The price of Bitcoin has been under strong selling pressure for the past two weeks, dropping by 3% to the $35,000 levels. This indicates that Bitcoin has entered a strong correction phase after reaching $37,000 last week, causing investors to tread cautiously in light of current developments.

2 Disturbing Factors in Bitcoin

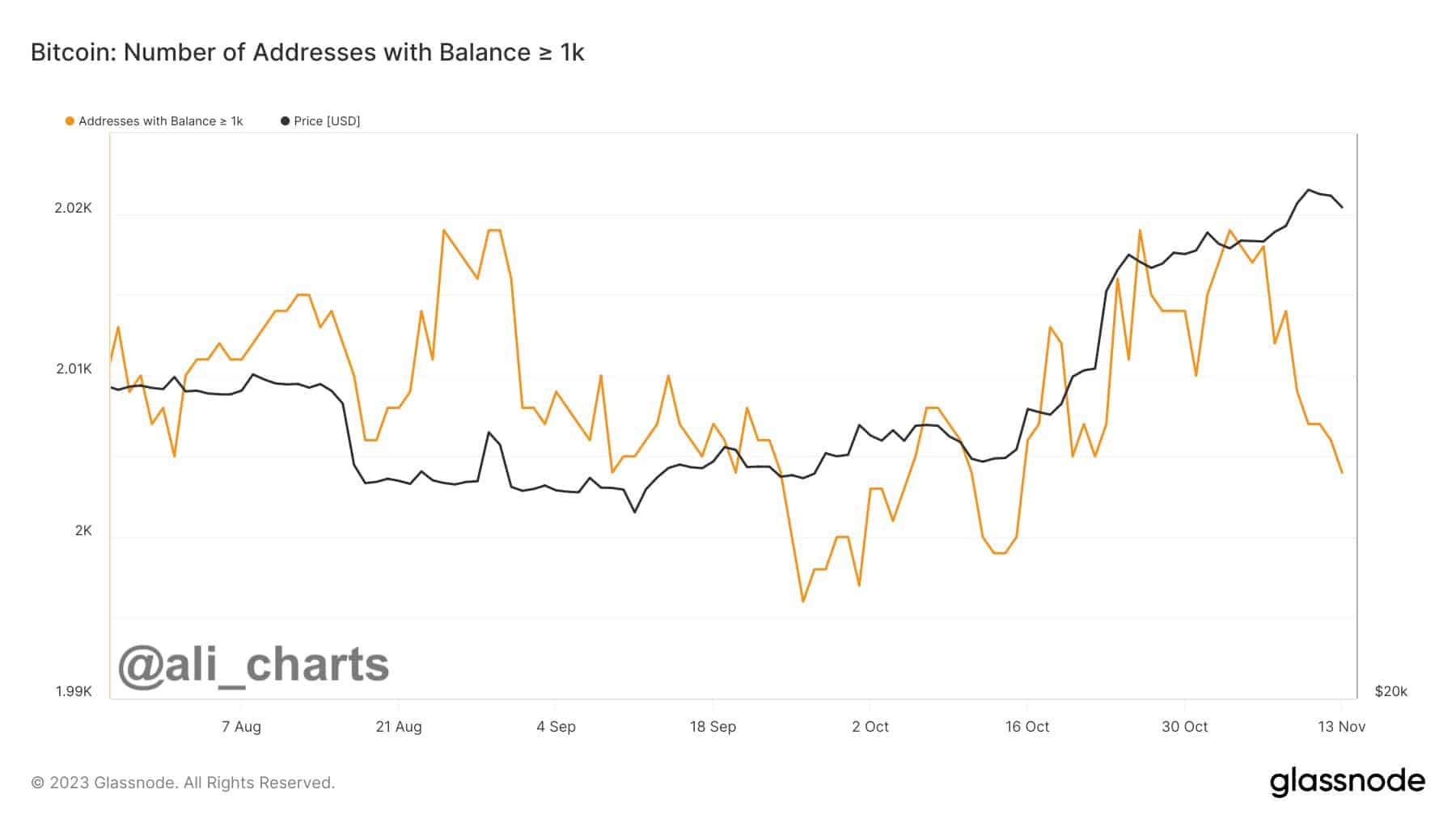

The recent selling pressure resulted from Bitcoin whales selling off throughout the past week. Experienced crypto analyst Ali Martinez stated that Bitcoin whales began taking profits after the price rose from $35,000 to almost $38,000 on November 3. During this time, more than 15 wallet addresses, each holding at least a thousand BTC, opted to sell or redistribute their assets.

