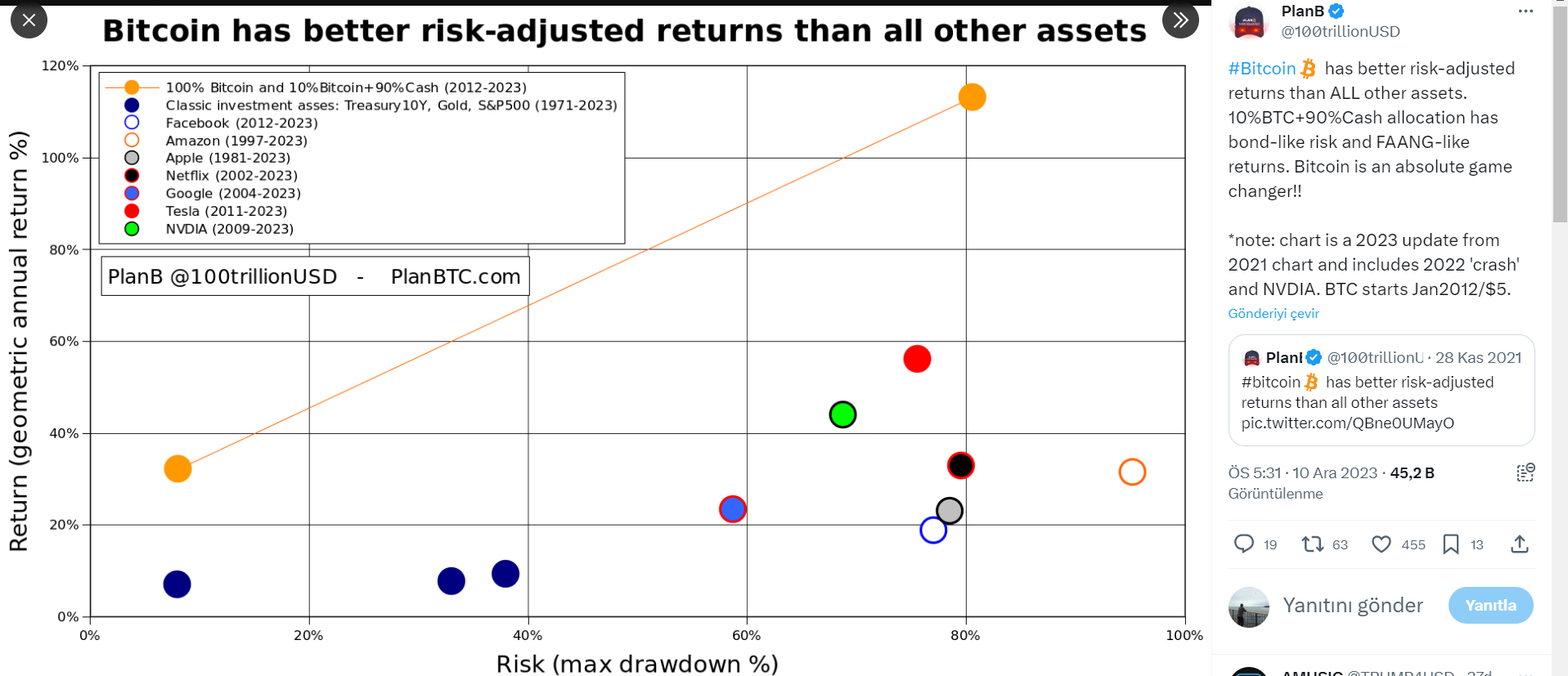

Famed analyst PlanB has stirred debate in the financial sector by asserting that Bitcoin stands head and shoulders above all other assets in terms of risk-adjusted returns. According to PlanB, a strategic distribution consisting of 10% Bitcoin and 90% cash not only reflects bond-like risk, but also yields reminiscent of tech giants in the FAANG group. This statement positions Bitcoin as an absolute game-changer in the investment world.

Analyzing the Landscape in Bitcoin and Others with PlanB’s Insights

By the way, let us remind you that FAANG stands for Meta (formerly Facebook), Apple, Amazon, Netflix, and Alphabet (Google). In a significant update for 2023, PlanB presents a graph that expands on the original 2021 version, taking into account tumultuous events such as the notable ‘collapse’ in 2022 and the impact of NVIDIA.

Bitcoin, which had its first value at $5 in January 2012, emerged stronger than ever after overcoming various market difficulties. PlanB’s chart provides a visual representation of Bitcoin’s resilience, showcasing its ability to navigate through market fluctuations and reach the peak.

This data-focused analysis is becoming a powerful tool for investors seeking assets that not only manage risks similar to traditional bonds but also provide returns competitive with the performance of tech giants like the FAANG group.

Bitcoin’s Unprecedented Role in Investment Portfolios

While PlanB’s predictions resonate in the financial world, Bitcoin emerges as a compelling force with its unique risk-adjusted returns. The proposed 10% Bitcoin and 90% cash-focused allocation strategy serves as a strategic mix that leverages high return potential reminiscent of tech giants while reflecting stability traditionally associated with bonds.

Investors are now witnessing the transformative impact of Bitcoin on traditional investment norms and heralding a new era where the digital asset plays a significant role in shaping diversified and resilient portfolios.

As seen in the chart above, Bitcoin has provided significant returns compared to other investment tools. This situation supports the saying “more risk, more gain”. At the time of writing, Bitcoin continues to trade at the level of 43,880 dollars.

Türkçe

Türkçe Español

Español