Reflecting on-chain data, it has become apparent that miners have continued their recent sales. In line with these sales, the sale of an additional 1,000 BTC caused a sharp drop in the Bitcoin price below $42,000, and despite challenging this level, it failed to reclaim it.

Bitcoin Miners Maintain Selling Pressure

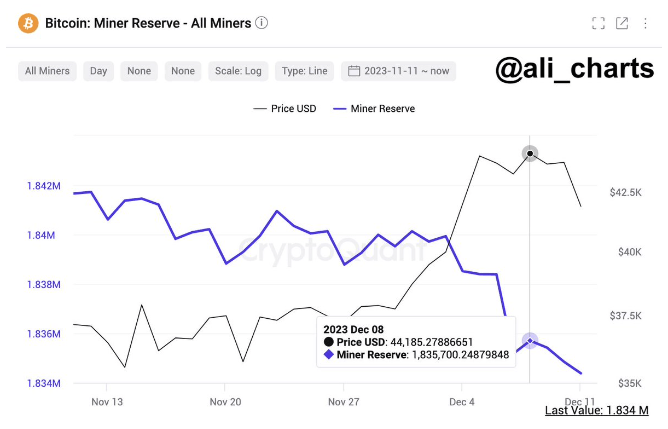

According to a post by analyst Ali Martinez on platform X, miners have been making some unusual sales since last Friday. The situation of interest here is the “miner reserve,” which reflects the total amount of Bitcoin that miners hold in their wallets.

When the metric value related to mining reserve increases, it can be interpreted that chain validators are currently adding more coins to their supply. Accumulations made by miners can naturally contribute positively to the BTC price.

On the other hand, a decline in the indicator suggests that there is currently a net outflow of cryptocurrency from miners’ wallets. Since one of the main reasons for the transfers of cryptocurrencies made by this group is to sell, such a development can trigger a downward price movement for BTC.

Below is a chart that reveals the trend in the Bitcoin miner reserve over the past month:

According to the chart mentioned above, there was a sharp decline in the Bitcoin miner reserve after surpassing the price level of $44,000. The chart also indicates that miners made noticeable BTC sales at these levels. However, they did not stop at the sales at this price level and carried out even more sales in the last few days, reflecting the continuing trend to the market.

Since last Friday, miners have executed a massive withdrawal of 1,000 BTC. The current value of these coins could have been approximately $42 million. Nevertheless, the purpose behind this withdrawal transaction is still not entirely clear.

Current State of Bitcoin

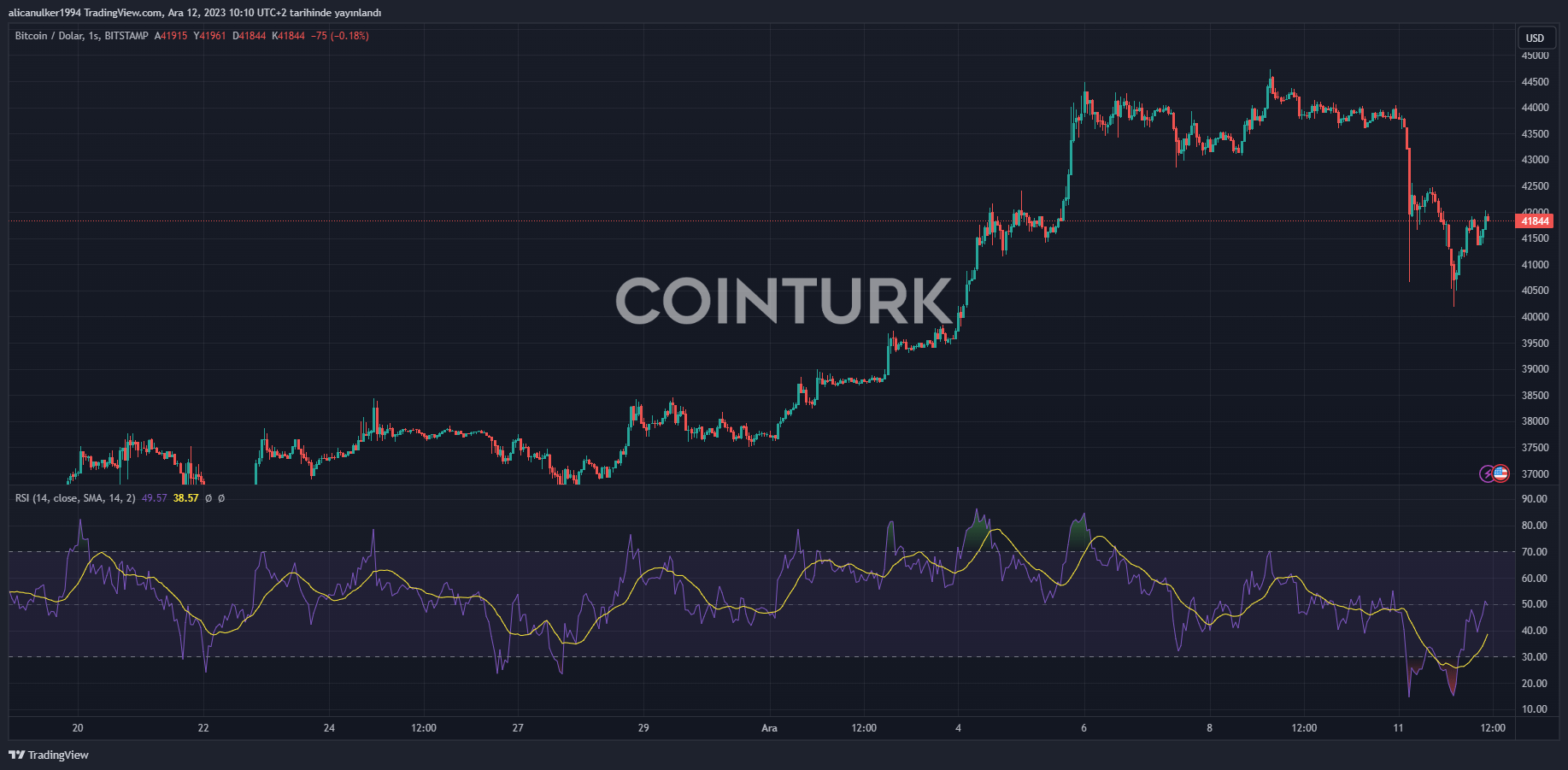

Following the miner withdrawals, the stagnation in Bitcoin increased, resulting in a major decline in the cryptocurrency. Although miners played a significant role in this process, given the scale of the sales in comparison to the BTC volume, it seems unlikely that they are the sole reason for the decline.

Miners are forced to regularly make sales to maintain their sustainability due to the costs associated with electricity bills and other expenses related to their activities. Consequently, there is a constant selling pressure in the Bitcoin market due to the situation of the group.

However, considering the transaction volumes, the scale of the sales often does not affect the market. As of the writing time, Bitcoin was trading at around $41,700, marking a 1% increase over the past week.

Türkçe

Türkçe Español

Español