Bitcoin price is once again trying to stay above $37,500 as this article is being written. However, the volume is weak. Due to the US holiday until Monday, the volume in the crypto market may continue to remain weak. If the bulls take advantage of this, the $38,000 resistance will be surprisingly surpassed in the coming hours.

Bitcoin Bullish Signal

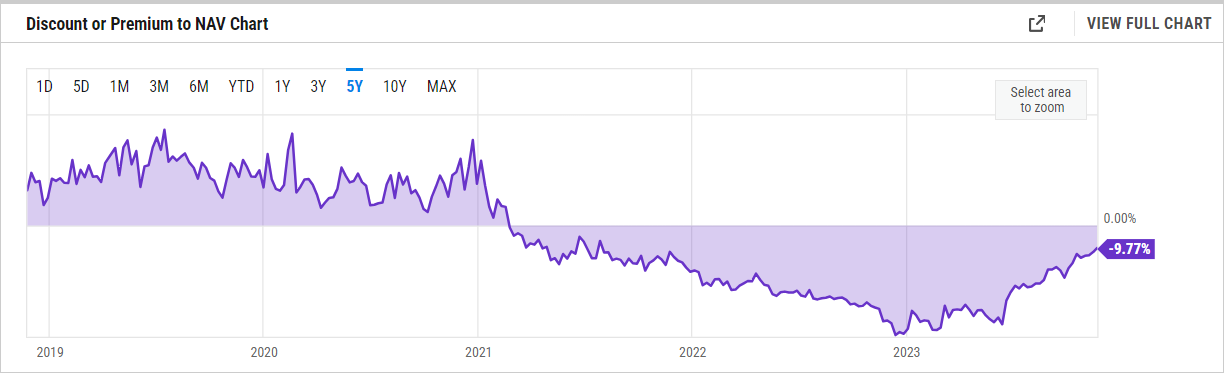

GBTC’s negative premium has dropped to -9.77% after a long period. The decrease in the negative premium to single digits is a result of the increasing demand for GBTC. Why is the demand increasing? Of course, it is due to the motivation of investors who believe that the negative premium will be eliminated with the approval of an ETF. GBTC is a trust, and if the SEC allows its conversion to an ETF, investors will get rid of the negative premium and make a profit of nearly 10% as soon as it is approved.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

GBTC, which rings the bullish alarm for all cryptocurrencies, can trigger much larger movements in the coming weeks. For example, if it turns positive and institutional entries continue to strengthen, investors’ risk appetite will increase even more. In the end, with the approval of the ETF, we will see trillion-dollar asset managers starting to stock BTC. This will result in billions of dollars of supply leaving exchanges and going into Coinbase custody wallets (issuers are agreeing with Coinbase for custody service).

Where there is limited supply, we will likely see increasing prices, especially with the motivation of the ETF.

Bitcoin Current Analysis

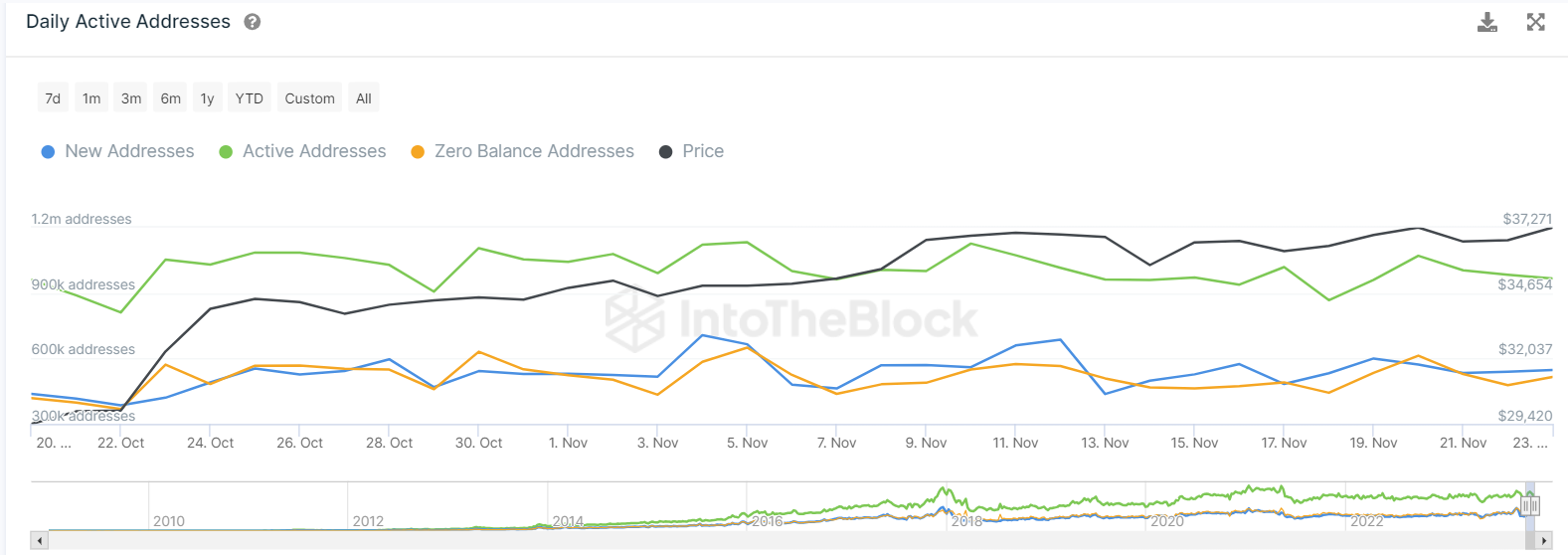

After daily active addresses fell below 900,000 on November 18, they exceeded 1 million on November 20. Investors who sensed the volatility took action, and we already know what happened the next day. The Binance settlement rumor became a reality, and the reason for this movement became clear.

