Markets seem to be under selling pressure with the expectation of the FED decision. Many altcoins appear to be going through a weak process on the weekly chart. However, Binance Coin (BNB), which has shown low performance during the mini altcoin bull run in the past weeks, may now be moving within a strong structure.

Will Binance Coin (BNB) Rise?

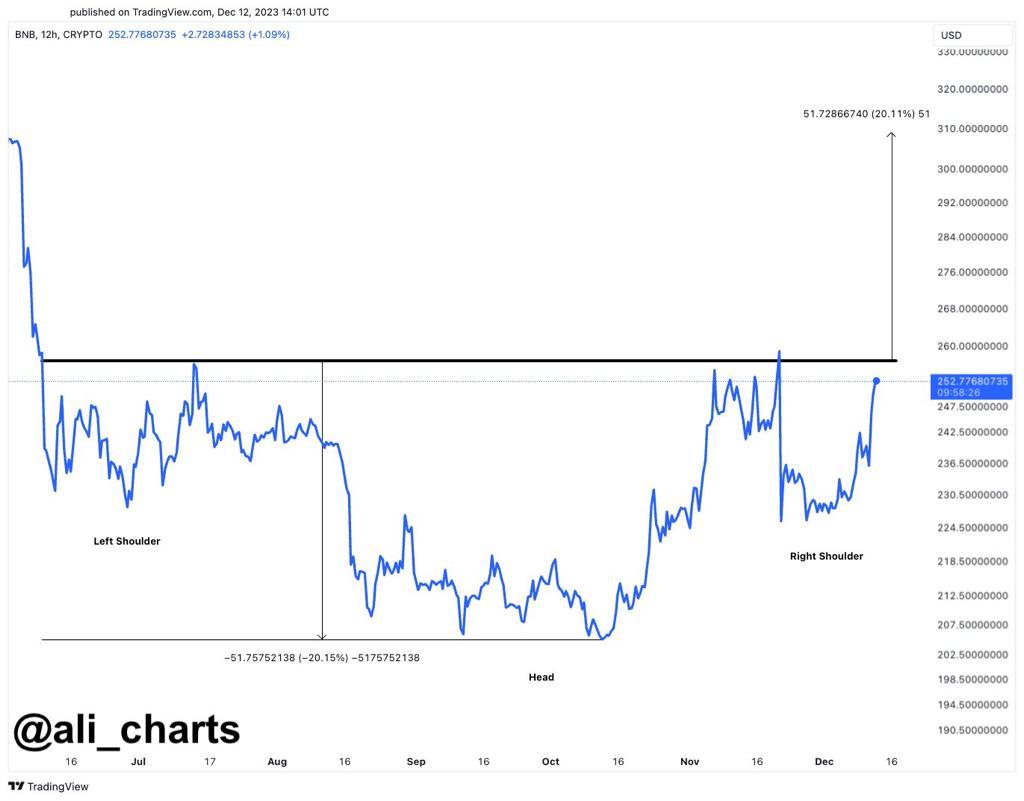

Renowned crypto analyst Ali Martinez mentioned that Binance Coin could be going through the process of forming a head and shoulders pattern. According to the analyst, if there is a sustained close above the $261 neckline, there could be a potential for a sharp breakout, and price action could trigger a move towards a $310 target for BNB.

At the time of writing, BNB Coin is trading at $247 after a 3% decline, with a market value of $37.4 billion. Binance Coin (BNB) also seems close to reclaiming the significant psychological resistance level of $250 and is challenging this zone. Moreover, there is an important trend resistance area for Binance at the $258 level, where buyers may face potential difficulties.

The recovery trend seen in the market in recent weeks has given way to uncertainty before the FED decision, but it is possible for BNB’s price to surpass $258 and reach a potential rise towards $300. Investors are closely monitoring these key levels for potential changes in BNB’s price during the process.

BNB Current Status

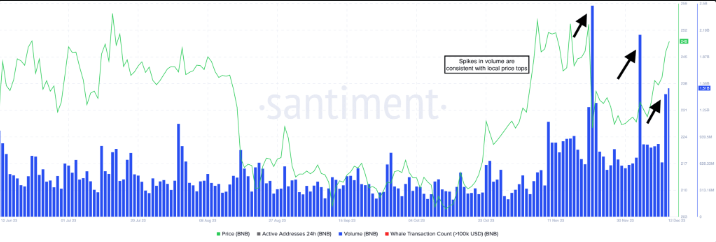

Three key metrics, which are Volume, Social Dominance, and Open Interest in USD, indicate that the upward trajectory of Binance Coin (BNB) prices may continue. Data provided by Santiment, analyzing BNB volume increases, reveals a correlation with the asset’s price peaks.

In particular, during the period between November 12 and December 12, the increase in BNB volume coincided with local price peaks, which did not escape Santiment’s attention.

As seen in Santiment’s chart, BNB’s social dominance typically starts to increase along with its price rises. In the past six months, this pattern has been validated several times and has highlighted the asset’s significance among market participants. BNB’s social dominance has continued to rise since December 5, 2023.

Türkçe

Türkçe Español

Español