LINK Coin, which has been experiencing a steady rise for weeks, has paused its upward trend from a significant resistance level. However, BTC price continues to hold at $37,000. The return of cryptocurrencies to a period of high volatility has excited investors, and the sustained institutional demand indicates that this movement could lead to even greater highs.

Chainlink (LINK) Price Analysis

With yesterday’s BTC drop, investors turned to panic selling. The relatively empty order books for altcoins caused these sales to result in even deeper lows. The LINK Coin price also dropped by nearly 10% and fell to a low of $14.40. Will the decline continue?

According to data compiled by CryptoQuant, investors’ exchange balances were at 149.9 million LINK. As of November 10, this number dropped to 148.5 million LINK. Approximately $20 million worth of LINK Coin has been withdrawn from exchanges at the current spot price.

The outflows from exchanges are favorable for price increases, so the LINK Coin rally may continue. If demand increases, there will be less available supply for sale, which will lead to price increases. A similar exchange supply shortage occurred during the price breakout on September 21. If it happens again, we may see another rapid upward movement.

Is LINK Coin a Good Buy?

After the Swift announcement in mid-September, interest increased and the LINK Coin price rose. The main reason for this is the ongoing curiosity in the tokenization field and Chainlink‘s declaration of being the largest player in this area. In fact, the foundation of this goes back much further with CCIP and others, which we have discussed in detail.

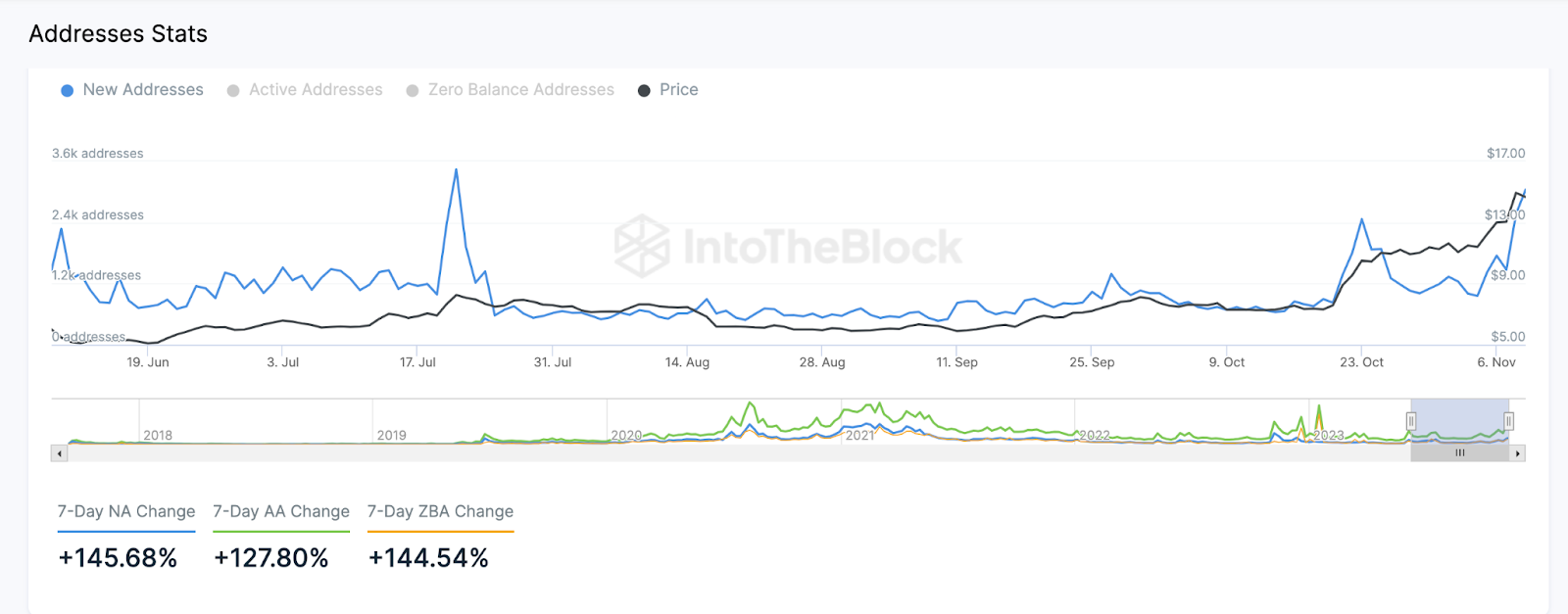

There is data that shows the weeks-long price increase is more organic than speculative. This is the rapid recovery in the number of new users on the network. As shown below, Chainlink’s increasing rate of acquiring new users reached a four-month high on Thursday with 3,004 addresses.

Considering all these reasons, the chances of a price rise for LINK Coin appear high. Additionally, closures above $15.4 indicate the continuation of the price increase from a technical standpoint. If the bulls succeed and the excitement in the RWA field can sustain long-term LINK Coin demand, $20 may not be such a challenging target.

Türkçe

Türkçe Español

Español