As bulls continue to push for further gains, the price of Chainlink (LINK) remains stagnant around $11. Analysts’ on-chain analysis identifies three critical indicators that could trigger a prolonged consolidation phase in the coming days.

16-Month High in Chainlink

During last week’s crypto market rally, Chainlink reached a 16-month high at $11.50, attracting attention from the media. However, the price has since remained stable. So, what are the main factors hindering further price increases for Chainlink?

While the popular altcoin rapidly climbed the crypto winners’ chart last week, hitting a new 16-month price high, holders have not rushed to cash in on significant profits. However, on-chain data indicates a significant decrease in Chainlink network activity.

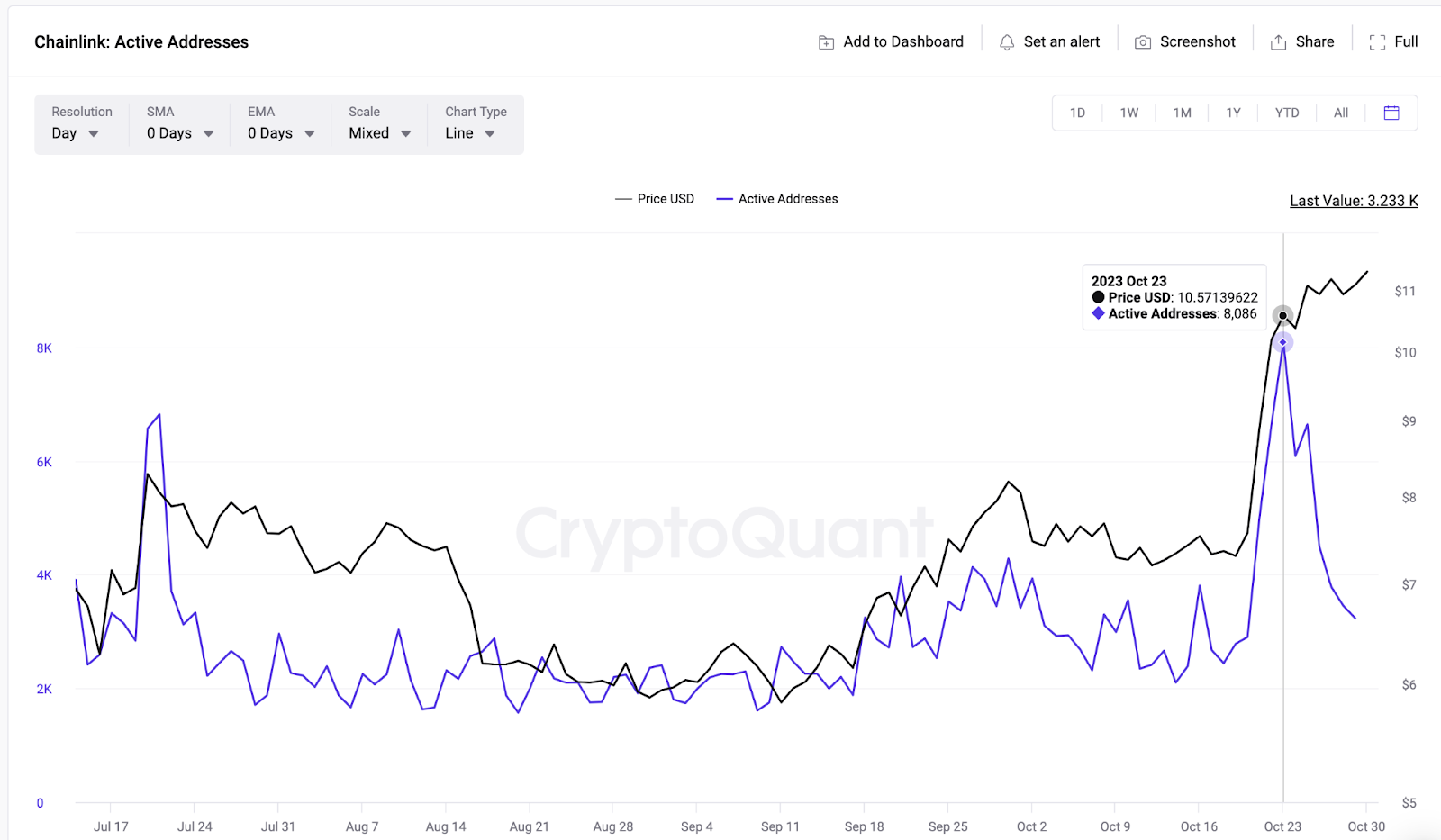

A shared CryptoQuant chart shows that Chainlink recorded a three-month high with 8,086 active addresses on October 23. However, within 24 hours, the LINK price rose to $11.50 for the first time since 2022. Nevertheless, the number of LINK active addresses has steadily declined since October 23, reaching 3,233 by October 29. This could indicate a 60% decrease in daily network activity within a week.

The daily active addresses metric predicts the rate at which existing users join a Blockchain network. A decrease in active addresses generally suggests less demand for the project’s core services. In the case of Chainlink, it indicates a 60% decrease in network activity over the past week.

Details from Santiment Reports

Last month’s price surge in Chainlink was supported by an influx of new users joining the ecosystem amidst real-world asset (RWA) and asset tokenization interest. However, recent on-chain data readings suggest a negative turn last week.

According to Santiment, the number of new addresses created on the Chainlink network has significantly decreased. Additionally, the growth of the Chainlink network reached a 110-day high with 2,465 on October 23. However, similar to the observed trend in active addresses, network growth figures also experienced a 60% decrease, reaching 1,008 new addresses by October 29.