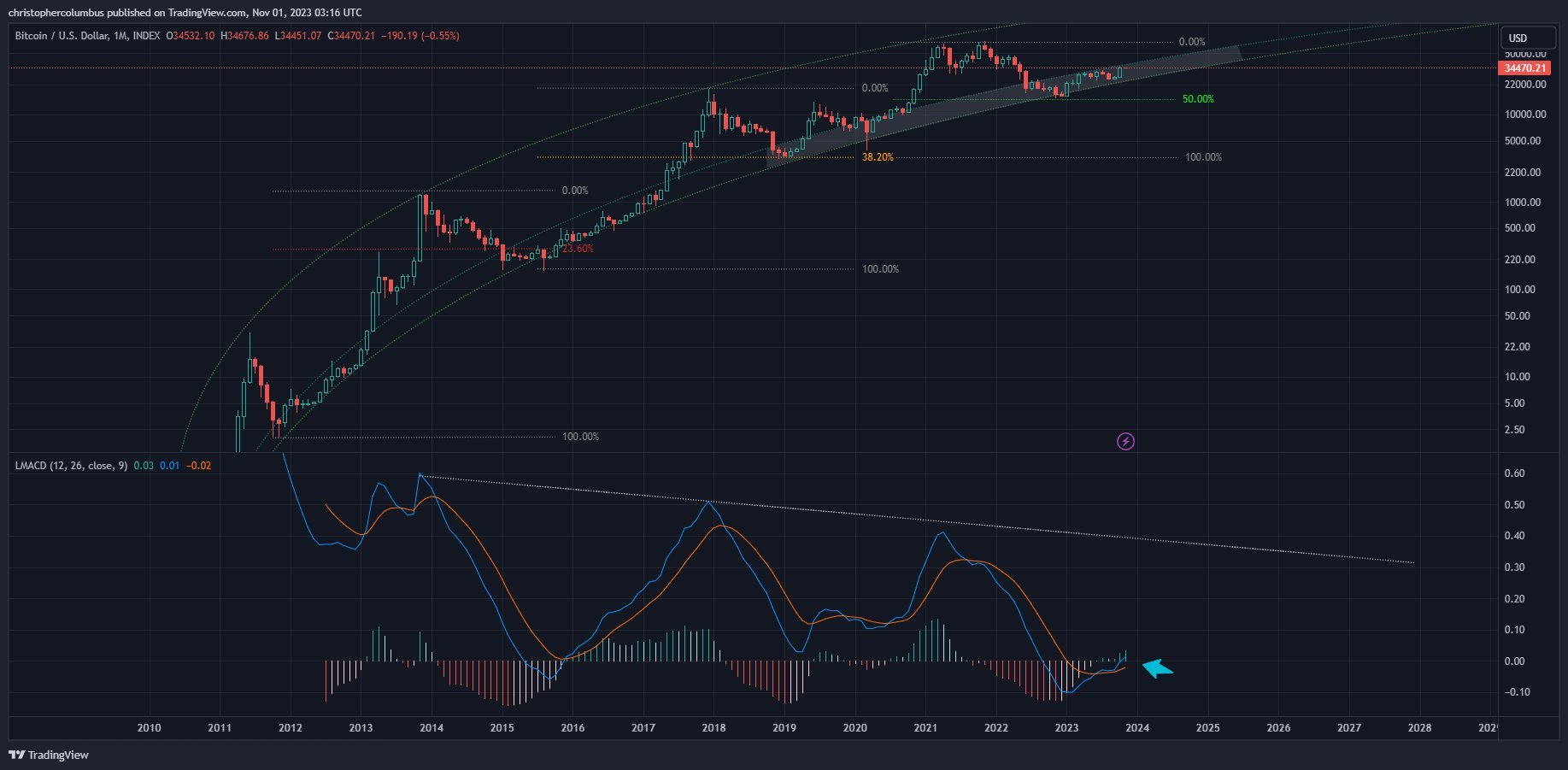

Prominent crypto analyst Dave the Wave has reported that the Moving Average Convergence Divergence (MACD) indicator on the monthly timeframe for Bitcoin (BTC) has crossed the zero line, signaling a potential entry into a bullish phase. This development has caught the attention of investors, enthusiasts, and analysts as it presents a strong signal for a potential price rally for the largest cryptocurrency.

MACD Indicator and Bitcoin

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price, typically the 12-day and 26-day exponential moving averages. When the MACD crosses above the zero line, it is generally interpreted as a bullish signal, indicating that the price of the asset may move upwards in the near future.

The recent chart shows that Bitcoin’s MACD has now crossed above this significant threshold. Such a movement has historically preceded price rallies and is seen as a positive sign by many technical analysts.

Recent Bullish Predictions for Bitcoin

Global asset management company Bernstein recently expressed confidence in Bitcoin’s potential performance, predicting that the price of the crypto king would rise to $150,000 by mid-2025. Considering Bitcoin’s current trading price of $34,400, this represents an impressive increase of 336% from current levels. The projection is based on the historical relationship between Bitcoin’s price and its marginal cost. Past data shows that Bitcoin rarely falls below its marginal cost, indicating that this metric could serve as a supportive “floor” for the value of the crypto king.

Furthermore, crypto service provider Matrixport suggested that Bitcoin could rise to the range of $42,000 to $56,000 if BlackRock’s spot Bitcoin ETF is approved. This prediction is based on the potential capital inflows nearing $24 billion.

Banking giant Standard Chartered also shared its year-end prediction for Bitcoin. The company revised its previous $100,000 target to $120,000, highlighting increased confidence in the flexibility and potential of the cryptocurrency market.

Türkçe

Türkçe Español

Español