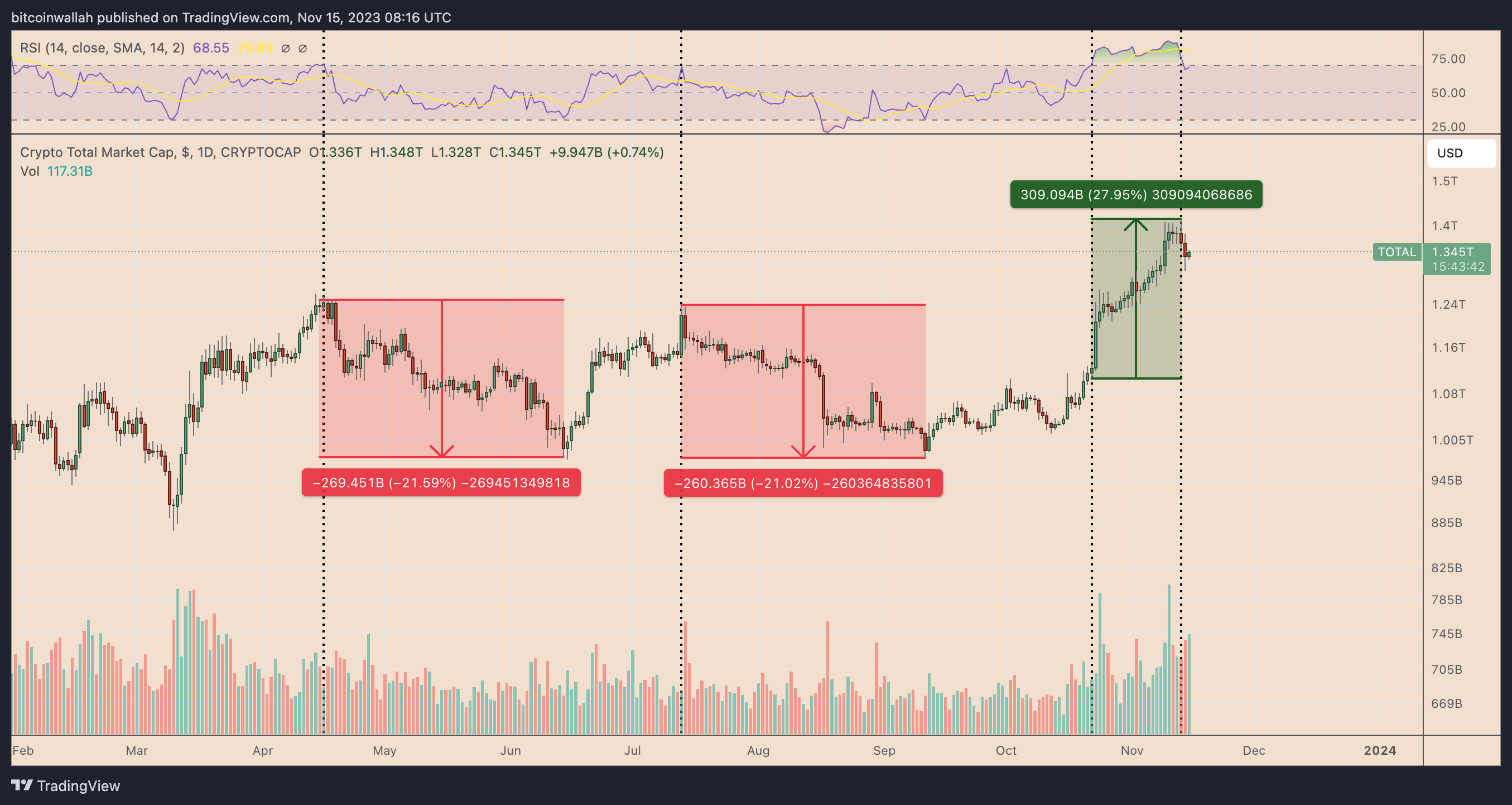

Recent price movements in the cryptocurrency market have led to a pessimistic period due to the declines in Bitcoin and Ethereum, which have been at the top of the market values in recent days. As of November 15, the net market value of the cryptocurrency market has dropped by over 6% to $1.32 trillion, compared to its highest level of $1.41 trillion seen two days ago.

RSI Levels Make an Impact in Recent Period

According to analysts, the recent downturn in the cryptocurrency market is largely due to overbought conditions. In particular, the daily relative strength index (RSI) indicator crossing above 70 in the largest cryptocurrencies in the market was seen as a sign of decline by many analysts. In summary, an RSI data reaching the overbought level reduces buying demand for crypto assets, leading to price pullbacks.

The cryptocurrency market ignored the overbought RSI signals, confirmed by a 27.85% increase between October 22 and November 13. The main reason for this was the increasing optimism in the rise sentiment due to the potential approval of a Bitcoin exchange-traded fund (ETF).

How Does the Bitcoin ETF Application Process Affect?

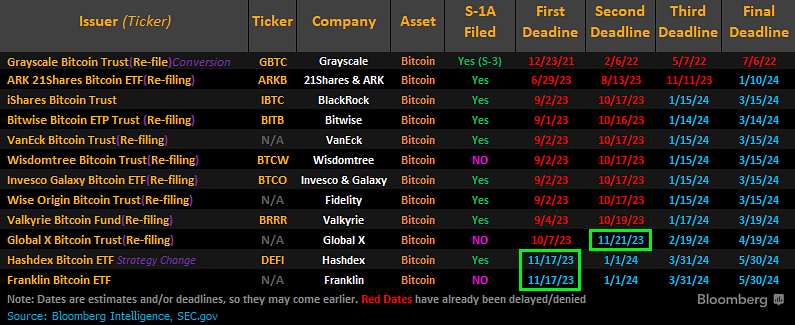

The decline in the cryptocurrency market is happening during a period when the US Securities and Exchange Commission (SEC) is reviewing some Spot Bitcoin ETF applications awaiting approval. In particular, the regulatory agency is expected to make a decision on the applications from Hashdex and Global X ETFs by November 17. In addition, the authorized institution needs to evaluate Franklin Templeton’s Bitcoin ETF application by November 21. If this process does not take place, the possibility of extending the final date for the applications to 2024 will be considered.

According to James Edwards, a crypto analyst at Australian fintech firm Finder, there will be another delay in the crypto market. The analyst discussed a fake BlackRock XRP ETF application that caused excessive price volatility in XRP prices. According to the analyst, this situation will undermine the chance of launching a Spot Bitcoin ETF in the US, as it supports the SEC’s allegations of price manipulation in the crypto market.

However, James Seyffart from Bloomberg announced that there is a 90% chance of the SEC approving a Spot Bitcoin ETF application by January 10, 2024. During this process, traders are potentially planning to profit from the highest prices in the crypto market in the past few months by using the excuse of a long wait.