Just minutes before the announcement of the meeting decision, the price of Bitcoin is at $34,400. Today, the resistance was broken. However, the price couldn’t stay above the resistance level. The Fed announcements will start shortly, and Powell will begin his speech half an hour later. So, can the price of Bitcoin embark on a journey to $40,000 as of tomorrow?

The Fed and Cryptocurrencies

In July, after the interest rates reached the highest level in 22 years, which is 5.25% – 5.5%, the Fed declared a pause in interest rate hikes. Most likely, we will see in this meeting that the interest rates are not raised. Like other risky assets, the announcements of the Fed interest rates also affect Bitcoin, which is in the risk markets.

Under normal circumstances, interest rates should curb inflation, and after a period of restriction, the Fed should start lowering interest rates. However, when Powell announced in September that there would be a pause in interest rates, he also stated that inflation is still very high. Therefore, we are far from interest rate cuts, and a door is left open for one more increase. This situation prevents the market from pricing the Fed’s easing program prematurely.

The recent CPI and Non-Farm Payrolls data were also above market expectations. The economic growth is on trend, and these three indicators alone suggest that the Fed’s tight stance may continue.

Can Bitcoin Reach $40,000?

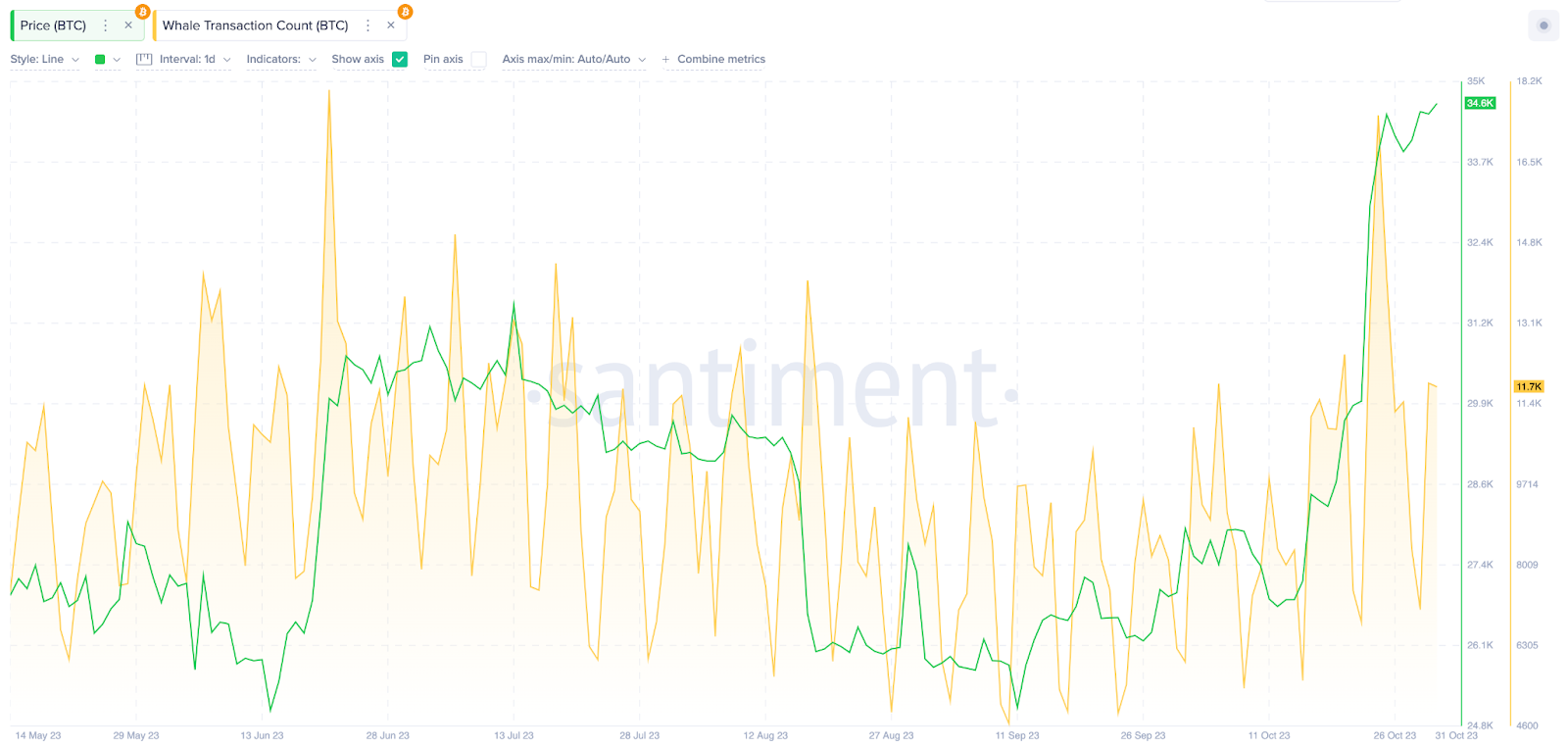

Data from Santiment shows that institutional investor interest in Bitcoin increased after the Fed announced the halt of interest rate hikes on September 20. The chart below shows that Bitcoin attracted at least 7,000 confirmed whale transactions each day in the past 10 days. If the Fed officially announces the end of interest rate hikes tonight, it could attract an even bigger wave of demand.

In an environment where interest rates have reached their peak and it is said that they will not be increased further, the price of Bitcoin seems to easily target $40,000. The fact that 79% of Bitcoin holders are in profitable positions indicates that the overall sentiment in the ecosystem is overwhelmingly positive.

So, what would it take for the $40,000 target to be invalidated? If Powell mentions the possibility of further increases, regional risks, and the potential for war, this could happen. Although not sufficient on its own, the possible hawkish stance of the Fed will pave the way for testing the support at $33,500.

If $33,500 is lost and the price falls below $30,000, the recent movement will remain a major bull trap. If this doesn’t happen, crypto investors will receive an early signal indicating the end of the bear markets tonight.

Türkçe

Türkçe Español

Español