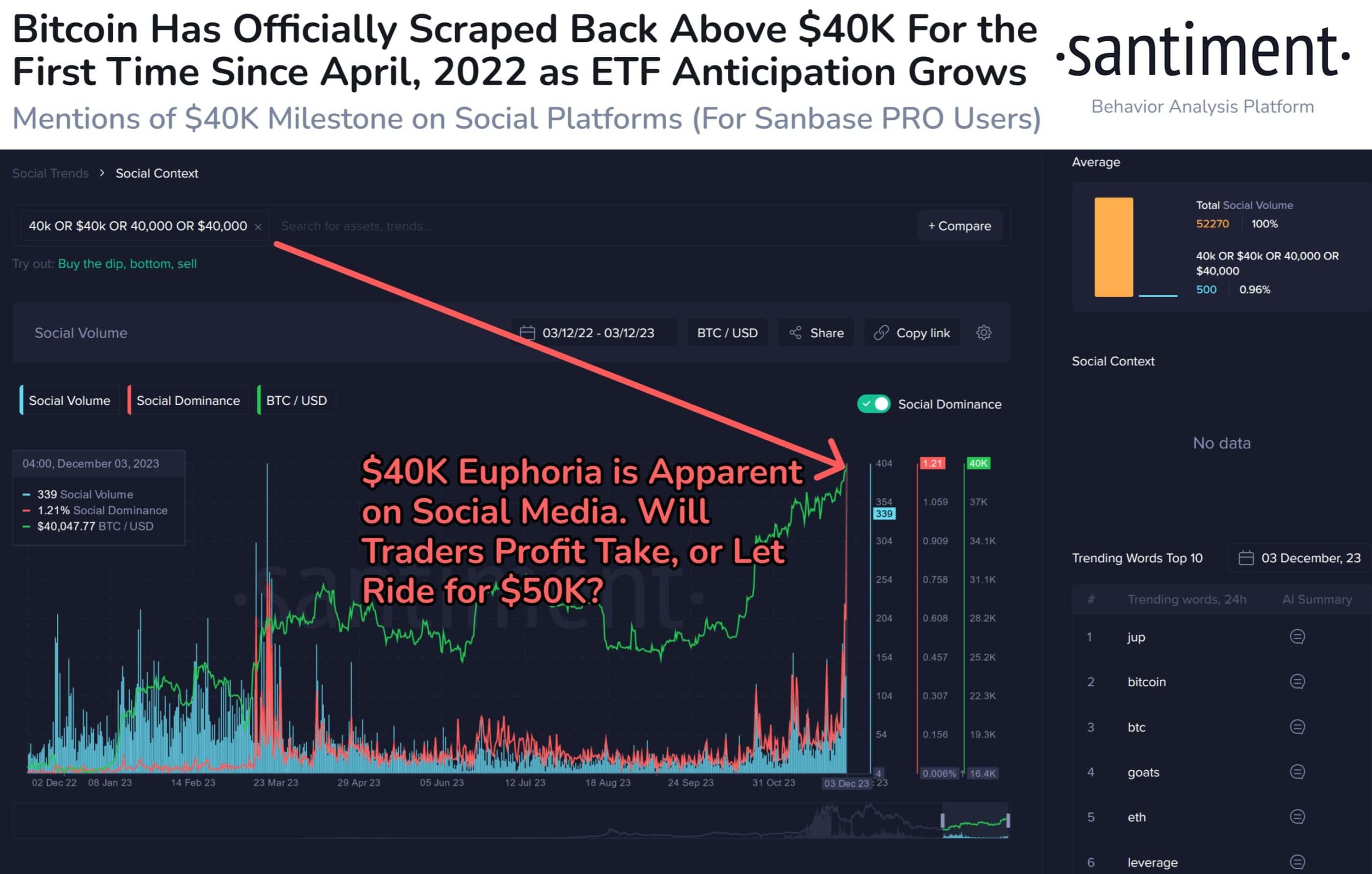

As inflation in the United States shows signs of cooling, investors are becoming more confident that the Federal Reserve has completed its interest rate hike process. Attention has shifted to speculation about possible rate cuts next year, creating a favorable ground for a rally in global markets. During the same period, Bitcoin (BTC) and altcoins experienced major surges. The price of BTC, the largest cryptocurrency, surpassed $41,000 for the first time in 18 months. Let’s take a closer look at what’s next for Bitcoin.

Factors Supporting the Rise of Bitcoin

The cryptocurrency market is closely following developments related to applications by major players like BlackRock to launch the first spot Bitcoin ETF in the United States, along with speculations that the Fed’s interest rate hike process is coming to an end and discussions of rate cuts have begun. Bloomberg ETF experts believe that some of these companies could receive approval from the US Securities and Exchange Commission (SEC) by February 2024. The outcomes of these applications will have a significant impact on Bitcoin and other altcoins.

Tony Sycamore, a market analyst at IG Australia Pty, stated in his latest investor note that “Bitcoin’s price continues to be supported by optimism over the approval of a spot ETF by the SEC and the possibility of the Fed cutting interest rates in 2024.”

Where is the Bitcoin Price Heading?

According to the technical chart, the next resistance level for Bitcoin is expected to be $42,330. Despite the upward movement in price, crypto analyst CrediBULL Crypto noted in his latest analysis that the open interest (OI) remains relatively low. Considering the historical trends of low OI levels, CrediBULL Crypto stated that even when OI reaches a baseline, it only causes a maximum drop of $2 in the price, which is then followed by an increase.

While the largest cryptocurrency was at $41,467 at the time of writing, in order for the rise to continue, the price needs to hold above $39,500. Although some market observers expect a drop to $30,000, CrediBULL Crypto believes the likelihood of the price falling to $35,000 or lower is slim.

Moreover, referencing a previous analysis, the analyst emphasized that with the price surpassing the $40,000 threshold, he no longer expects significant drops. Some market analysts, like CrediBULL Crypto, anticipate a continued increase in BTC’s price. Some even predict that the price could reach $60,000 before the next block reward halving expected in April 2024.

Türkçe

Türkçe Español

Español