Senior cryptocurrency analyst at Bloomberg has stated that Ethereum (ETH) and two other altcoins are creating unprecedented financial opportunities for emerging markets.

Analyst’s Warning on Three Altcoins

Blockchain analyst Jamie Coutts has stated on social media platform that ETH, Polygon (MATIC), and Solana (SOL) are unlocking greater access to the private credit market. In his statements, the expert said:

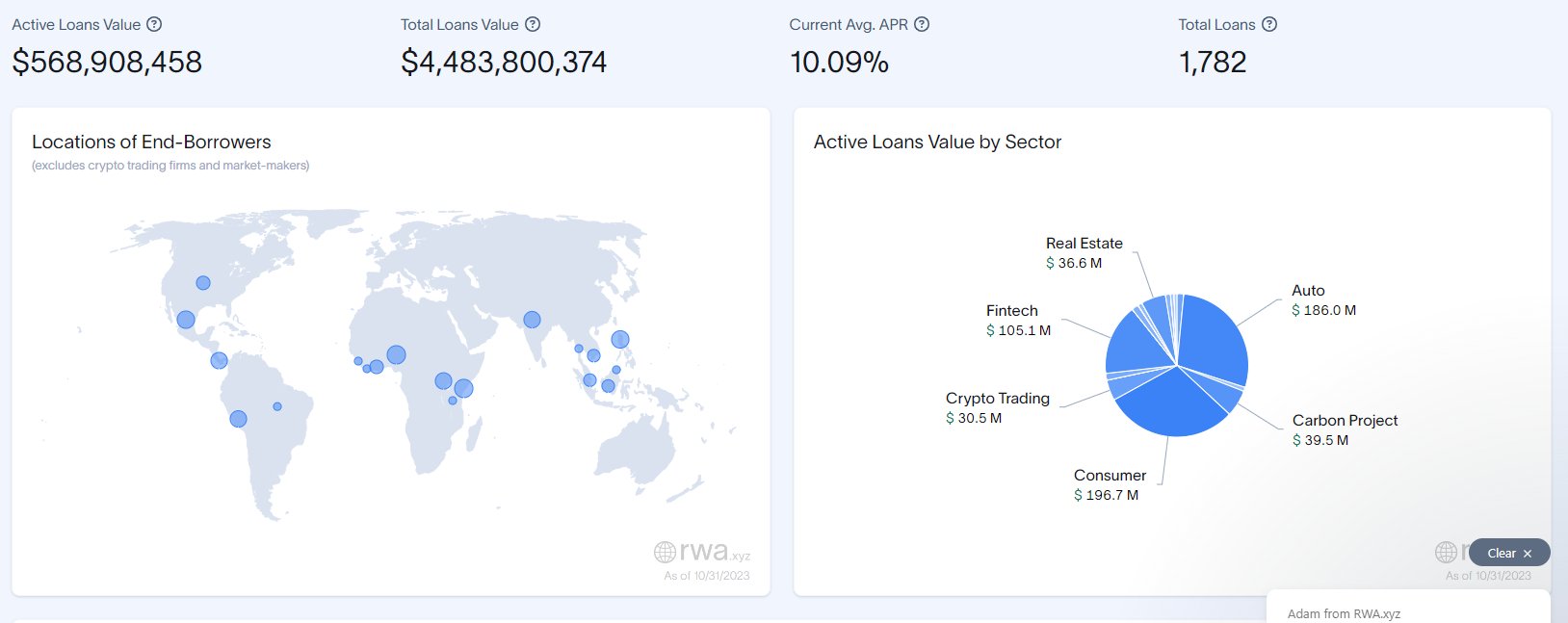

Public blockchains have tremendous potential to empower global citizens. The $850 billion private credit market is just the beginning. Currently, there is $568 million in active credit issued through credit funds on platforms like Ethereum, Polygon, and Solana. Who is investing? The demand primarily comes from emerging markets (EM), especially equatorial regions, with minimal participation from developed markets (DM). Historically, private credit was reserved for accredited investors. However, with the rise of public blockchains and stablecoins, regions struggling with inflation and yield shortage can now benefit from USD private credit opportunities. While Bitcoin leads this movement with its prominent presence and network, other blockchain networks will offer invaluable opportunities to a global population intentionally excluded from mainstream economy and its outdated regulatory protectors.

Expectations for BTC!

Coutts also argued that the private credit market carries risks, and the transparency of issuers is crucial to protect investors. The analyst emphasized the following in his statements:

Private credit is not risk-free. Just last month, decentralized lending platform Goldfinch experienced a loss in its fund. However, as long as issuers maintain transparency and effectively communicate risks, private investors from all backgrounds can access this traditional asset class in a contemporary and inclusive manner.

At the time of writing, Bitcoin is trading at $34,839 according to data from the website 21milyon.com.

Türkçe

Türkçe Español

Español