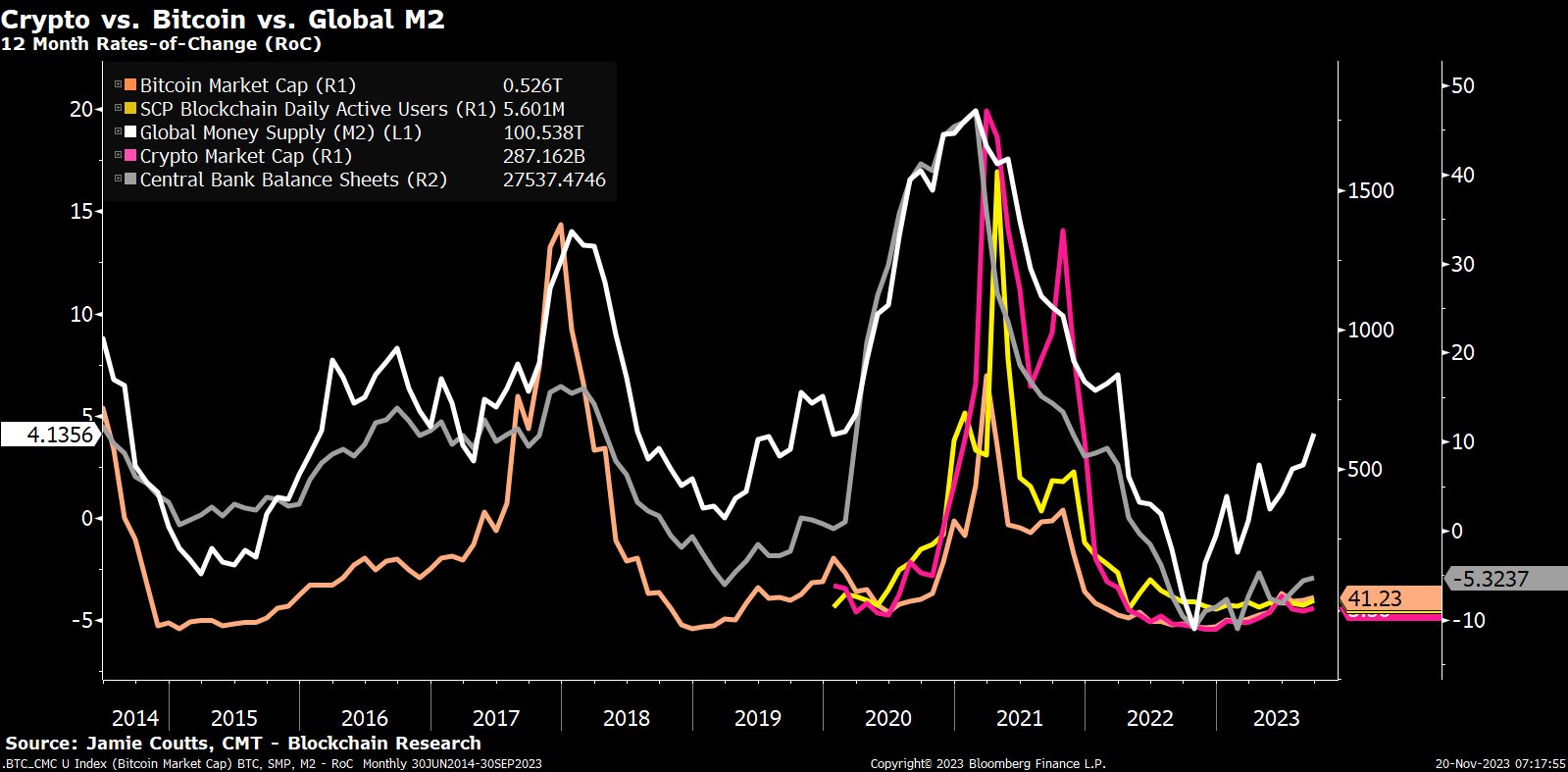

Bloomberg Intelligence analyst Jamie Coutts predicts a promising future for the cryptocurrency industry and blockchain technology. He claims that the sector has entered a “structural uptrend.” Coutts emphasized the interconnected nature of central bank liquidity, global M2 measurements, Bitcoin price, cryptocurrency prices, and the expanding user base in the crypto space by sharing his views on the social media platform X.

Navigating the Liquidity Cycle and Adoption of Blockchain

According to Coutts, the liquidity cycle reached its lowest level in the fourth quarter of 2022, coinciding with a decline in the user base of smart contract-focused blockchains. However, he notes that the liquidity cycle primarily affects the rate of adoption. Regardless of asset prices, the adoption of blockchain technology continues to show year-on-year growth. The analyst believes this indicates a strong and lasting trend.

Coutts predicts that blockchain technology is entering a structural uptrend that will last for several years. He emphasizes that this marks a significant moment for cryptocurrency and blockchain enthusiasts, signaling the beginning of the next cyclical rise.

Bitcoin as a Reserve Asset

Coutts highlights the evolving role of Bitcoin as a reserve asset, especially for certain nations. Energy-rich nation-states have made significant investments in facilities dedicated to Bitcoin mining. Coutts points out that these projected investments range from hundreds of millions to several billion dollars. According to the analyst, these countries view Bitcoin mining as a strategic energy initiative. Therefore, this approach by nations signifies a profound change in the perception and adoption of cryptocurrencies, according to Coutts.

Coutts emphasizes the increasing acceptance and utility of Bitcoin at a national level, stating that the “first of the sovereigns has arrived.” At the time of writing this article, the flagship cryptocurrency Bitcoin is trading at $37,415. The dynamic nature of the cryptocurrency market demonstrates Coutts’ optimistic outlook, indicating a long-term and transformative uptrend for both crypto and blockchain technology.

Türkçe

Türkçe Español

Español