Whales are on the move, and it’s not just happening in altcoins. Thousands of BTC are also being transferred on the network. However, for altcoins with less liquid assets, millions of dollars in sales bring along bigger problems. So, what’s next for BCH?

Future of BCH Coin

The listing of BCH Coin by the crypto platform EDX Markets, initiated by trillion-dollar asset managers, caused a significant price increase. In fact, we saw Bitcoin Cash reach its $329 peak in June 2023. But what happened next? On November 1st, EDX officials decided that it did not meet their criteria.

After the delisting, we came to the end of the supported rise by EDX Markets. The demand significantly decreased, and we mentioned back then that the long-term outlook turned negative due to this movement. Bitcoin killers, BSV and BCH, have been unable to achieve success in the time allotted to them and have begun to await their demise.

BCH Coin Analysis

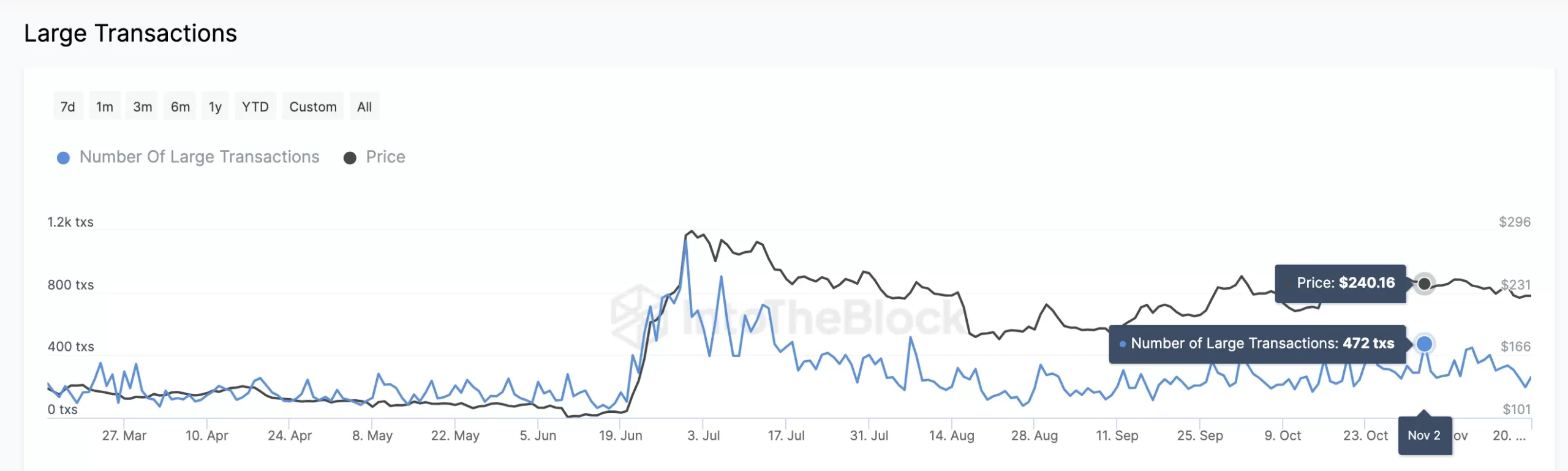

According to data from IntoTheBlock, the interest of BCH Coin whales decreased throughout November. In fact, we saw whale movements on the network hit a low of 195, which represents a significant level of activity when whales moved their assets for sale on November 2nd.

As of November 2nd, whales and miners held a total of 6.46 million BCH Coins. This figure has now dropped to 6.23 million (today), with $50.4 million worth of sales. This selling is likely to continue, and we will continue to see large investors reducing their risks due to long-term negativity.

If the price decline accelerates, it could trigger a period where individuals, in addition to whale sales, flee. The $200 support area represents a significant number of investors’ average price. Closures below this level could trigger stops for investors looking to avoid losses. The stop level is usually at or slightly below the purchase price. Investors place stop orders to limit their losses in sudden declines.

At the time of writing, Bitcoin is struggling to surpass $37,000 again. The cumulative trading volume of cryptocurrencies is around $59 billion.

Türkçe

Türkçe Español

Español