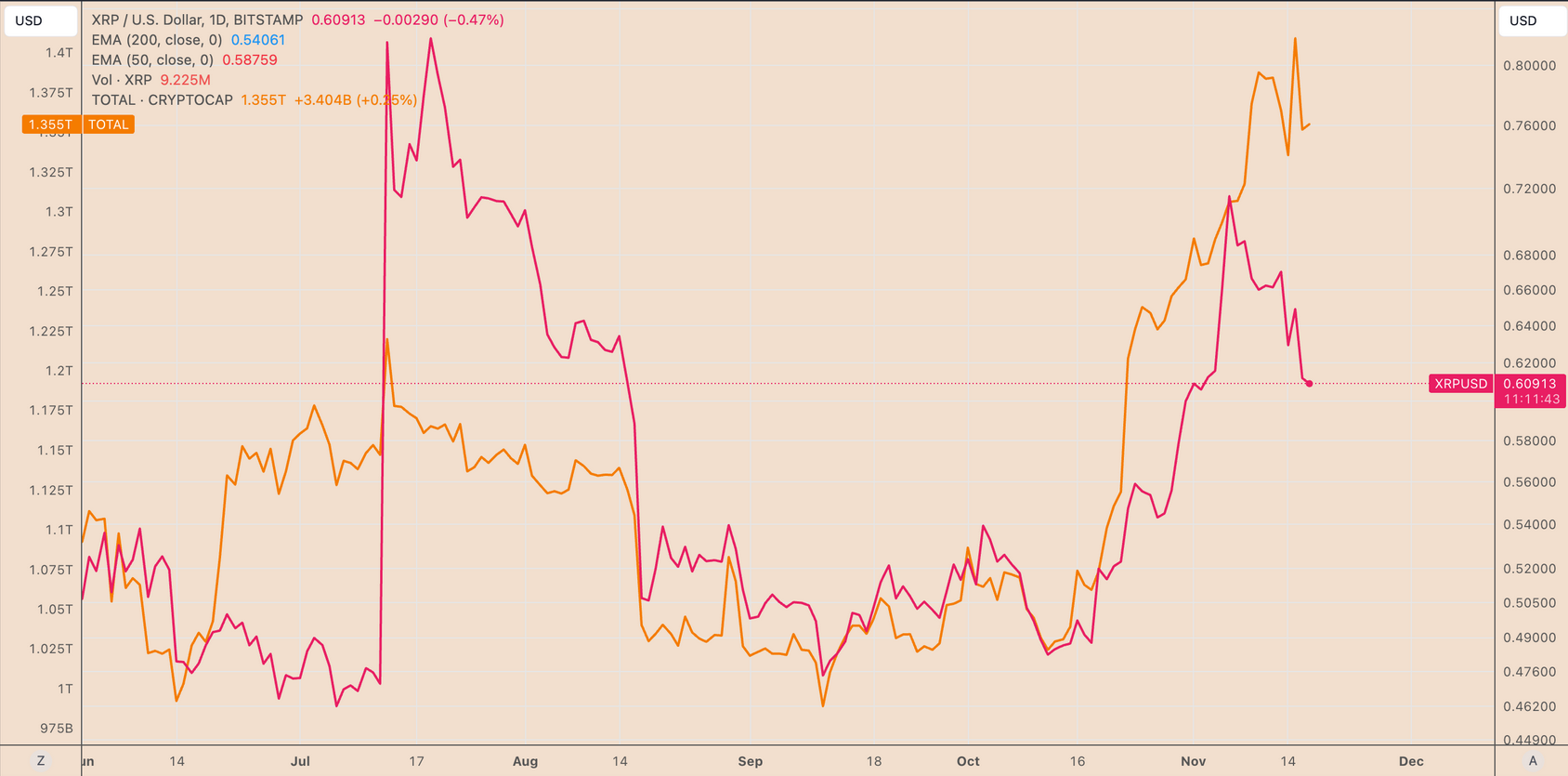

As the fluctuations in the price of Bitcoin continue, investor sentiment is turning negative, causing the XRP Coin price to drop to $0.6. After the news in July, it was expected that the price of XRP Coin would increase significantly. However, the early resolution of the lawsuit and the expedited appeals process are negatively affecting the price. This is because the SEC may score three goals in a row after the appeal.

Why is XRP Coin Dropping?

In the past 27 hours, the price has dropped by about 7.5%. The weekly loss is approaching 10%. XRP Coin is trading at $0.6, and the main reason for the drop is the negative sentiment surrounding Bitcoin’s price. However, XRP’s price has performed worse than the overall market. The reason for this is the rejected BlackRock XRP ETF application. We have been discussing the details of this since November 13.

Recently, we saw a filing for ETH, and it turns out the same thing happened for XRP Coin. However, the second application was incorrect. Bloomberg’s ETF analyst Eric Balchunas contacted the company to deny the news, and the XRP Coin price quickly dropped from the critical level of $0.75 to the $0.65 zone. Investors are still struggling to recover from the shock.

The timing was extremely poor, and combined with the pullback in BTC‘s price, XRP investors started selling to protect their profits. This led to the rapid loss of the $0.65 supply zone, and now the price is oscillating around the $0.6 support level.

XRP Coin Price Prediction

Since the BlackRock ETF rumor, the balances of addresses with balances between 100,000 XRP and 100 million XRP have decreased slightly. The drop is also supported by the RSI correction that reached its peak in July. The acceleration of the excessive buying correction that started on November 6 with the BlackRock incident and the simultaneous drop in BTC could make the $0.55 test inevitable for XRP Coin.

If the selling pressure continues, the $0.5 area, which served as support between March 2021 and January 2022, could be a reasonable target. On the contrary, if the price unexpectedly rises above $0.75, a rally could continue towards $1.13 and $1.36. However, the lack of appetite from buyers, the absence of short-term developments in the case, the rejected ETF, and BTC’s potential loss of $36,000 all indicate that the path of least resistance is downward.

Türkçe

Türkçe Español

Español