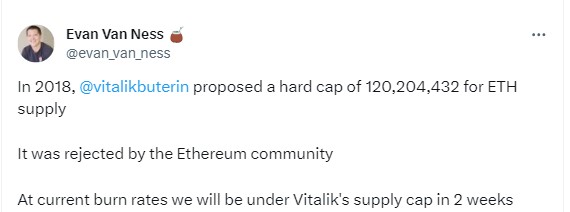

The circulating supply of Ethereum (ETH) has fallen below the critical threshold initially set by EIP-960. This milestone could mark a very important moment in Ethereum’s history. The ETH supply has now entered the scope of the hard cap proposed by Ethereum co-founder Vitalik Buterin.

ETH Supply Decline

EIP-960 was a proposal made by Vitalik Buterin in 2018, which suggested setting a hard cap on Ethereum’s supply of 120,204,432 ETH to ensure the platform’s economic sustainability under various conditions. The rationale was to create a predictable monetary policy similar to Bitcoin’s, evoke a sense of scarcity, and potentially generate value. However, the Ethereum community did not adopt this proposal, preferring to maintain a flexible supply policy that adapts to the network’s needs.

The fact that Ethereum’s supply has now fallen below this limit may inadvertently reference Vitalik Buterin’s vision of reduced supply. This is a byproduct of Ethereum’s transition to the proof of stake (PoS) consensus mechanism and the implementation of EIP-1559, which introduced a mechanism for burning transaction fees to reduce the overall supply.

Current Data on Ethereum

Analysts examining ETH’s price chart have a visual representation of Ethereum’s recent market performance. It was noted that the chart showed a price trend along with key observations. Moving averages indicate that the ETH price is currently above several moving averages, which could signal a bullish trend. The 50-day moving average (MA) appears above the 100-day and 200-day MAs, which is often interpreted as a positive sign.

On the leading smart contract platform, a noteworthy volume of transactions has formed, which could indicate strong market interest and support ongoing price movements. Resistance and support levels in the cryptocurrency seem to be encountering higher levels of resistance, but found support at the lower end, which could indicate a potential consolidation phase.