“`html

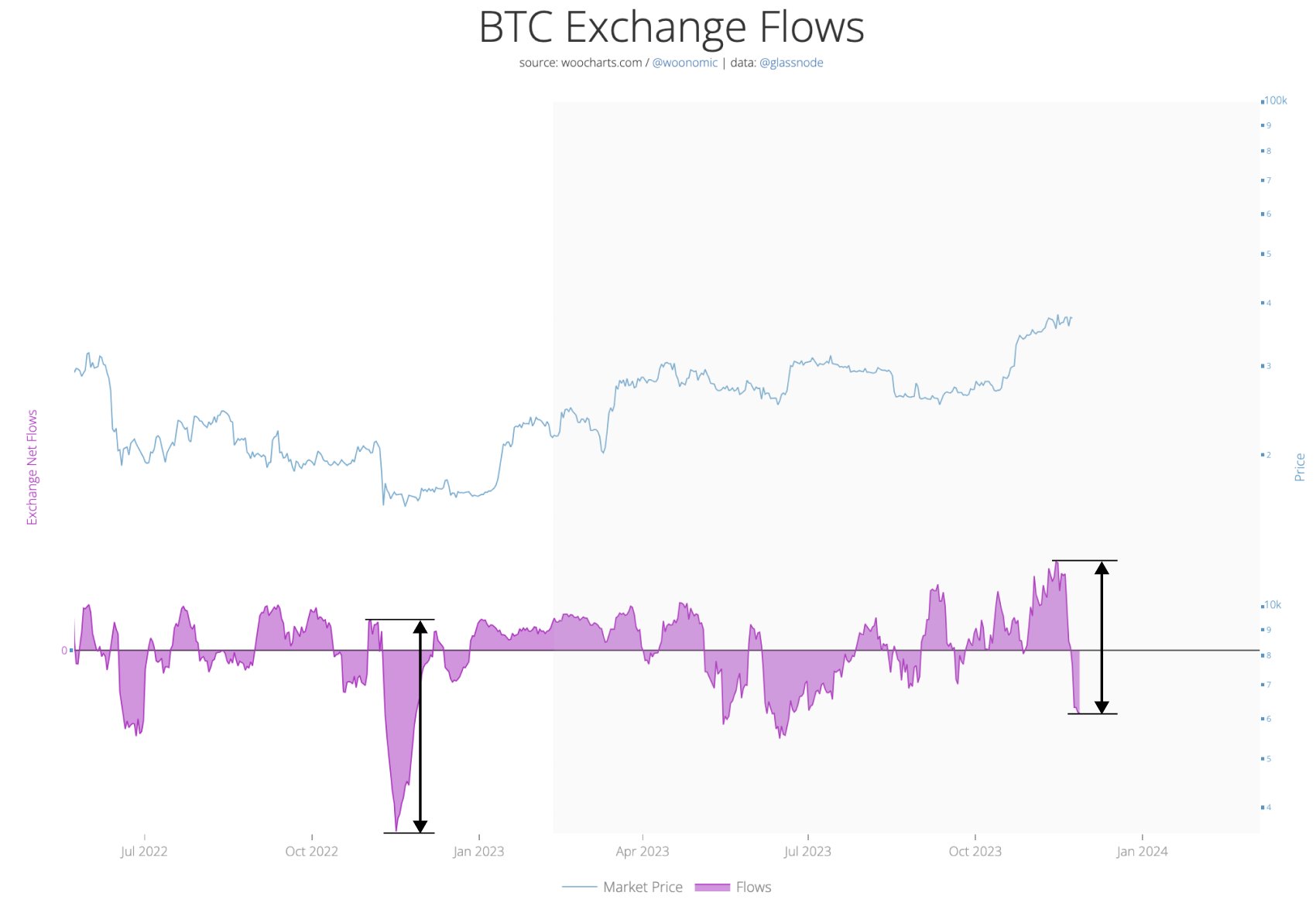

Leading on-chain analyst Willy Woo has announced that a key indicator which previously signaled Bitcoin‘s (BTC) 2022 bottom is flashing again. The analyst emphasizes that this signal for the largest cryptocurrency indicates a potential price increase.

Spotlight on Bitcoin Withdrawals from Exchanges

Closely followed on-chain analyst Woo mentioned in his account on social media platform X (formerly known as Twitter) that Bitcoin is starting to leave cryptocurrency exchanges, similar to when the crypto market bottomed last year.

Woo stated, “Bitcoins are now making a strong turnaround to exit from crypto exchanges. I haven’t seen such buying movement since the market bottomed.”

