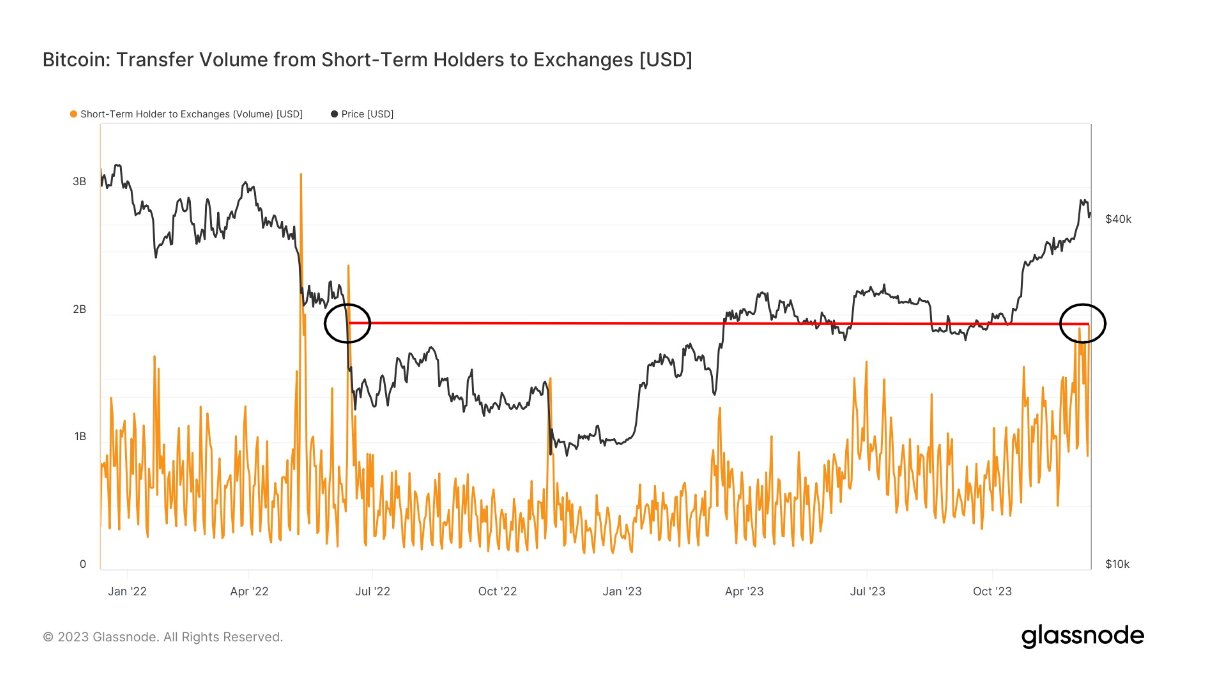

Recent on-chain data indicates that Bitcoin speculators have been panic selling, leading to a price correction towards $40,000. Figures from the on-chain data analysis firm Glassnode show that in just one day, on December 12th, short-term holders (STH) sold over $2 billion worth of Bitcoin.

Increased Selling Pressure in Bitcoin

According to data from TradingView, Bitcoin experienced its largest single-day drop of 2023 this week, with the decline reaching 8.1% at one point. In response to this sell-off, the more speculative side of Bitcoin’s investor base followed suit, reducing their exposure in what seemed like a bout of composure regarding market outlook.

Glassnode reveals that STHs, who held Bitcoin for 155 days or less, transferred assets worth $1.93 billion to exchanges on December 11th and another $2.08 billion on December 12th. Both days marked the highest levels of STH selling pressure in the long term, with both profitable and unprofitable organizations participating in this trend. The last time daily sales exceeded $2 billion was in June 2022, which was a reaction to the impending collapse of the blockchain company Celsius.

James Van Straten, a research and data analyst at the crypto analysis firm CryptoSlate, highlighted the significance of the week’s STH movements in a post shared on December 12th, cautioning his followers: “With a total of $2 billion in asset sales resulting in a $1.1 billion loss, this applies to everyone who likely bought individually after seeing Bitcoin’s annual increase of 150% between December 6th and 13th.”

