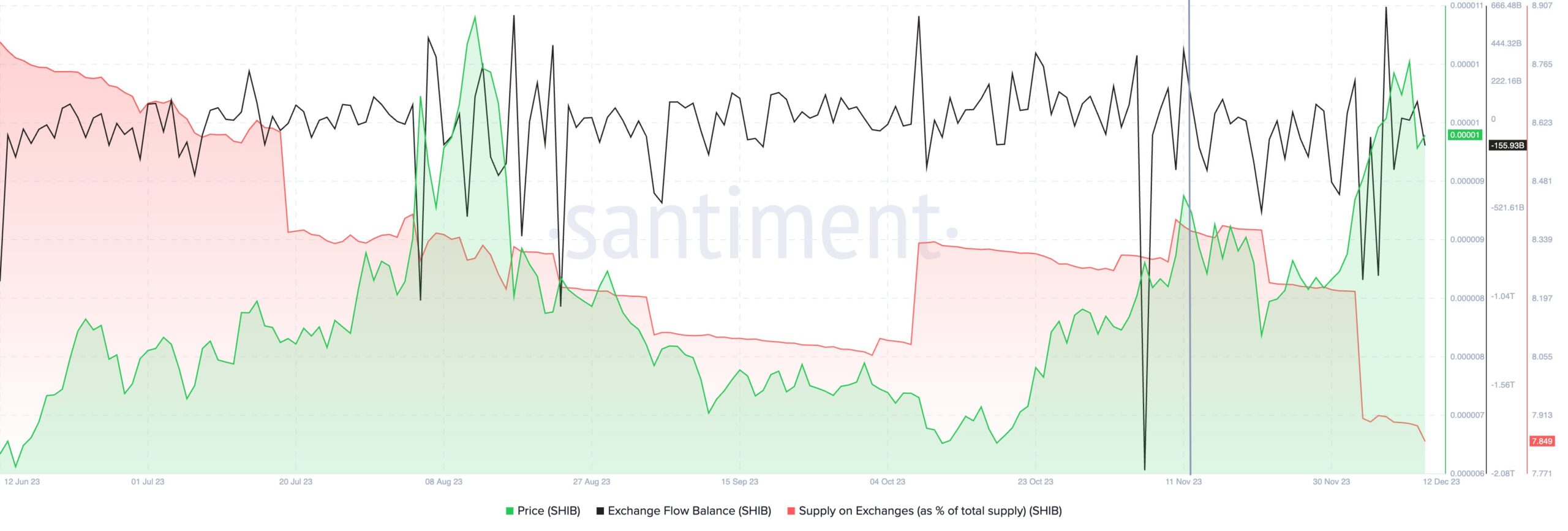

Shiba Inu, the cryptocurrency market’s popular meme token, is showing an interesting trend that experts believe could lead to a bull run. According to data from on-chain analysis firm Santiment, the supply of Shiba Inu on exchanges has decreased by 0.51% since November 12th.

The Supply-Demand Relationship of SHIB

Considering Shiba Inu’s total supply of 589.59 trillion SHIB and the circulating supply of 589.35 trillion SHIB, the percentage decrease continues to be significant and represents billions of SHIB. Approximately 7.85% of Shiba Inu’s massive supply is currently held on exchanges. The positive aspect of this is that there is less SHIB on exchanges. This could also mean a reduction in selling pressure, which in turn could lay the groundwork for potential gains.

The supply is likely decreasing due to more analysts and investors preferring to store their Shiba Inu tokens themselves. This situation could indicate that investors prefer to hold onto their tokens rather than selling them in anticipation of possible future rewards. A small increase in demand with a reduction in supply in the market could be enough to rapidly drive prices up.

Token Burning in SHIB

At the time of writing, SHIB has seen a decrease of 1.74% over the last 24 hours to a level of $0.000009455. While a surge in transactions on Shibarium is observed, Shiba Inu is preparing for a significant supply decrease as another major SHIB burn approaches. The Shiba Inu team will conduct three different manual burns on the 14th, 15th, and 16th of December this week.

The total value of these burns is expected to exceed the previous burn of 8.2 billion tokens. The team announced this in the sixth and final issue of SHIB Magazine, which was published yesterday. Shibarium’s total transactions have rapidly increased to 97,919,035. In addition, Shibarium reached a remarkable figure of an average of 7.5 million transactions per day, just three months after its inception. Historical data shows that every token burning event in cryptocurrencies has caused volatility in prices.

Türkçe

Türkçe Español

Español