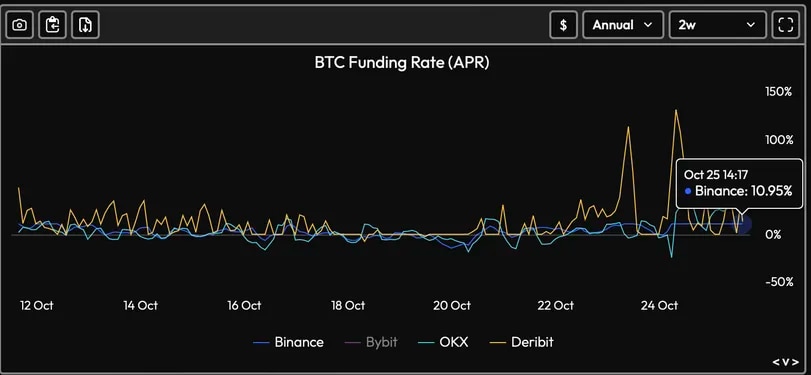

Bitcoin’s Funding Rate Exceeds 10% in Futures

According to Velo Data, the difference representing the cost of holding long/short positions in perpetual futures, also known as funding rates, has exceeded 10% annually on major cryptocurrency exchanges, including the renowned cryptocurrency exchange Binance. Positive funding rates mean that buyers or long position holders pay short position holders to keep their leveraged positions open.

Traders are taking advantage of the price difference between Bitcoin’s perpetual futures prices and the spot market price by opening short positions in perpetual futures while simultaneously buying cryptocurrencies from the spot market, evaluating a strategy called funding fee arbitrage. In this way, they minimize the risk caused by ongoing price increases and safely pocket the 10% share of funding.

“A Perfect Market for Arbitrage Opportunities”

Markus Thielen, the Head of Research and Strategy at the cryptocurrency financial services platform Matrixport, commented on the arbitrage difference. Thielen stated the following regarding the matter:

This is a perfect market for arbitrage opportunities, where almost 10-20% (if not more) risk-free returns can be achieved. Bitcoin’s annualized perpetual futures premium was 40% yesterday. It has dropped to 13% today, but it is still good enough for arbitrage transactions.

Currently, the increase in the premium of the perpetual futures market is consistent with previous upward trends. Bitcoin’s price has increased by 25% in the past four weeks, with most of the gains occurring during North American trading hours.