Trading Volume Continues to Grow

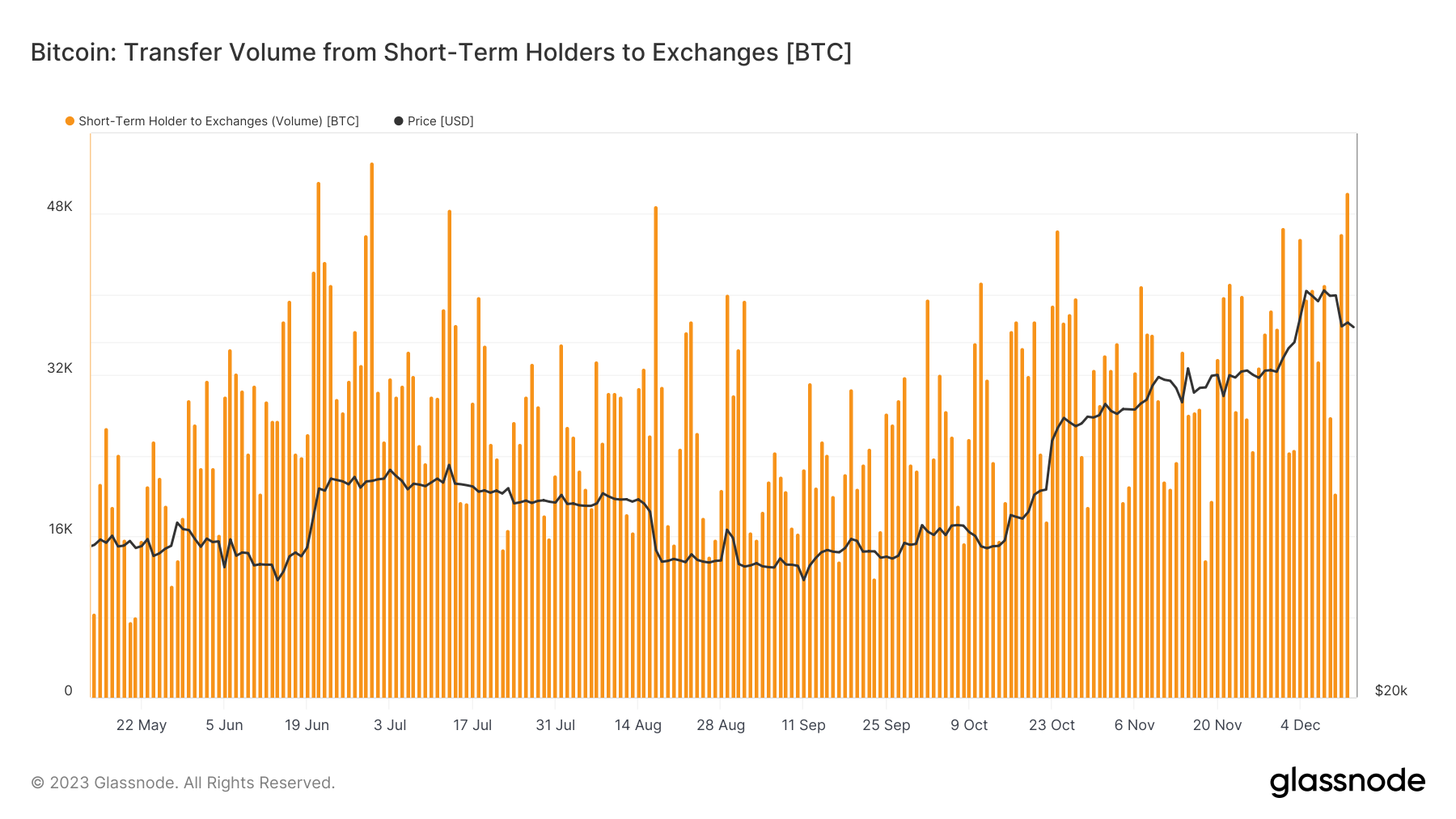

In terms of Bitcoin, the trading volumes were less significant, with the volume on December 12th signaling the largest volume seen since the beginning of July. At that time, the BTC/USD pair had fallen to $25,000 before rising above $30,000.

Continuing their analysis, Glassnode pointed out numerous on-chain indicators suggesting that STHs may have filled the bullish signal for now. Analysts noted that the profit-taking around $45,000, the highest level in 19 months, this month was meaningful, indicating that potential demand saturation could emerge. The firm’s latest weekly newsletter “The Week On-Chain,” published on December 12th, concluded with: “So far, after such a strong start to 2023, the rally seems to have encountered resistance, with on-chain data showing STHs as a significant driving force.”

Türkçe

Türkçe Español

Español