Bitcoin saw a surge in value due to speculation, and altcoins followed suit. Local tokens of DeFi protocols like Uniswap (UNI) also appear to have benefited from this surge.

In the midst of these developments, Uniswap made a strategic move by introducing an interface fee to finance its development. This fee is intended to be collected daily from investors using Uniswap’s web interface and wallet.

Uniswap and Future Plans

The implementation of the interface fee by Uniswap signaled a new strategy to increase the platform’s revenue streams. Hayden Adams, the founder of Uniswap, stated that the purpose of this initiative is to support the development of the growing protocol.

The implementation of Uniswap’s interface fee received mixed reactions. Compared to centralized exchanges, the 0.15% fee seemed relatively high. For comparison, Binance applies a fee of only 0.1%.

Metamask Swaps, a popular wallet provider, charges an even higher fee of 0.875% for transactions.

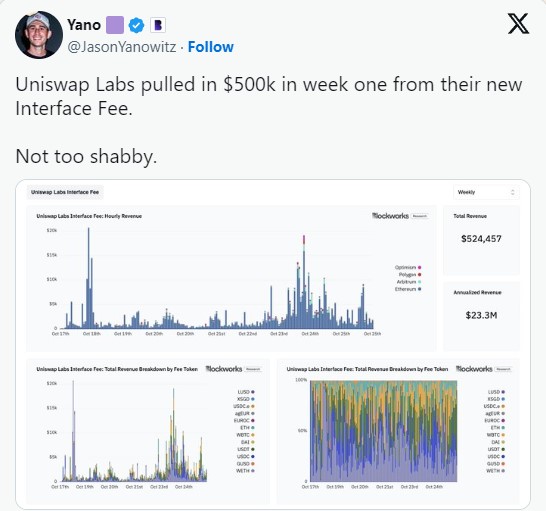

Despite the relatively high fee, Uniswap had a significant trading volume last week and generated substantial fees. During this period, $500,000 was collected through the fees.

Current Status of Uniswap

Data provided by Santiment highlighted the effects of the interface fee. Despite the fee, there was an increase in active users on the Uniswap platform. This increase can be expressed as a significant rise of 34.2% compared to the previous week. The increase in user count is a promising indicator that the new fees did not deter investors.

However, there are also some indicators that show relatively weak positivity. There has been a decrease in the number of commitments in the protocol. Generally, such decreases can raise concerns about the ongoing development of the platform.

When examining the UNI token, it can be said that it did not achieve significant price gains compared to its competitors last week. As of the time of writing, the altcoin is trading at $4.09, and there has also been a decline in network growth. Additionally, it was revealed that addresses are not performing many UNI transactions. The lack of interest from new addresses may negatively impact UNI’s future price.

Türkçe

Türkçe Español

Español