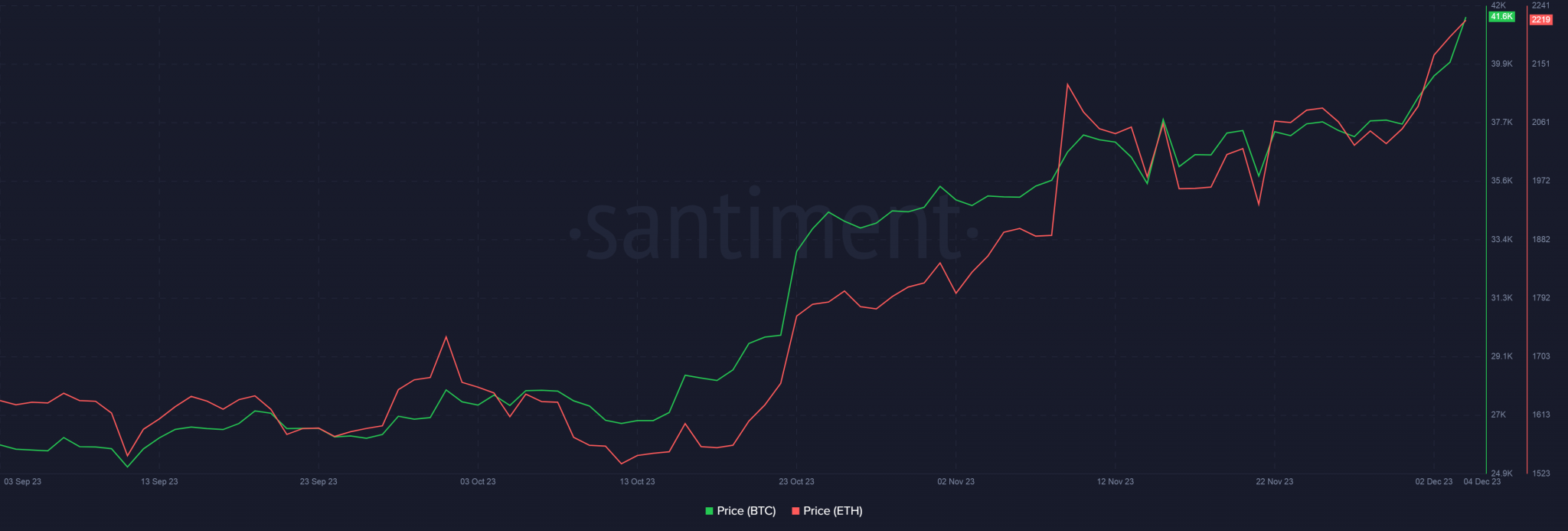

Bitcoin and Ethereum correlation reached its lowest level in 60 days, dropping to 75% in November, according to crypto analytics firm Kaiko.

Bitcoin, Ethereum Correlation

The deviation may have a significant departure from the all-time high levels (ATH) of 97% seen at the end of 2022. Additionally, a sharp decline in the parity has been observed since November. It appears that the divergence is caused by the increase in spot ETH exchange-traded fund (ETF) launches.

The broader upward trend in the market is said to be driven by excitement over potential approvals of a spot Bitcoin ETF. This led to the start of the rally in mid-October, with BTC gaining 26% by the end of the month. However, ETH lagged behind in catching up with this pace and finished October with a 17% increase. The announcement of spot ETH ETFs by TradFi giants like BlackRock and Fidelity reversed the situation for ETH in November. The second-largest cryptocurrency surpassed the critical barrier of $2,000 for the first time since May 2022.

Coinbase Reports

Additionally, according to Coinbase’s report dated April 21, the low correlation between BTC and ETH provides a rationale for portfolio diversification, as holding both assets can result in higher returns. Analysts emphasized the importance of spreading investments across different cryptocurrencies and reducing risks associated with any specific category.

On the other hand, this trend can affect trading strategies such as cross-risk hedging for institutional investors. Cross-risk hedging is the practice of managing risk by investing in two cryptocurrencies with similar price movements but not exactly correlated. However, analysts and investors should not consider these as investment advice, but rather exercise necessary caution.

Türkçe

Türkçe Español

Español