As of the writing of this article, the Bitcoin price stands at $41,500, having impressively climbed throughout the third month. December has started on a strong note. But what awaits investors as we begin the countdown to 2024? What are the expectations for the cryptocurrency markets for the coming year?

Bitcoin and Cryptocurrencies

The king cryptocurrency has closed its seventh weekly candle in green, continuing its steady rise. The latest CoinShares report also indicates that institutional demand remains strong. Additionally, we’ve seen the price surpass $42,000 just a few hours ago. These developments excite investors and increase interest, yet the unpredictable nature of cryptocurrencies should not be forgotten.

Many analysts had thought reaching $40,000 this year would be impossible. Some even said it would be surprising to reach this level before the halving day. Yet, here we are in December, and the price has exceeded $42,000.

Several technical indicators suggest Bitcoin is currently in an overbought zone and that $42,000 could act as a strong resistance. After approximately a 55% increase in price over 7 weeks, the market may now enter a period of consolidation and pause.

2024 Bitcoin Price Target

On the weekly chart, BTC has reached a decreasing resistance area. The resistance coming from the ATH region indicates a significantly important level. $42,000 was also seen as an ATH for BTC in January 2021. Now, it should not be surprising to see some delay in this region with the resistance coming from $69,000.

The RSI, which has been in the overbought region for six weeks, is now at 81, and the possibility of a correction increases as long as this indicator remains at the peak. A correction could be triggered by new news or the sale of BTC held by the US Department of Justice. Or, interestingly, the RSI could linger in the overbought region for weeks.

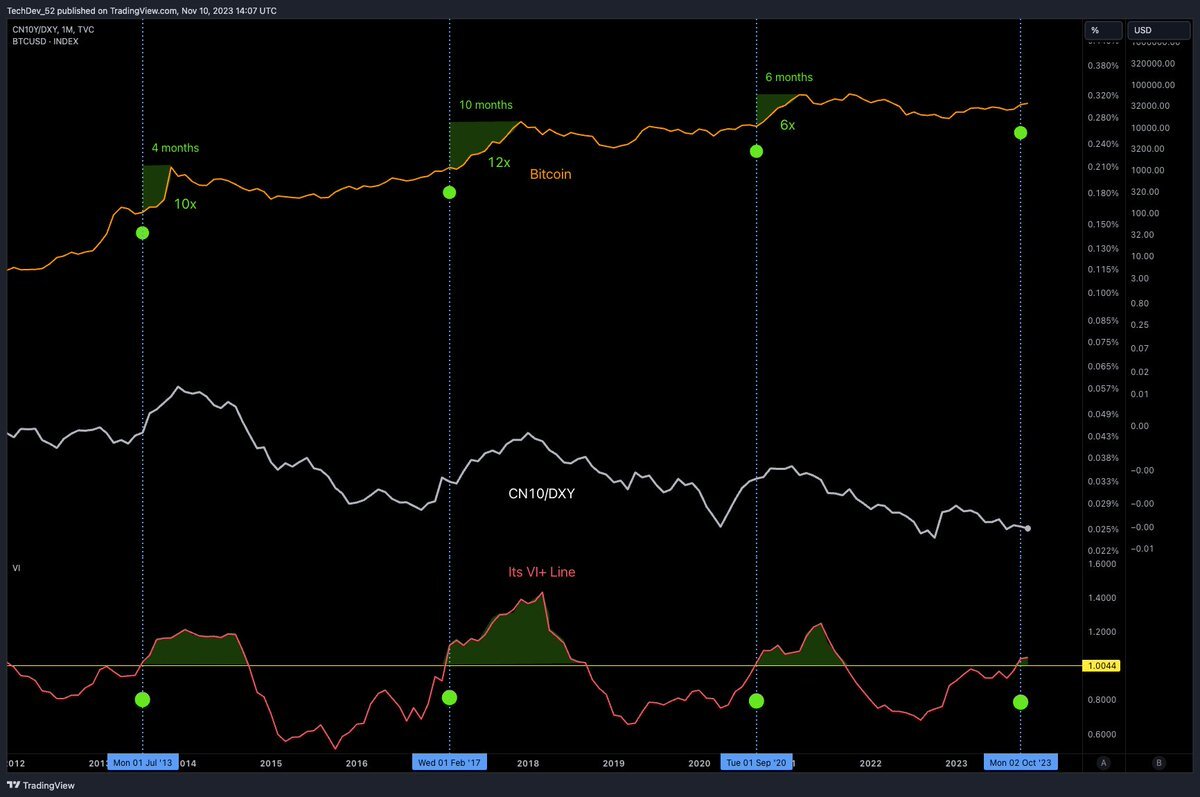

Popular crypto analyst jasonpizzino has highlighted the important resistance level of $42,000. TechDev_52 pointed out a significant signal in the Vortex Indicator (VI) analysis, suggesting that the price could exceed $69,000 within 4-10 months, which would mean a new ATH in 2024.

However, the view presented by TechDev challenges the narrative of the 4-year cycle. Perhaps in the upcoming period, block reward halving may not have as much impact on the price as we have seen. As we observe the effects of institutional demand, these trends may become clearer.

Türkçe

Türkçe Español

Español