Corporate investors’ interest in Bitcoin and altcoin-focused investment products has been noteworthy in the past week. This week, there are very striking results, which were announced by CoinShares.

Bitcoin Purchases Draw Attention

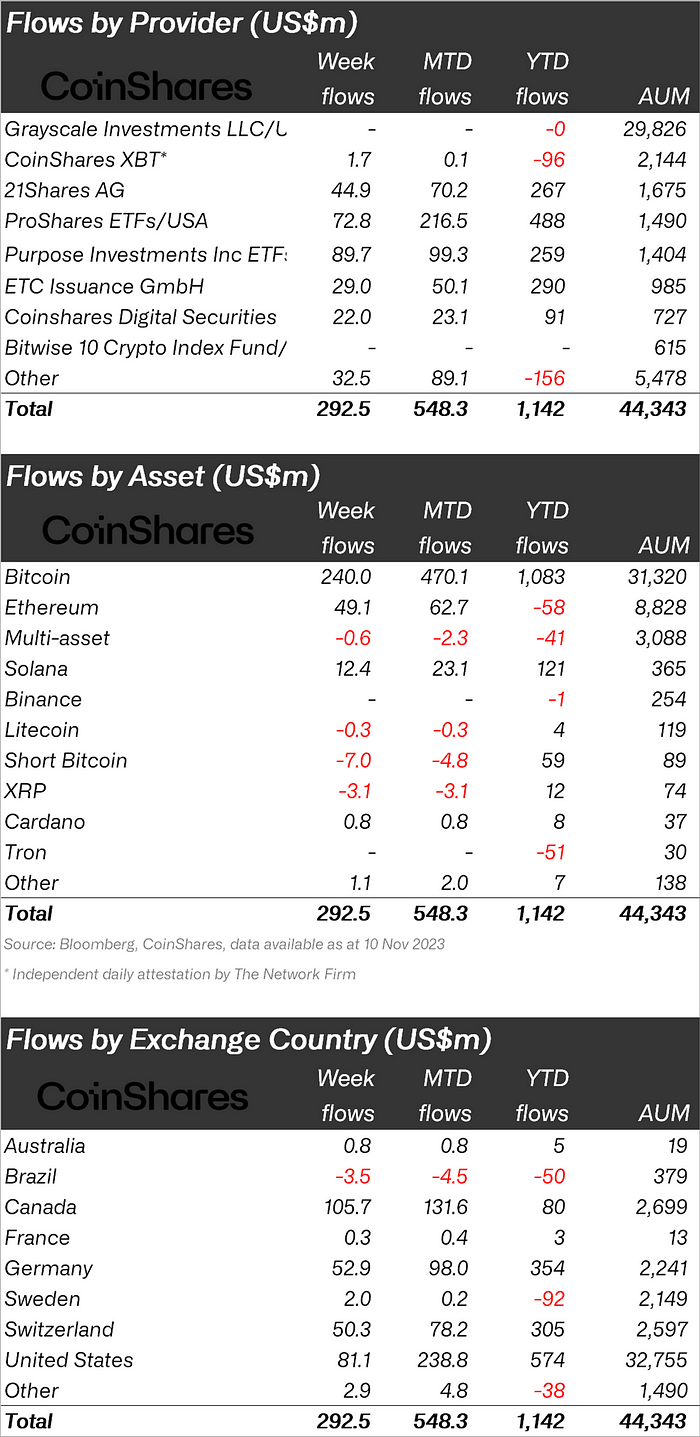

According to the CoinShares report, an important milestone was reached in ETP inflows. Bitcoin and altcoin-focused digital asset investment products received a total of $293 million in inflows last week. Thus, inflows have exceeded $1 billion in the past seven weeks.

This week’s inflows have a significant reflection. According to this, it became the third-highest annual inflow on record. As a result, total assets under management (AUM) increased by 9.6% last week. Since the beginning of the year, this figure has increased by a total of 99%. The total AUM reached $44.3 billion, which is the highest figure since May 2022. Bitcoin ETP trading volumes account for 19.5% of the total trading volumes on reliable exchanges. This indicates that ETP investors are more involved in this rally compared to the years 2020/2021.

Millions Flow to 2 Altcoins

While there were $7 million outflows in Bitcoin-focused short products, this is also an indicator that the positive sentiment continues in the cryptocurrency market. On the other hand, inflows for two altcoins are also noteworthy. Ethereum stood out with $49 million inflows. This figure is the highest inflow seen since August 2022.

While these inflows occurred in Ethereum, there have also been significant inflows for Solana, the rising star of recent days. Corporate investors have made a $12 million investment in Solana. Additionally, there was an investment inflow of $800,000 for Cardano. Finally, the outflows in XRP this week are noteworthy. There are $3 million outflows. As seen in the report, it was a positive week. The future direction of the crypto market will depend on whether the upward movement will continue or not.