In the crypto market, as investors continue to expect a rise, a noteworthy comment has been made. According to famous economist Peter Schiff, Bitcoin is likely to experience a significant price drop before an important date for institutional investors. Schiff warned his followers about the recent Bitcoin price increases in his latest post.

Last Hope for Bitcoin: Potential ETF Approval

Peter Schiff, the chief economist and global strategist of asset management firm Europac, has been criticizing Bitcoin lately. According to the renowned analyst, unlike gold, Bitcoin is doomed to lose its value. He also constantly emphasizes his opinion that nobody wants to hold this asset except to sell it later at a higher price.

With the BTC/USD pair reaching its highest levels in 18 months, everyone’s attention turned to the launch of the United States’ first Bitcoin spot price exchange-traded fund (ETF). It is believed that the approval will be given in early 2024, and rumors suggesting that the green light could be given in November fueled the rise, surpassing $37,000 last week.

What are Analysts’ Bitcoin Predictions?

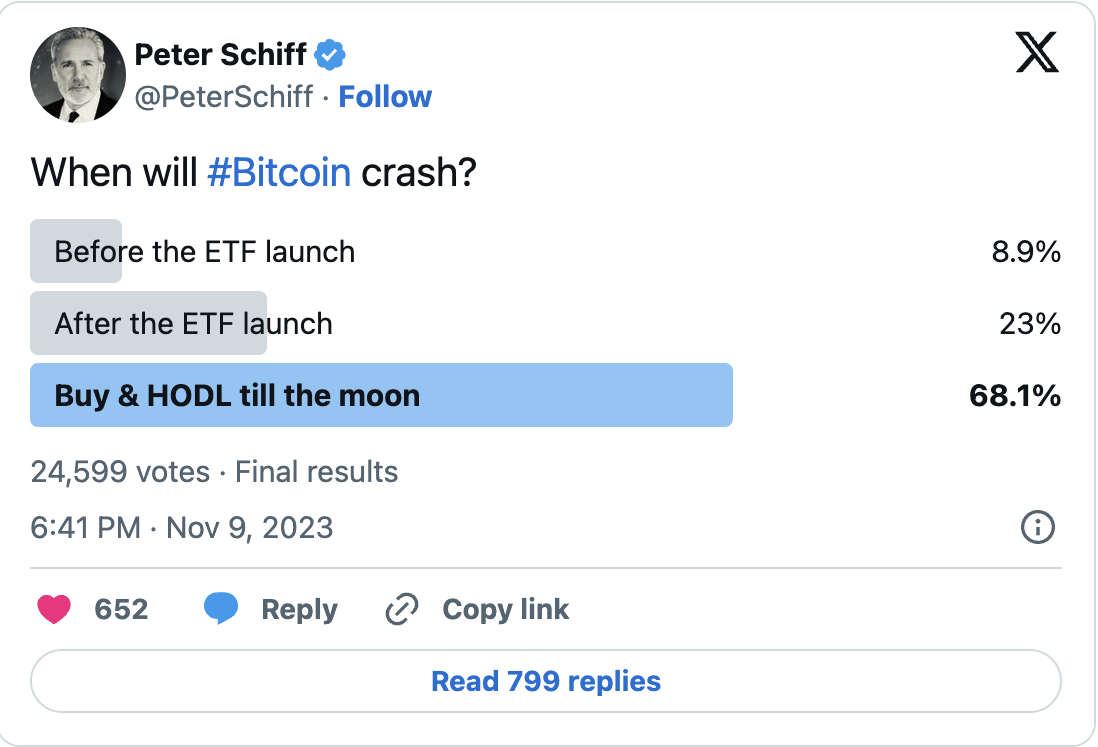

Peter Schiff presented two different scenarios for a Bitcoin crash on X’s poll on November 9, before and after the ETF launch. The option “Buy and HODL until the moon,” which became the most popular choice with approximately 68% of the 25,000 votes, was also preferred by the participants. However, Schiff did not change his mind:

“Based on the results, my prediction is that Bitcoin will crash before the ETF launch. So, people who buy into the rumor and wait for the truth to sell will actually not make a profit.”

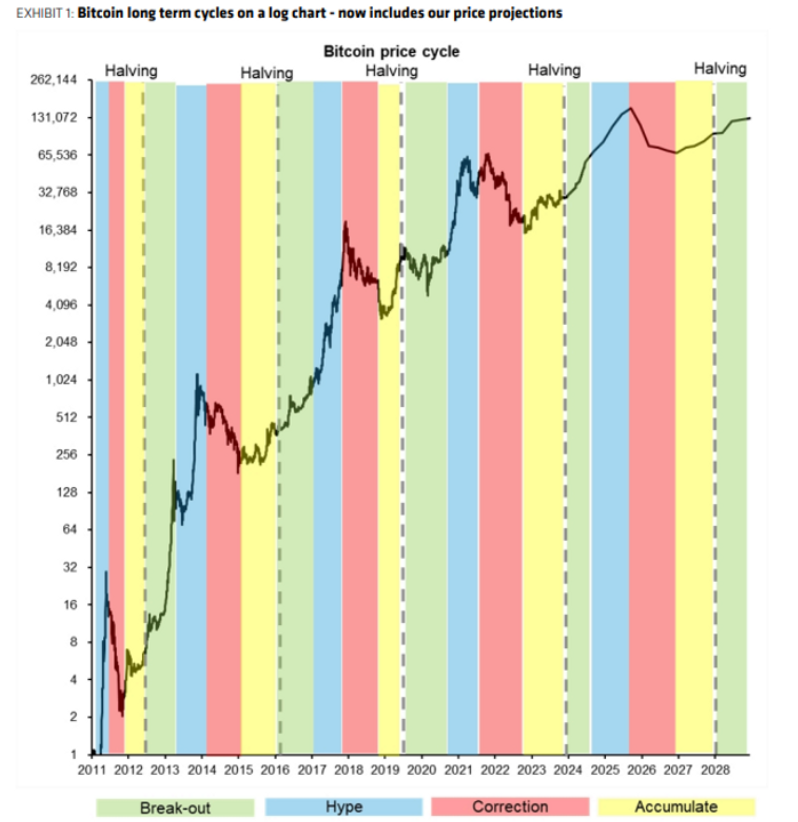

As the ETF debate seems to be increasingly favorable for Bitcoin, the psychological pressure in institutional circles has begun to ease. Among the recent optimistic Bitcoin price predictions is AllianceBernstein’s forecast, which predicts a peak of $150,000 in the next cycle:

“We believe early fund flows could be slower and accumulation could be more gradual, and ETF flows could gain momentum after the halving, leading to a cycle peak not in 2024 but in 2025.”