Despite the ups and downs in the altcoin market, Solana, also known as the Ethereum killer, has continued its upward trend in the past 2 weeks and remains one of the best-performing cryptocurrencies in the top ten list. Major investors like VanEck have raised their price predictions for Solana to $50, and the SOL price has also risen to $44.

Solana and FTX Transfers

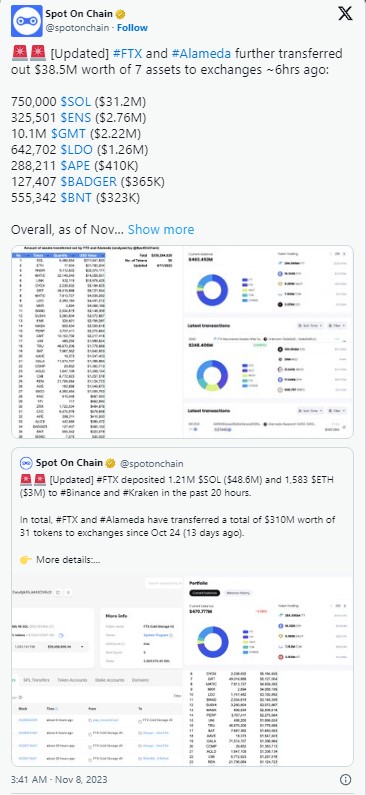

On-chain data reveals that a significant portion of Solana owned by the crypto exchange FTX has been transferred to other exchanges. Despite all these developments, the selling pressure created by FTX continues to be overcome by Solana bulls.

According to data from Spot on Chain, approximately $40 million has been transferred to exchanges by FTX and Alameda in the last 24 hours. These recent transfers are in line with what has been observed in the past few weeks.

Following a market fluctuation, the price of SOL entered a rising channel and initiated an upward movement. The most notable event since July has been the breakthrough of the significant resistance level of $28.16.

If it manages to stay above the resistance at $42.50, the upward trend in Solana’s price may continue, and it could test the upper resistance level at $46.83. Holding at this level could lead to reaching an important resistance level of $50 in the future.

However, a break in the rising support trendline could result in a loss of upward momentum, potentially causing the price to retreat to the support level of $38.77 in the short term. In the event of a trend reversal, the downward movement could deepen, and the price could test a lower support level of $33.29 in the coming days.

Is Solana the Ethereum Killer?

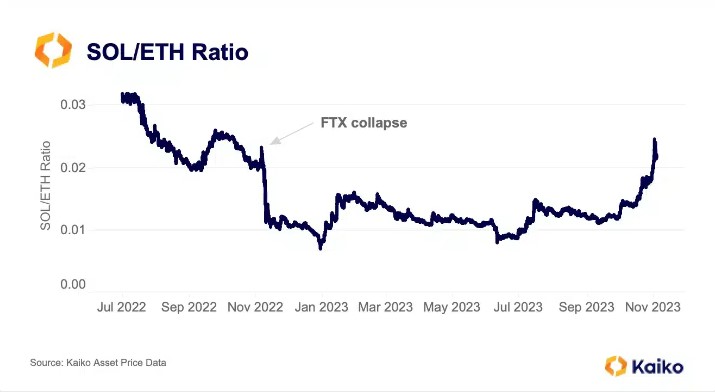

Solana is outperforming the largest altcoin and living up to its reputation as the Ethereum killer. According to a recent report by Kaiko Research, there has been a consistent rise in the Solana (SOL) – Ethereum (ETH) ratio since September. As a result of the rally, the ratio mentioned in the report has returned to the levels seen before the collapse of the FTX crypto exchange in November 2022.

Therefore, the rise in the SOL/ETH ratio indicates that SOL has a better performance than ETH, while a decrease in the ratio implies that SOL is underperforming compared to ETH. The research report by Kaiko stated:

Since September, SOL has clearly been the better-performing side, with the ratio jumping from 0.011 to approximately 0.025, breaking the ratio just before the collapse of FTX.

Türkçe

Türkçe Español

Español