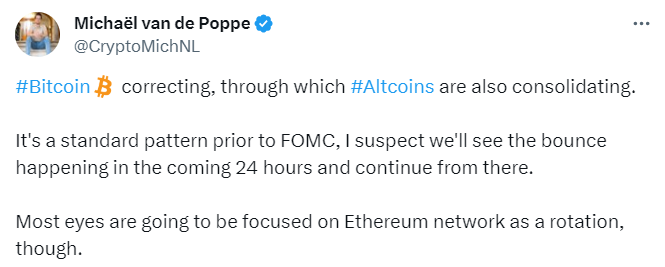

Crypto currency analyst Michaël van de Poppe shares his views on the current trend of Bitcoin and its potential impact on the broader market. According to him, Bitcoin is undergoing a correction process, which is a standard pattern observed before the activities of the Federal Open Market Committee (FOMC). This correction is likely to affect the consolidation of various altcoins in the crypto space.

Van de Poppe predicts that the correction in Bitcoin is a typical start of the FOMC and foresees a rebound on the horizon within the next 24 hours. This model is consistent with historical market behavior, where investors typically adopt a cautious stance before major economic events.

As Bitcoin analyst Van de Poppe points out, the influence of the FOMC is expected to echo in the crypto world, leading to a short pause and consolidation. BTC has been moving above the $40,000 level for some time. At the time of writing, BTC is at $41,213.

While the cryptocurrency Bitcoin is correcting, Van de Poppe indicates that the market’s interest is shifting towards the Ethereum network. He anticipates a rotation in Ethereum, a significant player in the crypto market.

Focusing on the movement of Ethereum, the leader of altcoins, highlights the interconnected nature of various digital assets, indicating a potential ripple effect on altcoins.

Van de Poppe summarizes his general theory regarding Bitcoin’s current price structure. The renowned analyst prefers a rally towards the $48,000 to $50,500 range for Bitcoin, which he argues would be consistent with the typical pattern observed before each halving cycle.

Following this expected rally, a potential rejection and correction phase could bring the cryptocurrency Bitcoin’s price down to the $35,000 to $38,000 range.

As the crypto market navigates between these fluctuations, Bitcoin analyst Van de Poppe’s analysis provides valuable information for crypto enthusiasts. The upcoming bounce in Bitcoin and the evolving dynamics in the Ethereum ecosystem will likely set the tone for broader market movements. The analyst advises investors to stay alert and adapt their strategies according to developments in the crypto space.

Türkçe

Türkçe Español

Español