Crypto analyst and investor Ali Martinez suggests that a decentralized exchange based on Ethereum (ETH) could be on the verge of making a significant upward movement.

Analyst’s Comment on UNI

Analyst Ali Martinez stated on social media platform X that Uniswap (UNI) seems to be “making an exit” after invalidating the descending triangle on the weekly chart.

A descending triangle is generally considered a bearish continuation pattern. According to Ali Martinez, if Uniswap closes above $5.70, UNI could rise to $10, representing an increase of approximately 62% from the current price.

Next, Ali Martinez discussed Polygon (MATIC) and suggested that if Ethereum’s scaling solution fails to surpass a critical price level, it could witness sell-offs. The analyst stated:

MATIC fell below a crucial supply zone ranging between $0.84 and $0.86. Within this range, 14,240 addresses hold 4.13 billion MATIC tokens. The longer the Polygon price stays below this zone, the higher the likelihood that these token holders will start selling to avoid significant losses.

MATIC is currently trading at $0.772, well below Ali Martinez’s supply area.

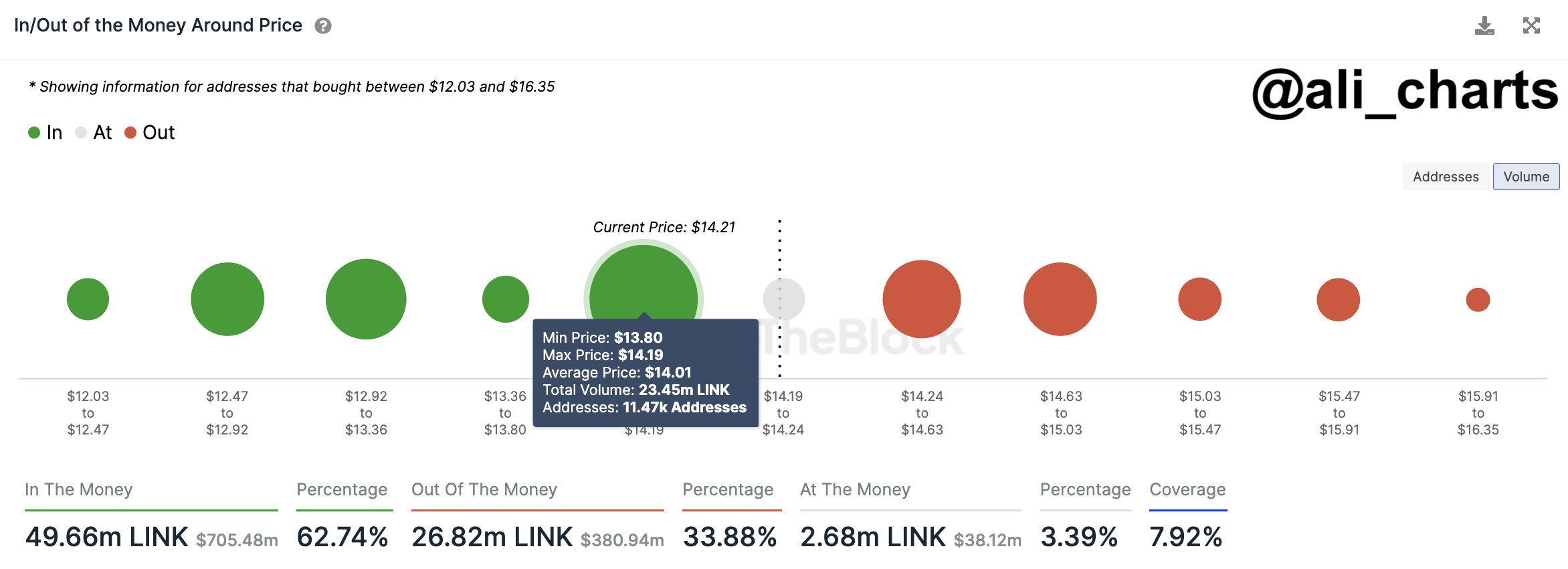

Critical Zone for Chainlink

Another cryptocurrency on the analyst’s radar is Chainlink (LINK). The popular crypto analyst suggests that Chainlink could revisit and surpass $16.62, the highest level of 2023. He stated:

Chainlink is in a significant demand zone ranging between $13.80 and $14.20. Within this zone, 11,470 wallets hold 23.5 million LINK. Staying above this zone with minimum resistance and solid support could pave the way for LINK to climb to new yearly highs.

At the time of writing, popular altcoin LINK is trading at $14.34.

Türkçe

Türkçe Español

Español