Former CEO of the crypto exchange BitMEX, Arthur Hayes, confessed to buying <a href="https://en.coin-turk.com/renowned-cryptocurrency-analyst-predicts-major-surge-for-popular-altcoin-is-solana-sol-a-worthwhile-investment/”>SOL, the native token of the Solana blockchain network, and drew attention to the bullish outlook for the cryptocurrency. Hayes’ purchase of SOL by the famous figure occurred after it had risen by 500% from its December 2022 low of around $8.

Comment from a Prominent Figure on Solana

This development took place just days after VanEck, an asset management firm that oversees $76.4 billion worth of crypto assets, made a prediction of a 10,600% price increase for SOL by 2030, emphasizing its potential to capture market share from Ethereum, Solana’s rival.

In addition to this analysis, an analyst from FieryTrading predicted a 150% increase for Solana when it broke the $38 resistance level. SOL had already experienced an 80% increase in October and recently reached $46.75, its highest level in 14 months.

According to Hayes’ statement, he bought SOL at around $46.75. He expects the price to continue rising in the coming weeks, which is attributed to ongoing scalability efforts on the Solana network.

What are the Expectations for SOL in November?

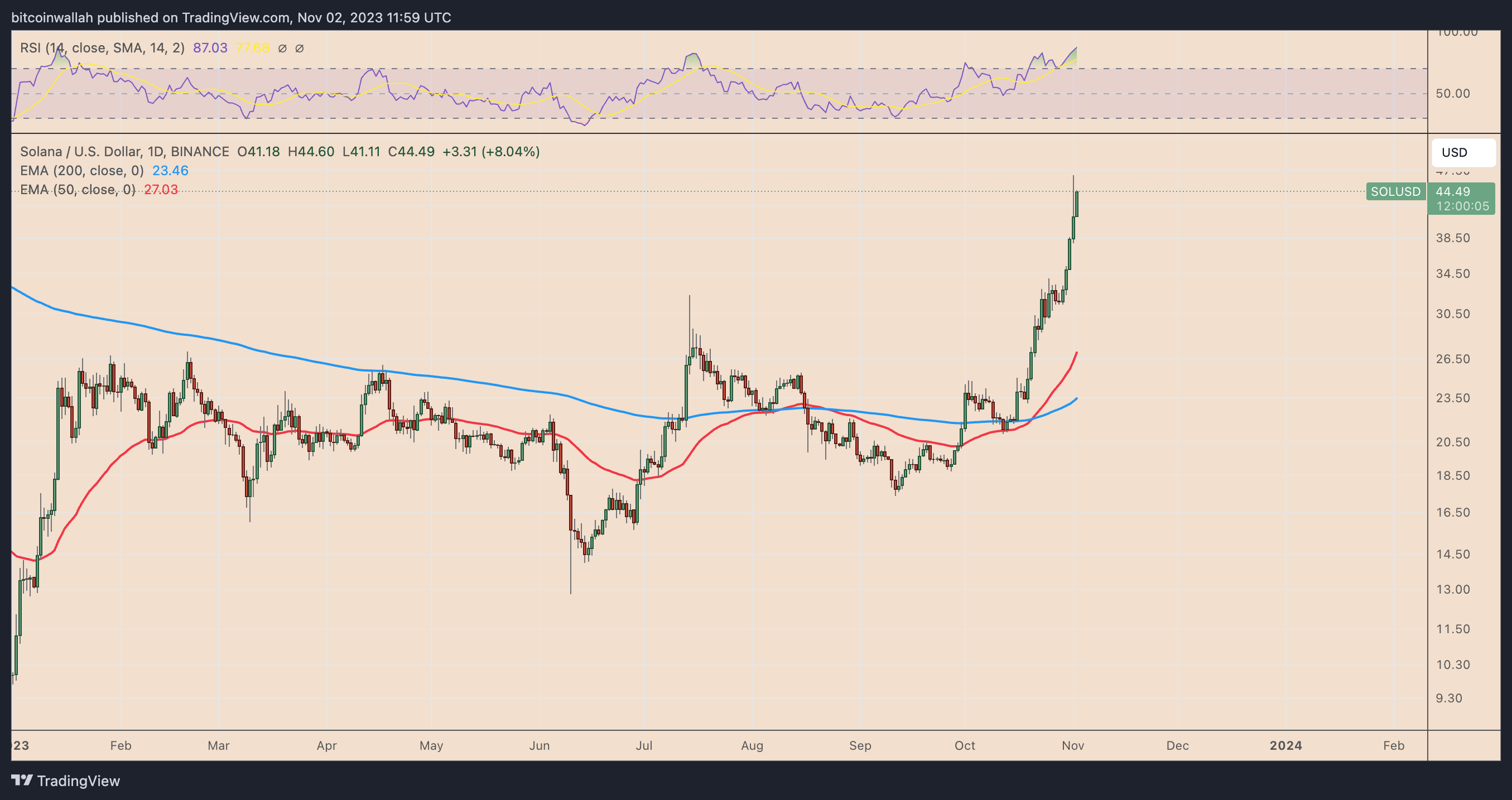

However, technical and fundamental signals point to a potential 30% price decrease for SOL in November. The notable upward trend of SOL in recent months has pushed the daily relative strength index (RSI), a momentum indicator, to its most overbought levels since January 2023.

From a technical perspective, overbought RSI values indicate a potential corrective or consolidative move in assets. This situation in SOL increases the likelihood of a sharp correction in November, as fractal analysis shows that the overbought RSI level precedes price corrections of 35% to 50% throughout 2023.

If this scenario unfolds, the next downside target would be the support level around $30.25, a drop of approximately 30% from current prices, which has been in play between June 2022 and November 2022.

Türkçe

Türkçe Español

Español