Predicting Bitcoin’s Ascent up to $525,000

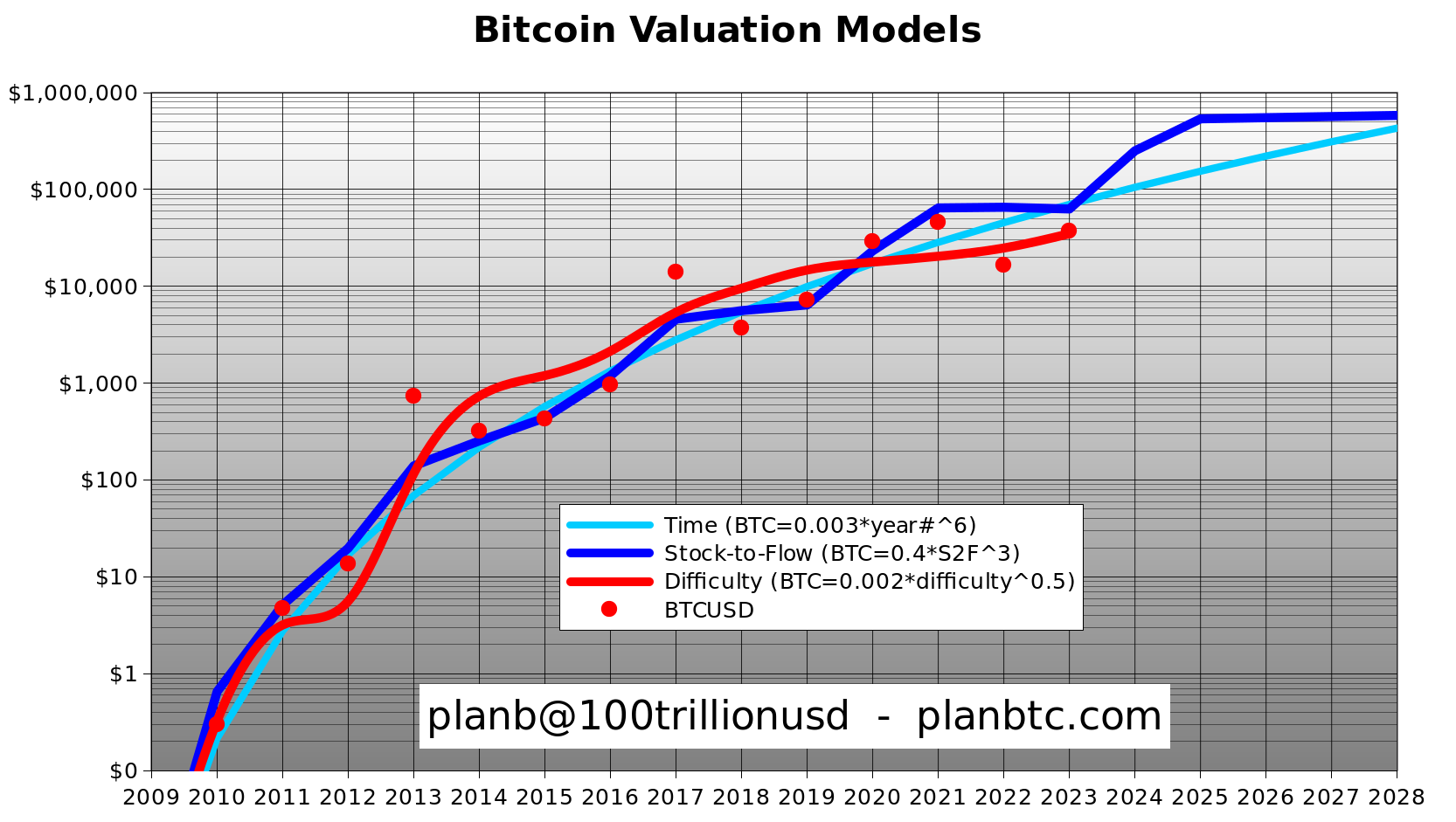

Another leading on-chain analyst, PlanB, continues to express his anticipation of a rise in BTC. Highlighting the hash rate of the biggest crypto’s network as a measure of processing power, he suggests that this indicates the price will stay above a key level, saying:

The hash rate-based price of Bitcoin reached $35,000 yesterday. In my opinion, this could mean that BTC will never fall below $35,000 again, except for possible black swans or short-term fluctuations, based on the $/kWh-arbitrage fundamentals.

PlanB recently stated, based on past price trends during the quadrennial block reward halving cycles, also known as halvings, he expects Bitcoin to rise to $525,000 in the next four years. He noted that during the block reward halving cycles, Bitcoin has shown a tendency to rise more than four times from the bottom ranges:

In the 2012 block reward halving, Bitcoin was below $16. During the 2016 halving, BTC ranged between $256 and $1,024. In the 2020 halving, it was between $4,000 and $16,000.

For the 2024 halving, it will range between $16,000 and $65,000. I would not be surprised if in the next four years, it ranges between $65,000 and $525,000.

- Key indicator flashes, hinting at Bitcoin’s rise.

- Analysts anticipate significant BTC price movements.

- Historic halving cycles suggest future growth.

“`

Türkçe

Türkçe Español

Español