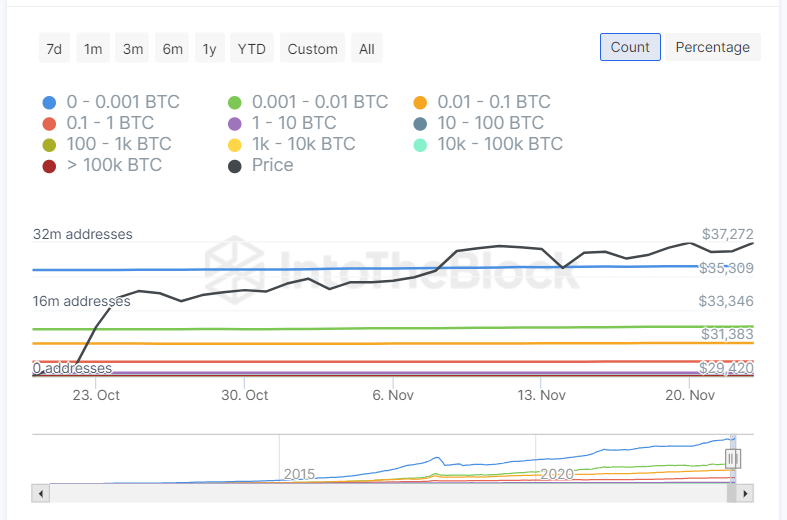

In the last 30 days, the group that increased their holdings the most were those who held between 0.001 and 0.01 BTC. They showed a growth of 5.88%. We also saw a decrease of nearly 1% in the addresses holding 10k to 100k BTC. While small investors tend to accumulate, some large investors saw this process as an opportunity to take profits.

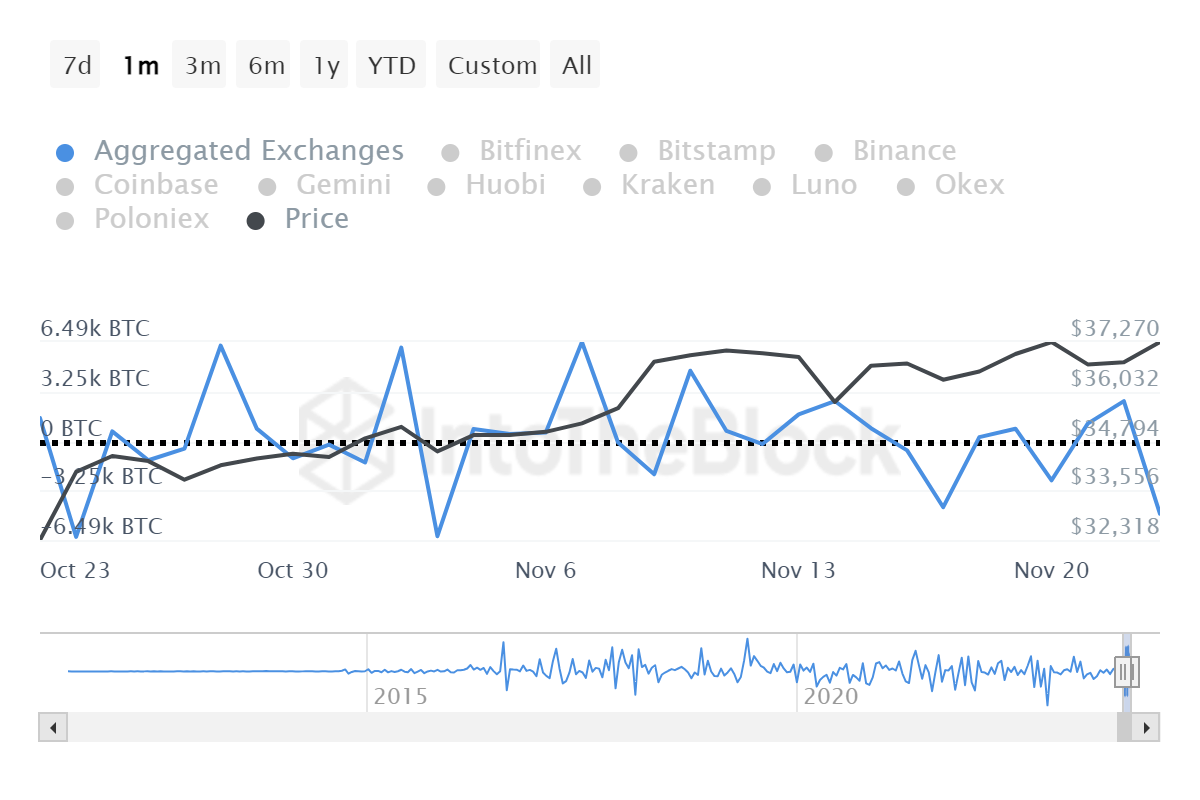

As the Binance settlement announcement came, we saw an increase in transfers, and net inflows to exchanges also increased during the same period. Although some investors turned to selling to reduce risk, there was a net BTC outflow of nearly 5,000 from exchanges yesterday. This is the second largest monthly outflow after the outflow on November 3, so it can be interpreted as optimism.

Türkçe

Türkçe Español

Español