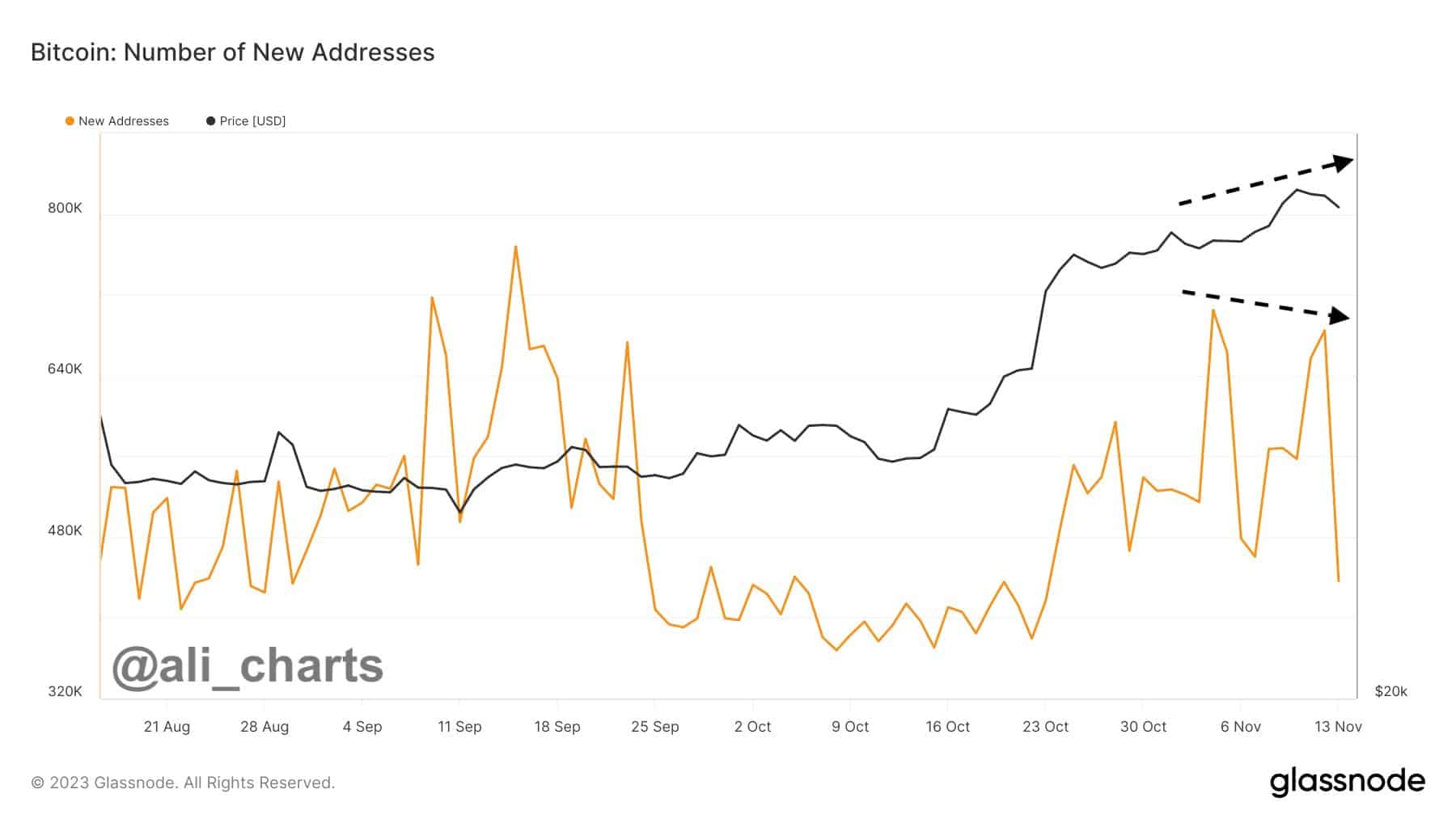

Furthermore, Ali Martinez highlighted the slowdown of the Bitcoin network. The combination of price increase and network growth slowdown suggests a potential lack of momentum to sustain the upward trend, raising concerns. This downward trend between the price and network growth of BTC serves as a top-level selling signal that investors need to consider.

With the current price drop, Bitcoin has fallen below the significant support level of $36,400. This suggests that the price could drop as low as $30,200.

Positive Developments for BTC

The latest inflation data from the US indicates a continued decrease in inflation. Analysts predict that Bitcoin will soon follow the decline in inflation and rise to $40,000.

Another crypto analyst, Michael van de Poppe, stated that Bitcoin is in search of support and could find strength to rise to higher levels after testing the range of $34,800 to $35,200.

Meanwhile, the US Securities and Exchange Commission (SEC) will announce its decision regarding the approval of a spot Bitcoin ETF by November 17. Cathie Wood from Ark Invest suggested that the possibility of greenlighting the spot Bitcoin ETF has increased, referring to discussions between ARK and BlackRock.

Türkçe

Türkçe Español

Español