According to Bloomberg analysts, there is a 90% chance of approval for Bitcoin exchange-traded funds (ETFs) in January. While this prediction remains possible, the halving event continues to be a significant topic of discussion within the crypto community. Additionally, a potential short-term decline in Bitcoin could be another issue to consider.

Will Bitcoin Price Rise?

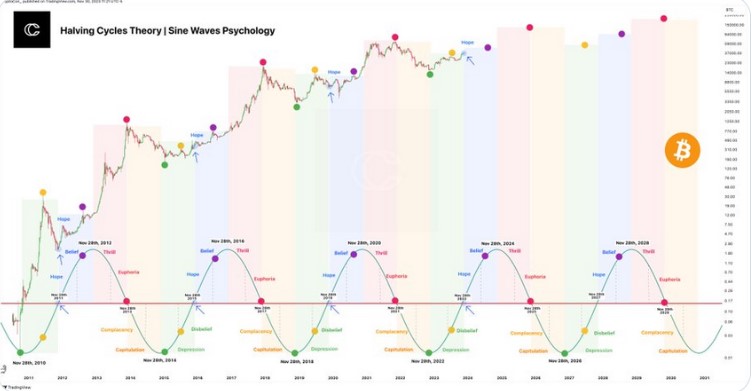

According to famous crypto investor CryptoCon, BTC has left depression and disbelief behind to move on to the next stage:

Hope is the second stage of the halving cycle. After a long period of despair, the (BTC) price is starting to show signs of a comeback.

Bitcoin’s protocol reduces the reward for mining in new blocks by half approximately every four years through an event known as halving. This potential decrease in new supply could create upward pressure on the price as the rate of new Bitcoin entering the market slows down.

After the halving, a decreased supply in the market is generally supported by rising prices. It can also trigger a bull market characterized by increased investor interest.

According to the analyst, investors are currently in the “hope” stage of the cycle. This means that after a long period of despair, investors are starting to believe in Bitcoin again, as evidenced by the signs of recovery in the Bitcoin price and its current fair value. It is worth noting that the next stage of the cycle is belief.

In the next stage, investors generally start to believe in Bitcoin, which rapidly drives up the price. This stage is expected to occur in June 2024 and last for about two years. The final stage of the cycle, known as the “red year,” is when the Bitcoin price potentially reaches its all-time high and then crashes. The analyst predicts that this stage will begin in June 2026 and last for about a year.

Cryptocurrencies and the Bear Scenario

Crypto analyst Alan Santana stated in a post that historically, the halving event triggered a correction before rallying the price of Bitcoin. As crypto Bitcoin prices rise, there could be excessive expansion in the market, leading to a bear market where prices drop and investor sentiment turns negative.

The expert also drew parallels with past events such as the Ethereum Merge. In this context, he warned against the overly speculative environment surrounding the Bitcoin ETF. He made the following statement:

They are saying that billions and billions and billions and billions and more are coming thanks to these ETFs, really? The thing is, these ETFs won’t sell Bitcoin to their “traditional trading tools” customers; they will sell shares, coupons, numbers on the screen, or something else. If they need Bitcoin, they either buy it now or bought it a long time ago to use as a backup for their customers’ funds.

Bitcoin’s Future and Comments

According to crypto trader EliteTradingSignals, who is closely followed by crypto investors, Bitcoin is currently trading at $38,800, very close to the upper Bollinger Band. This indicates that Bitcoin may be overbought and a pullback could be imminent.

The fact that the one-week time frame (TF) is seen as green can also be considered as a counter-signal indicating the possibility of the price continuing to rise in the long term. However, in the case of short-term overbought conditions, a pullback may be more likely.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry risks due to their high volatility and should conduct their own research before making any transactions.

Türkçe

Türkçe Español

Español